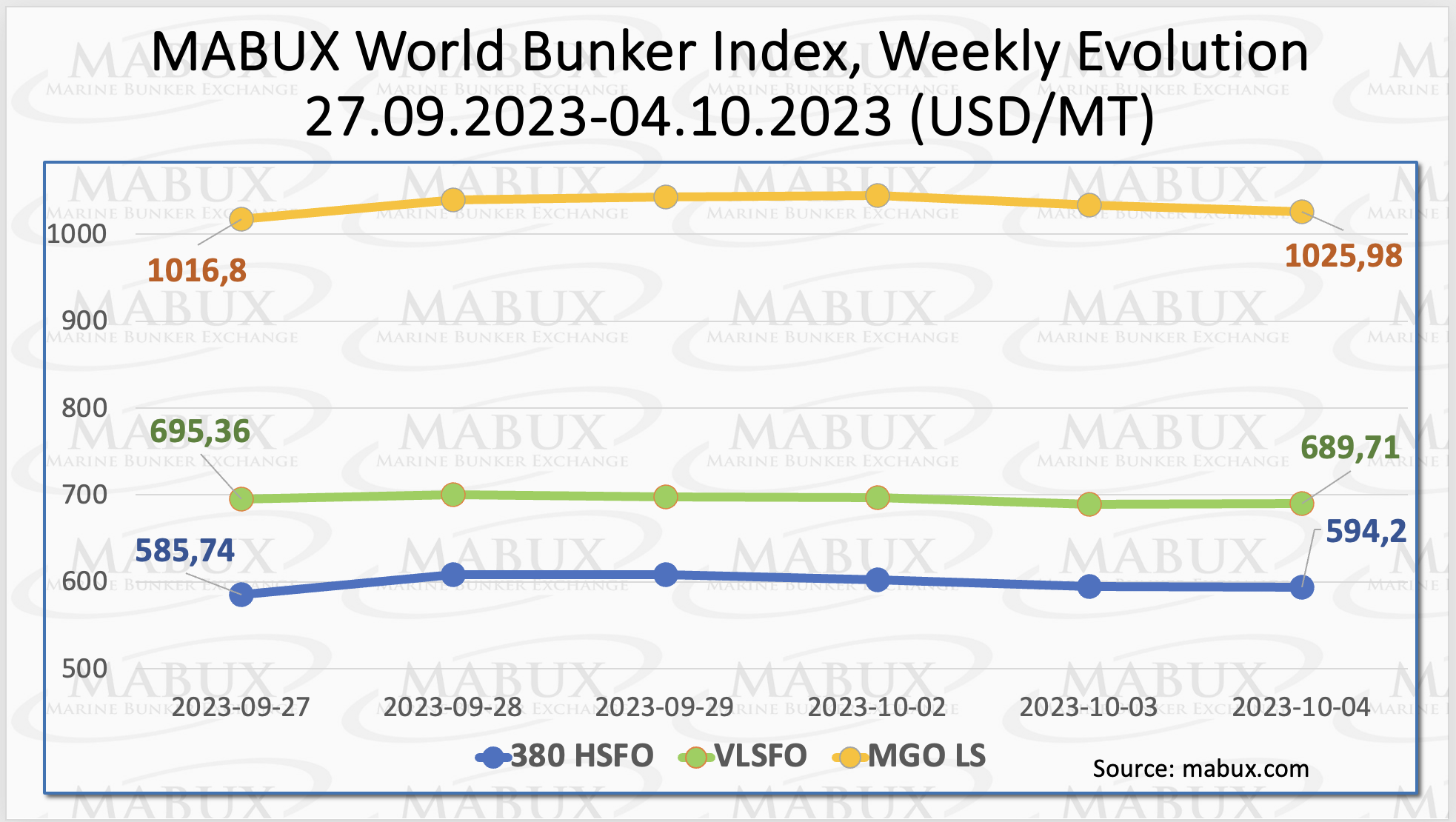

The MABUX global bunker indices experienced some minor fluctuations in the last week.

The 380 HSFO index rose by US$8.46, the VLSFO index lost US$5.65, while the MGO index increased by US$9.18.

“At the time of writing, the market was generally following a slight downward trend,” pointed out a MABUX official.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to decline, minus US$14.11, falling below US$100 for the first time since 7 September of this year.

At the same time, the weekly average also decreased by US$11.88. In Rotterdam, SS Spread began to gradually increase again, plus US$21.The weekly average SS Spread in Rotterdam also widened by US$8.83.

In Singapore, the price difference between 380 HSFO and VLSFO increased more significantly, plus US$35. The weekly average increased by US$20.50.

Based on the dynamics of SS Spread in the major hubs, it is possible that global SS index values may show an uptrend in the coming week.

The European gas market experienced a slight decline at the start of October. Even though European gas storage facilities are currently at around 93% capacity, prices remain volatile due to unfavorable renewable energy production and disruptions in Norwegian gas fields.

Many market participants anticipate limited downward pressure on prices as the European Union approaches the heating season. Furthermore, Europe’s liquefied natural gas (LNG) imports have decreased by 20% compared to the previous year, primarily due to the ample storage levels throughout Europe.

The price of LNG as bunker fuel in the port of Sines (Portugal) began a firm decline, reaching US$801/MT on 2 October.

Meantime, the differential in price between LNG and traditional fuel on 2 October has once again surged, with LNG holding a strong advantage of US$262 over conventional fuels, compared to US$58 just one week earlier. MGO LS was quoted that day in the port of Sines at US$1,063/MT.

During Week 40, the MDI index (the ratio of market bunker prices (MABUX MBP Index) to the digital bunker benchmark MABUX (MABUX DBP Index)) continued to register underpricing for all types of bunker fuels in all selected ports.

In the 380 HSFO segment, the average weekly underpricing values increased by 6 points in Rotterdam, by 5 points in Singapore and by 18 points in Houston but decreased by 4 points in Fujairah.

In the VLSFO segment, the MDI showed an increased undercharging only in Houston – plus 14 points. In the other three ports, the MDI narrowed, by 2 points in Rotterdam, 17 points in Singapore and 11 points in Fujairah.

In the MGO LS segment, the average underpricing premium increased only in Houston (plus 2 points) and decreased in Rotterdam by 2 points, in Singapore by 10 points and in Fujairah by 3 points.

“We anticipate that the global bunker market is currently showing signs of potentially

entering a moderate downward trend. Consequently, global bunker prices may

experience a slight decline in the upcoming week,” commented Sergey Ivanov, director of MABUX.