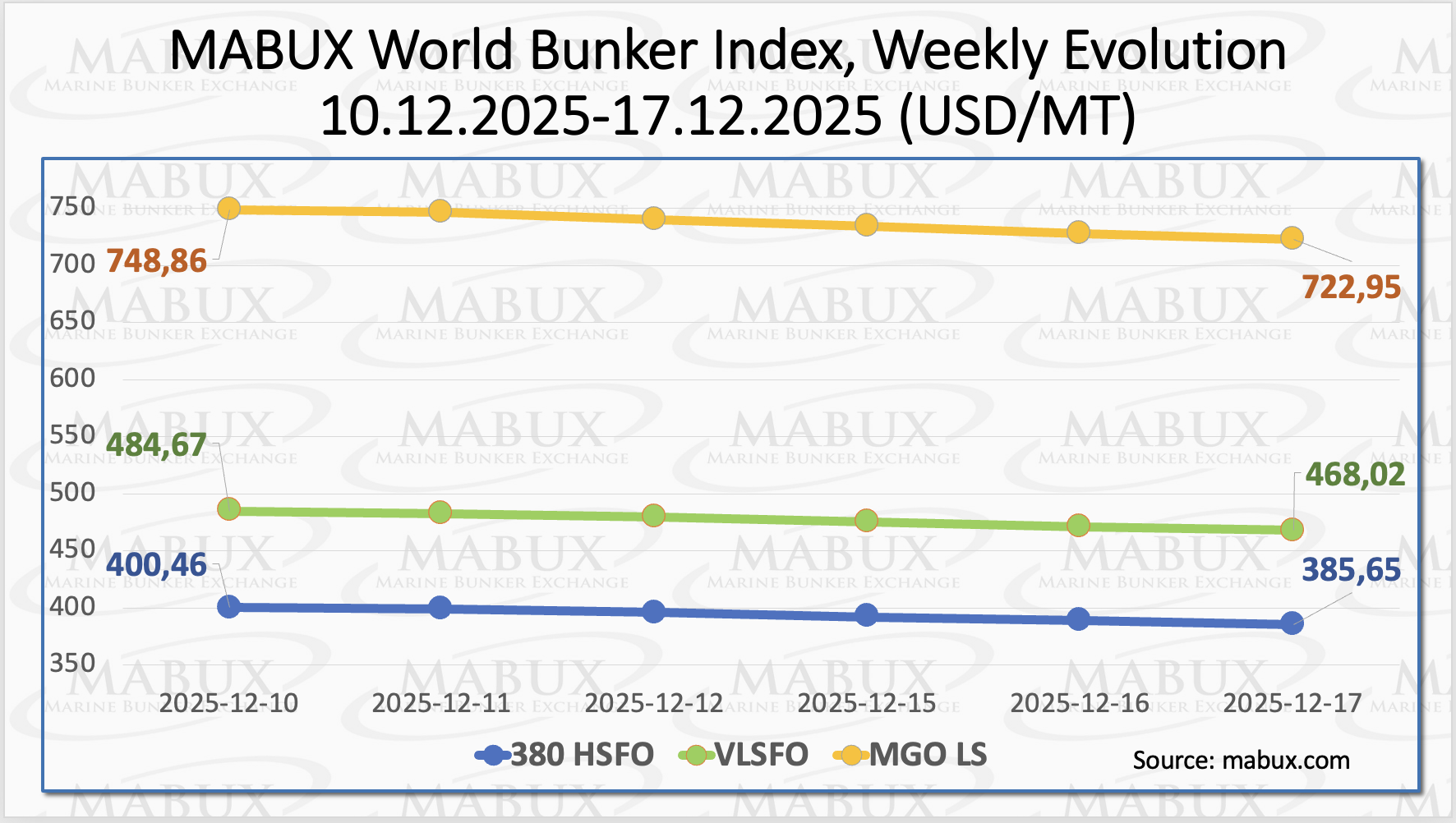

By the end of Week 51, global MABUX bunker indices extended their downward trend. The 380 HSFO index fell by US$14.81, to US$385.65/MT, dropping below the US$400 threshold.

The VLSFO index declined by US$16.65 to US$448.02/MT. The MGO LS index decreased by US$25.91 to US$722.95/MT. At the time of writing, the global bunker market was showing early signs of an upward corrective rebound.

