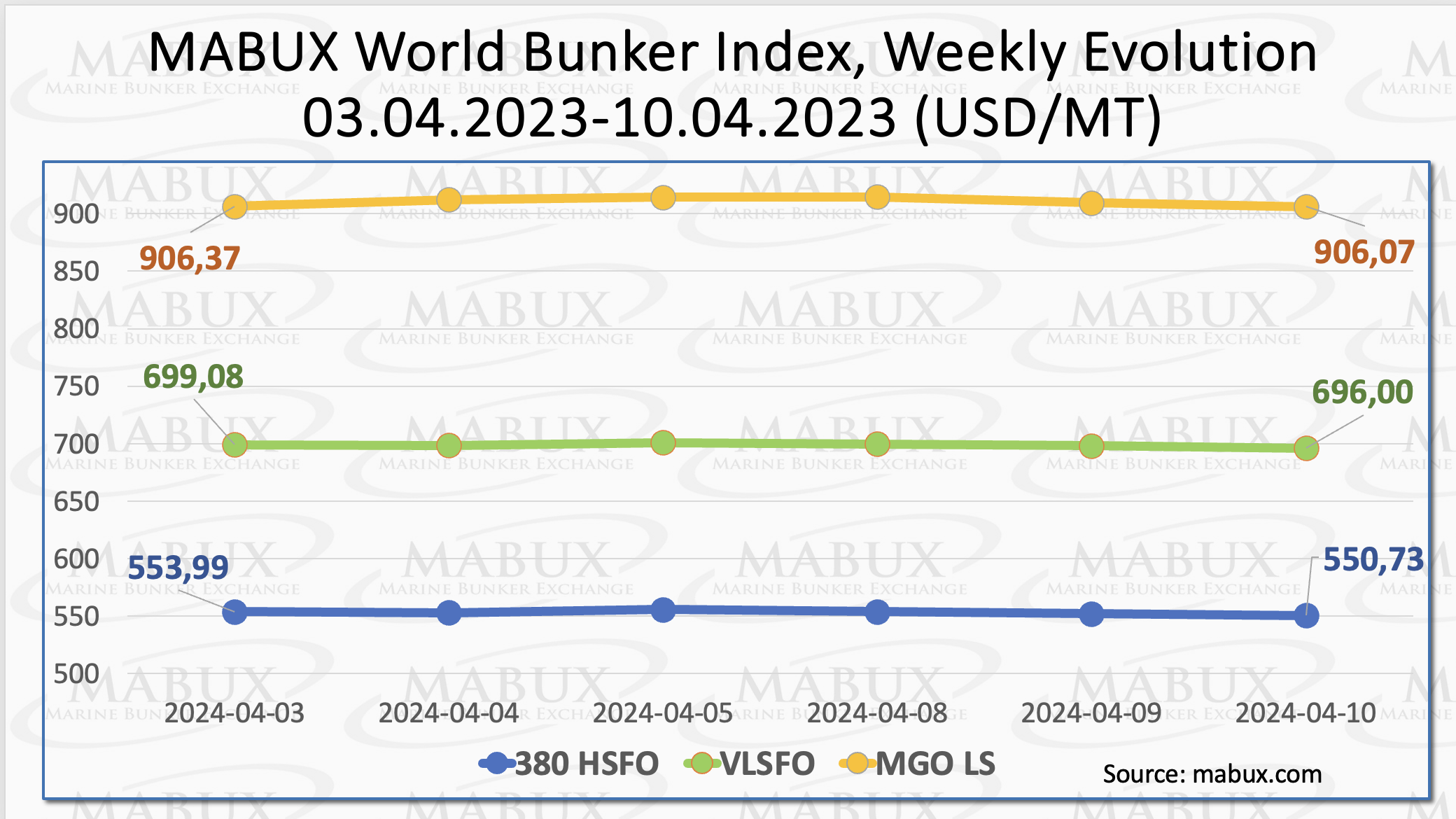

During the 15th week of the year, the Marine Bunker Exchange (MABUX) global indices saw a slight downturn.

The 380 HSFO index dropped by US$3.26 to US$550.73/MT. Similarly, the VLSFO index decreased by US$3.08 to US$699.08/MT and the MGO index experienced a minimal decline of US$0.30 to US$906.07/MT.

