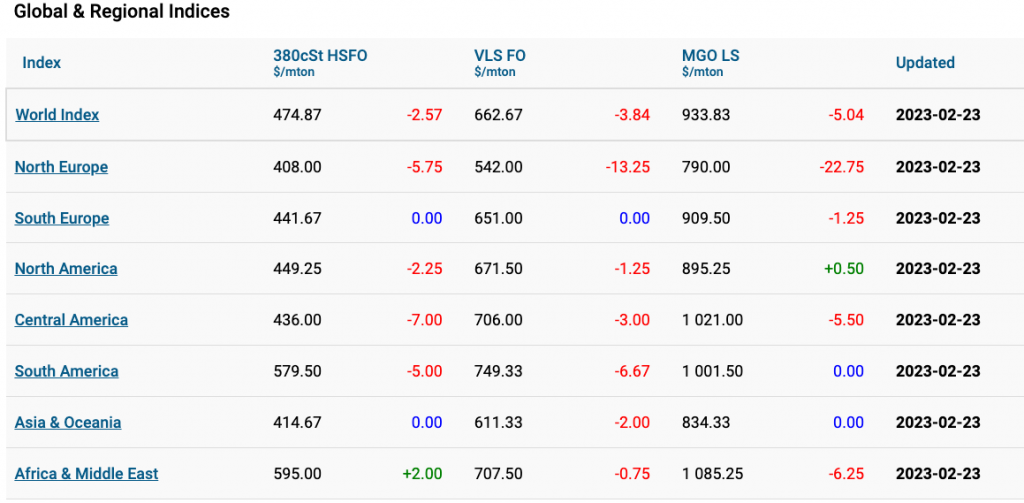

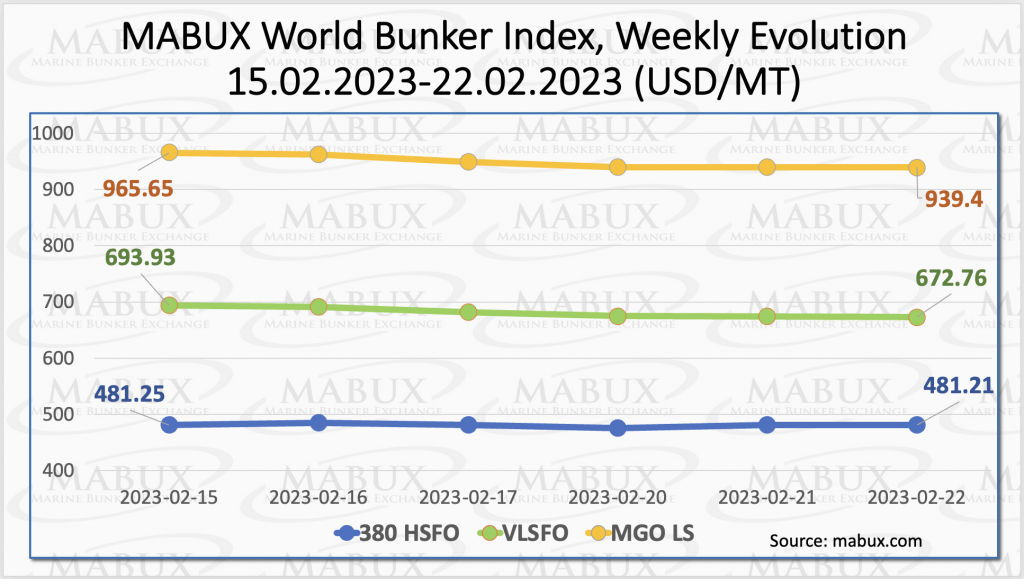

Over the eighth week of the year, Marine Bunker Exchange (MABUX) global bunker indices showed a moderate decline.

The MGO index lost almost US$26/mt falling to US$939.4/mt, the VLSFO index decreased by around US$21/mt reaching US$672.76/mt, while the 380 HSFO index remained relatively steady at US$481.21/mt.

“At the time of writing, irregular fluctuations prevailed in the market,” pointed out a MABUX analyst in the weekly report of the organisation.