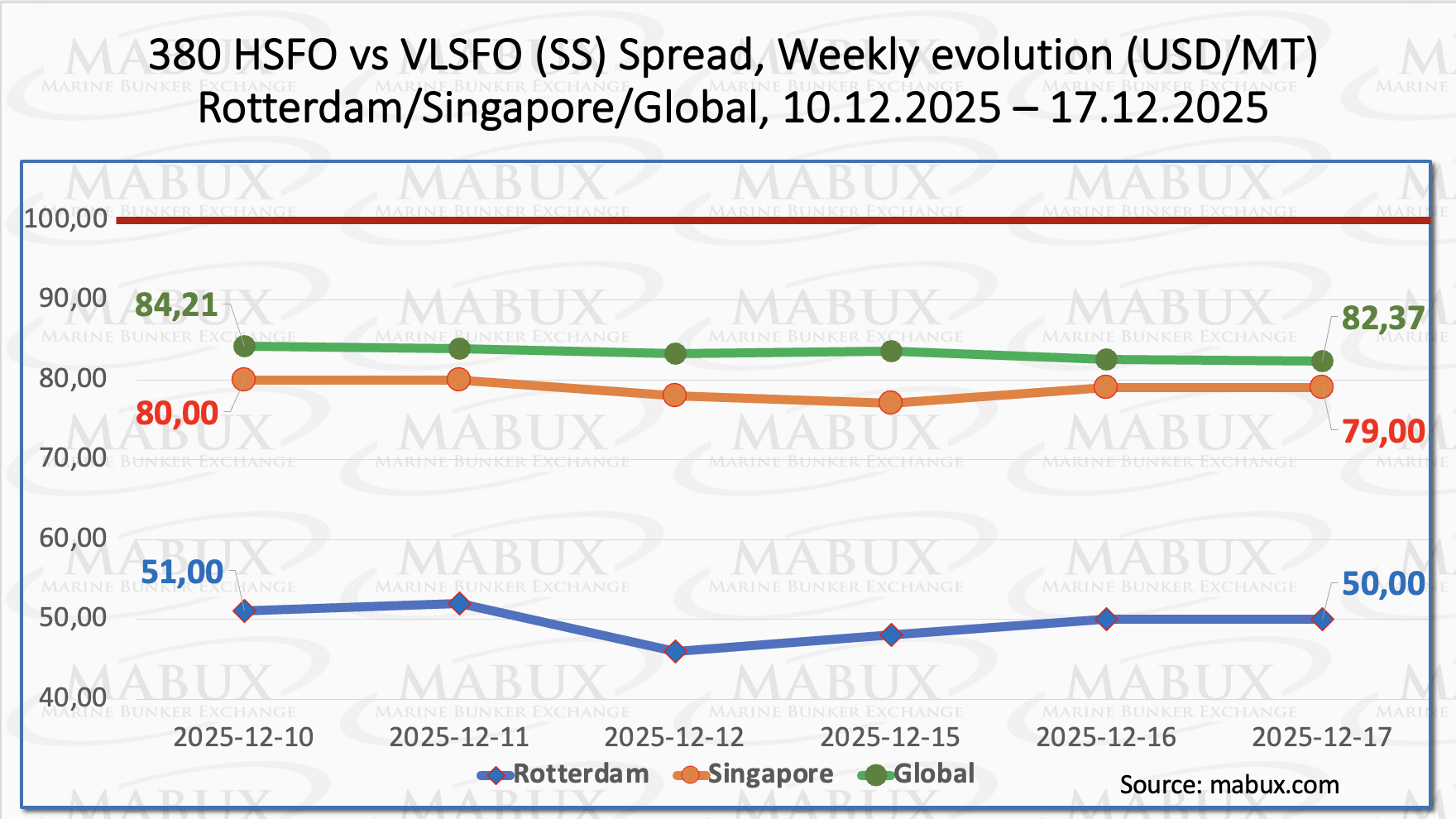

The MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—posted a moderate decline of US$1.84, to US$82.37. The spread remained above the US$80.00 threshold but stayed consistently below the psychological US$100.00 level (SS breakeven).

In contrast, the weekly average value of the index increased by US$1.27. In Rotterdam, the SS Spread narrowed by US$1.00 to US$50.00, while the port’s weekly average SS Spread rose by US$3.17.

In Singapore, the 380 HSFO/VLSFO spread also decreased by US$1.00, to US$79.00, slipping below the US$80.00 mark; the weekly average in the port fell by US$4.17. Overall, SS Spread indicators continue to move in mixed directions without forming a clear trend.

They remain firmly below US$100.00, sustaining the comparatively higher economic attractiveness of conventional VLSFO versus the 380 HSFO + scrubber configuration.

”We expect the SS Spread to continue fluctuating in different directions next week”, Sergey Ivanov, Director, MABUX commented.

By the end of the week, the Istanbul ECA Spread declined by a further US$5.00 to US$85.00, while the weekly average eased by US$3.33. In Venice, the ECA Spread narrowed sharply by US$33.00, falling to US$77.00 and dropping below the psychological US$100.00 threshold; the weekly average decreased by US$34.16. Overall, ECA Spread dynamics in both ports indicated a contraction, although the move has not yet become sustainable. We expect a moderate upward corrective rebound in the ECA Spread next week.