“As of the time of writing, there wasn’t a discernible trend in the global bunker market,” stated a MABUX official.

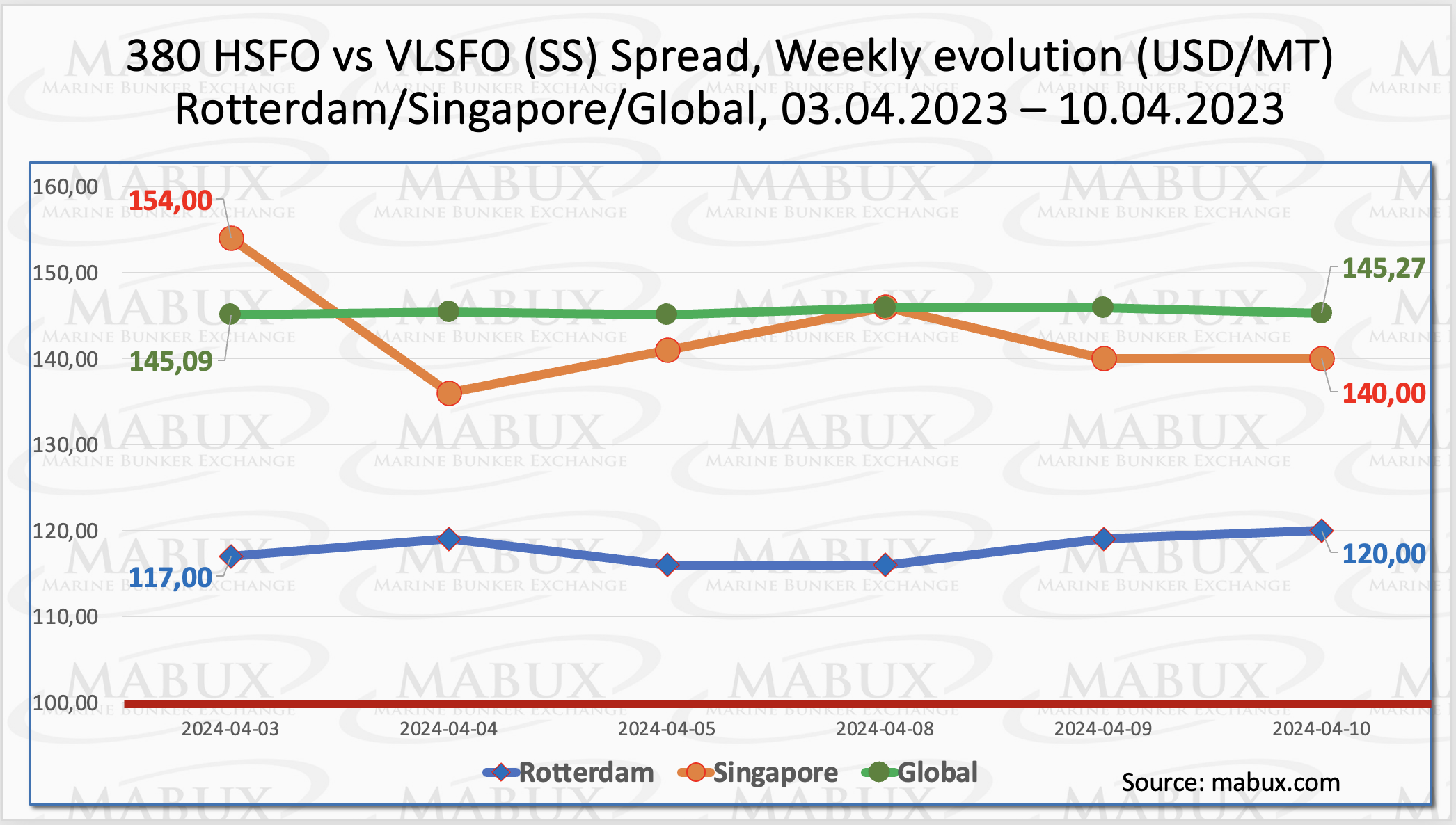

The MABUX Global Scrubber Spread (SS), representing the price gap between 380 HSFO and VLSFO, remained nearly static, with a slight increase of US$0.18 to US$145.27 from the previous week’s US$145.09. However, the weekly average rose by US$2.94.