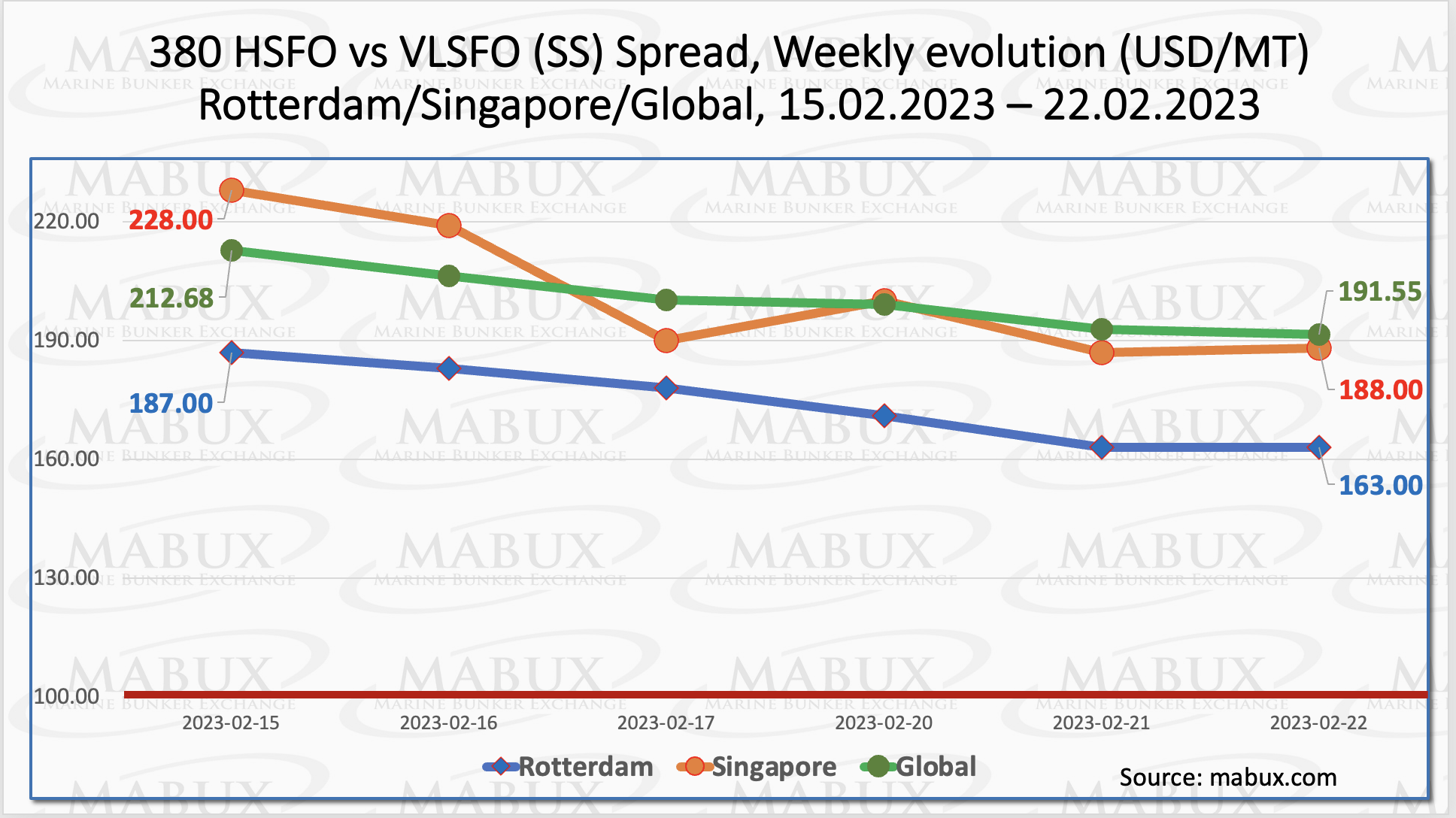

Additionally, the Global Scrubber Spread (SS), the price differential between 380 HSFO and VLSFO, showed a firm decline of US$21.13 for the eighth week, falling to US$191.55.