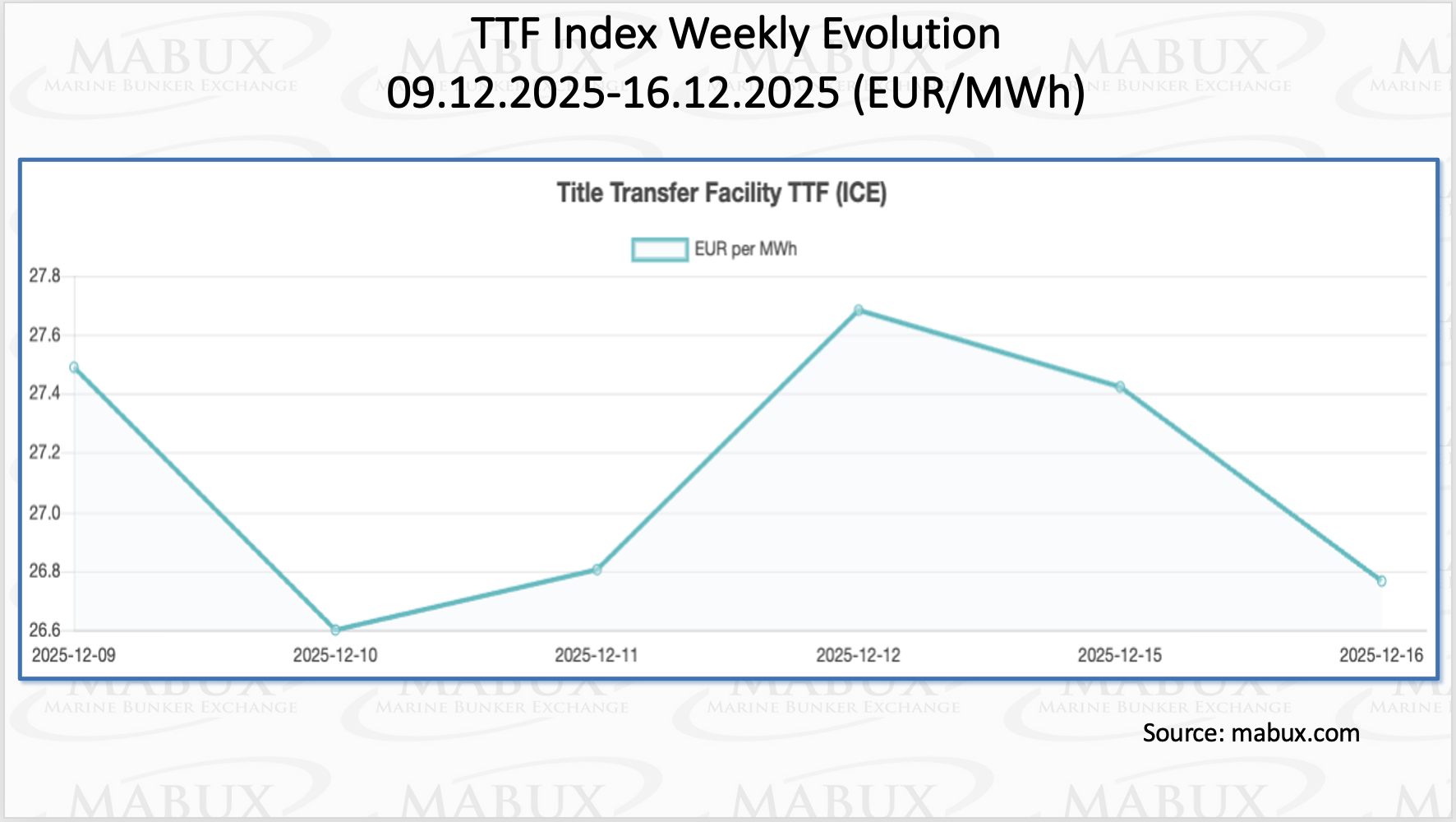

Weaker global gas demand—particularly in Asia—has reduced competition for Atlantic Basin LNG cargoes. The IEA notes that LNG supply growth in 2025 is outpacing demand, with U.S.

Atlantic shipments reaching multi-year highs. European weather forecasts have shifted toward milder conditions, lowering expectations for heating demand and, consequently, any weather-related upward pressure on TTF. Markets are trading within a relatively narrow range, underscoring the resilience of TTF fundamentals and the limited influence of macroeconomic or political drivers.