In Rotterdam, the SS Spread widened by US$3.00, moving from US$117.00 to US$120.00, consistently staying above the US$100.00 (SS Breakeven) threshold. The port’s weekly average also increased by US$5.83.

Conversely, Singapore witnessed a notable contraction in the 380 HSFO/VLSFO price difference, decreasing by US$14.00 to US$140.00 from the previous week’s US$154.00, breaking through the US$150.00 mark. Additionally, the weekly average in Singapore decreased by US$9.00.

“We expect irregular changes in the SS Spread dynamics in the upcoming week,” said a MABUX spokesperson.

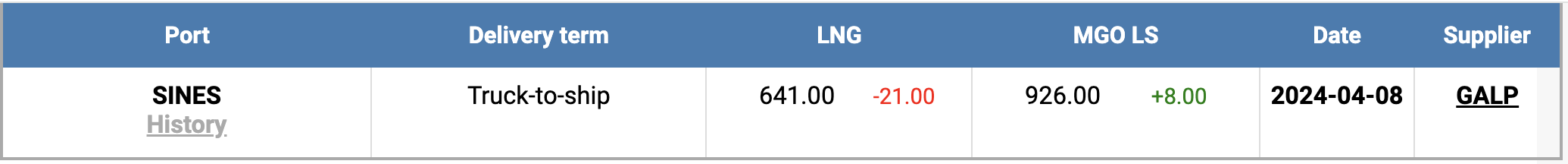

Europe has successfully managed the winter season with unprecedented levels of natural gas in storage, setting a strong foundation for the upcoming winter. As of the end of March, European natural gas reserves stand at 58.7% capacity, a new record surpassing last winter’s 56%.

Plans are underway to replenish these stocks, but there are indications that Europe may reduce LNG imports this summer due to weaker demand. This strategy aims to moderate the pace of stock accumulation to avoid premature site filling. Projections suggest Europe could reach 90% storage capacity by early August if it follows last year’s filling rate.

On 8 April, the price of LNG as bunker fuel at the port of Sines, Portugal, dropped to US$641/MT, a decrease of US$21 compared to the previous week. Simultaneously, the price gap between LNG and conventional fuel widened to US$285 in favour of LNG, up from US$263 the previous week. On the same day, MGO LS was priced at US$926/MT in the port of Sines.

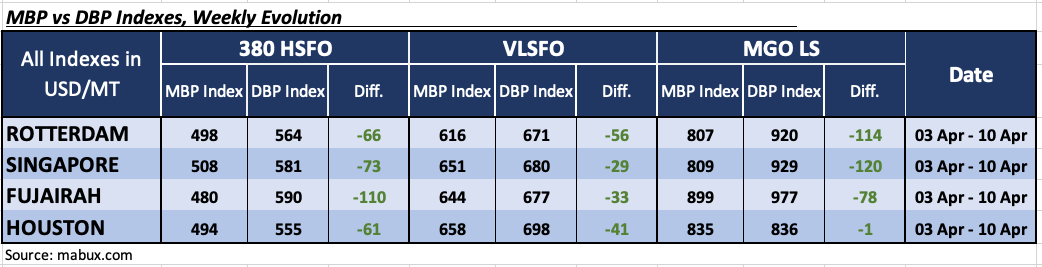

In the 380 HSFO category, the weekly average underpricing widened by 6 points in Rotterdam, 5 points in Singapore, 9 points in Fujairah, and 19 points in Houston. The MDI index in Fujairah remained above the US$100 mark.

For VLSFO, average weekly underpricing levels surged according to MDI, with increases of 6 points in Rotterdam, 21 points in Singapore, 23 points in Fujairah, and 29 points in Houston.

In the MGO LS segment, Houston moved into the undercharge zone, with all four ports now undervalued. Weekly averages increased by 10 points in Rotterdam, 10 points in Singapore, 29 points in Fujairah, and 9 points in Houston. MDI indices in Rotterdam and Singapore continued to surpass the US$100 threshold.

At the close of Week 15, no ports were noted as overvalued across any segments of the bunker market. The prevailing trend toward undervaluation of bunker fuel is expected to continue into the following week.

“We expect the global bunker market to be dominated by irregular fluctuations with no

clear trend in the coming week,” pointed out Sergey Ivanov, director of MABUX.