Meantime, the global average also decreased by US$15.14. In Rotterdam, SS Spread fell by US$15.16 to US$163 and in Singapore, the 380 HSFO/VLSFO price difference showed again the most significant reduction (US$40), decreasing to US$188.

The SS Spread weekly averages in Rotterdam and Singapore also dropped by US$15.16 and US$46.17, respectively.

“Next week, we expect the SS Spread to continue a downward trend,” noted a MABUX representative.

MABUX said that Europe’s benchmark natural gas price fell this week to the lowest level in 18 months as concerns about a gas crisis this winter continue to recede amid mild weather and above, average inventories across the continent.

But the falling price in Europe could invoke more demand in the industrial sector, as well as more demand in Asia, which would compete for spot LNG supply with Europe, according to the MABUX report.

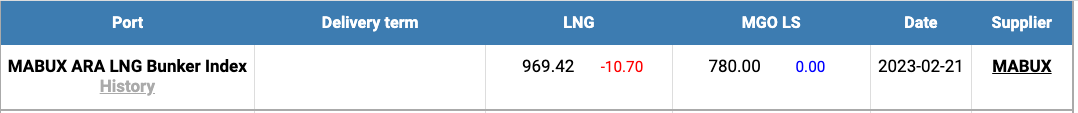

The price of LNG as a bunker fuel in the Amsterdam Rotterdam Antwerp (ARA) region declined slightly and reached US$969/mt on 21 February.

The difference in price between LNG and conventional fuel on 21 February was US$189, while MGO LS in the ARA region was quoted at US$780/mt that day.

This price difference continues to gradually decrease, while MABUX officials expect this trend to continue.

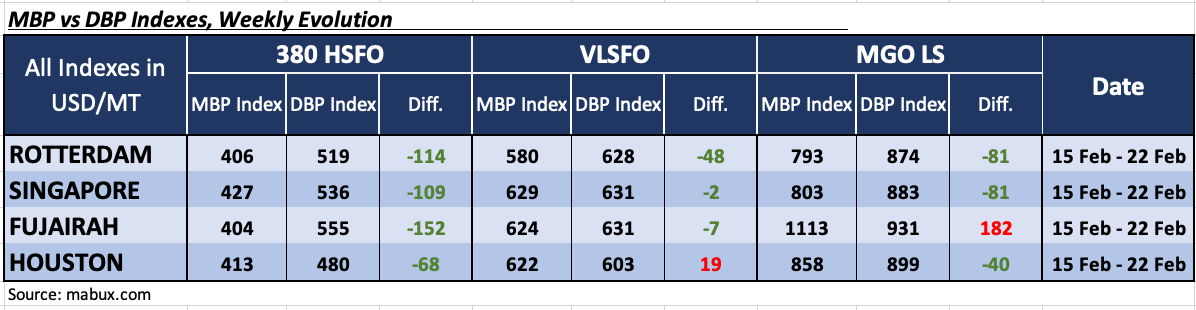

Over Week 08 of 2023, the MDI index, correlation of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index), registered an underestimation of 380 HSFO in all four selected ports.

The average underestimation margins decreased moderately and amounted as follows:

- Rotterdam – minus US$114

- Singapore – minus US$109

- Fujairah – minus US$152

- Houston – minus US$68.

In the VLSFO segment, according to MDI, two ports, Singapore and Fujairah, have moved into the underestimation zone and joined Rotterdam. The underprice margins were minus US$2, minus US$7 and minus US$48, respectively. Houston remained the only overvalued port in this fuel segment with a plus US$19.

In the MGO LS segment, Houston moved into the undervalued zone and joined Rotterdam and Singapore. The undercharge ratio was minus US$40, minus US$81 and minus US$81, respectively. Fujairah remained the only overvalued port, plus US$182.

The most significant change in this bunker fuel segment was an increase in undercharge average in Houston by 43 points.

“Uptrend forecasts of bunker prices due to the European Union embargo on imports of refined petroleum products from Russia implemented on 5 February did not materialise: indices are declining moderately. We expect this trend to continue next week,” commented Sergey Ivanov, director of MABUX.