As of 16 December, European regional gas storage facilities were 69.89% full, down 2.54 percentage points from the previous week. Storage levels continue to decline and now stand 1.44 percentage points below the level at the beginning of 2025 (71.33%). In Week 51, the European TTF gas benchmark extended its moderate downtrend, falling by €0.725/MWh to €26.764/MWh (from €27.489/MWh last week).

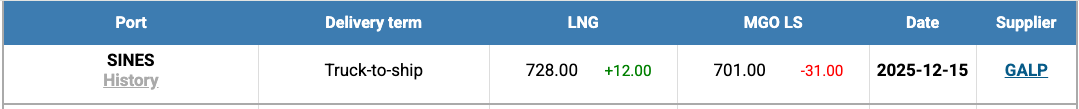

The price of LNG as a bunker fuel at the port of Sines (Portugal) increased by a further USD 12.00/MT this week to US$728/MT, up from US$716/MT last week. As a result, the price spread between LNG and conventional fuel shifted in favor of conventional fuel—for the first time since October 20, 2025—with the differential widening to US$27/MT, compared with US$16/MT in favor of LNG the previous week. As of December 15, MGO LS at the port of Sines was assessed at US$701/MT.

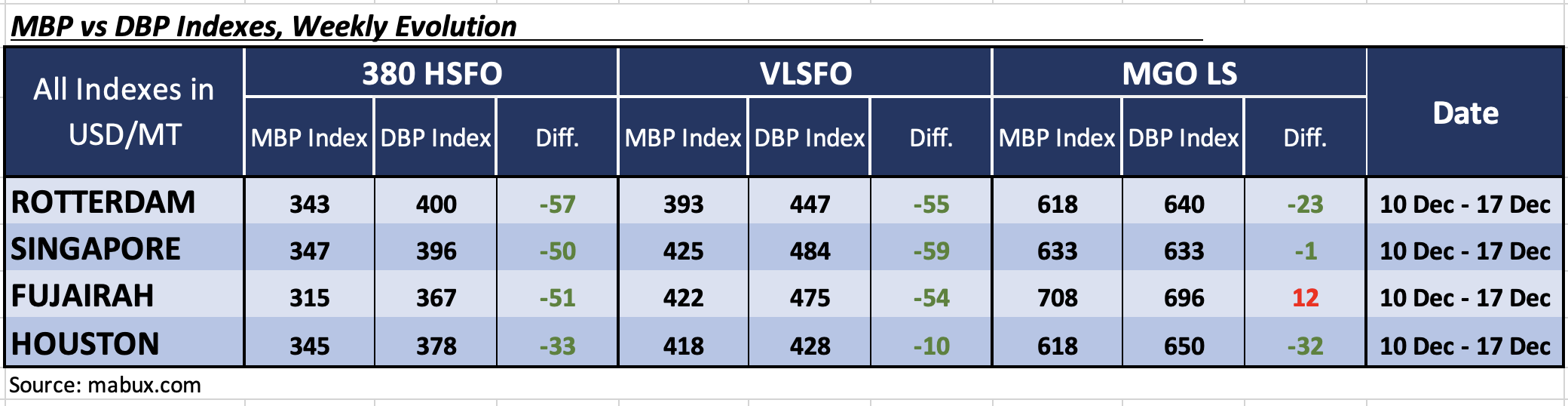

By the end of Week 51, the MABUX Market Differential Index (MDI)—reflecting the ratio of market bunker prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—showed the following trends across the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All four ports remained undervalued. Average weekly MDI values increased by 3 points in Rotterdam and by 2 points in Houston, while they decreased by 2 points in Singapore and by 4 points in Fujairah.

• VLSFO segment: All ports also stayed undervalued. The MDI edged down by 1 point in both Rotterdam and Singapore, and fell by 4 points in Fujairah, while increasing by 3 points in Houston. Notably, Houston’s MDI remains close to the 100% MBP/DBP correlation level.

• MGO LS segment: Fujairah moved into the overvalued zone, becoming the only overvalued hub in this category, with the MDI higher by 28 points. The other three ports remained undervalued: the MDI declined by 10 points in Rotterdam and Singapore but increased by 6 points in Houston. Singapore’s MDI, in turn, moved closer to the 100% MBP/DBP correlation level.

”After one overvalued port reappeared at the end of the previous week (Singapore in the MGO LS segment), the balance of overvalued/undervalued hubs remains mixed. Nevertheless, we expect undervaluation to remain the dominant trend in the global bunker market in the near term”, said Sergey Ivanov, Director, MABUX.

”We expect the global bunker market to be characterized by mixed price fluctuations during the final weeks of 2025. At the same time, market dynamics could shift to the upside under the influence of geopolitical developments, particularly in the event of progress toward a settlement of the conflict in Ukraine”, Ivanov added.