Global bunker indices tracked by Marine Bunker Exchange (MABUX), showed a consistent downward trend, disregarding potential growth factors such as the possible introduction of secondary sanctions or import duties by the United States.

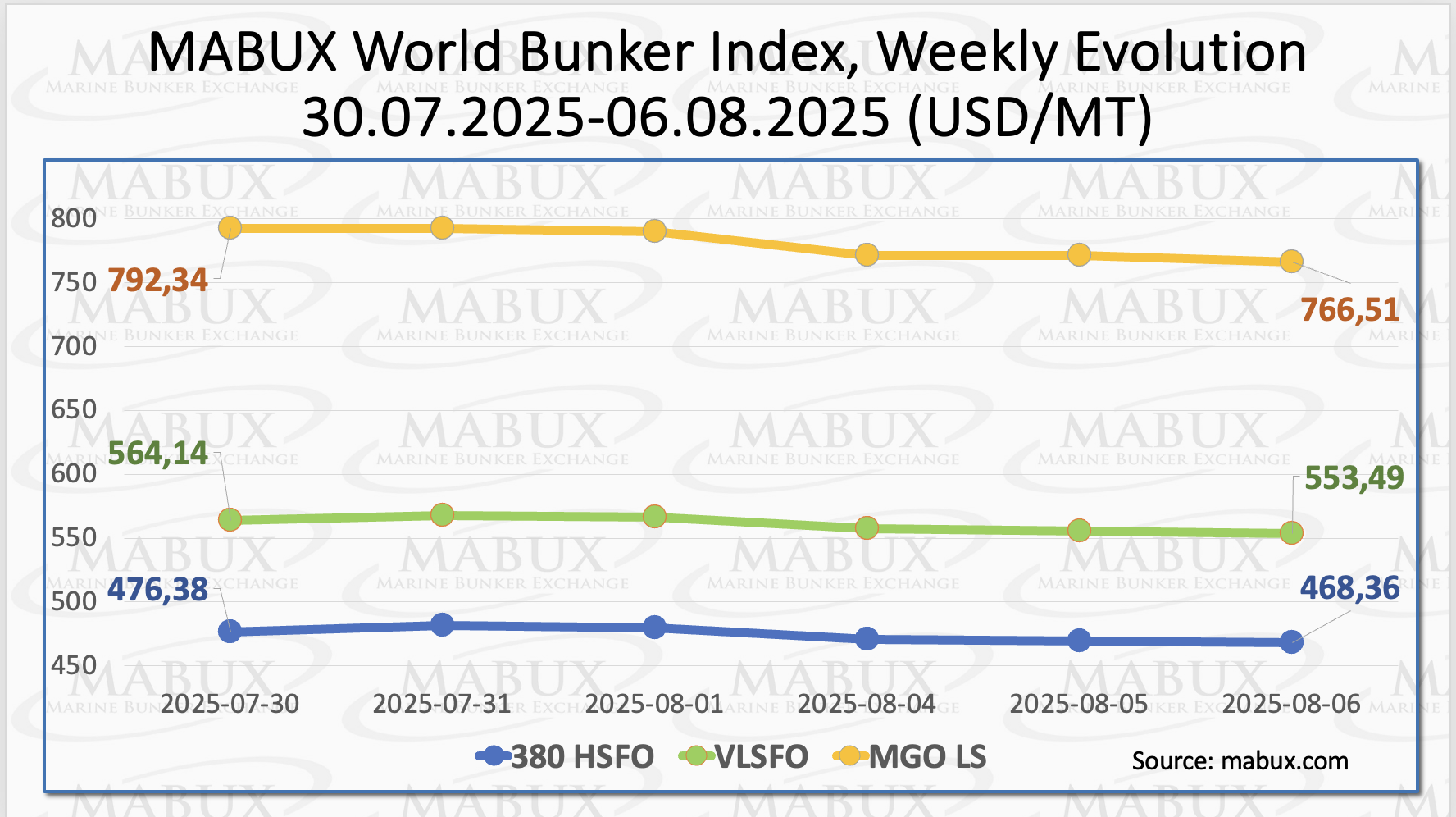

The 380 HSFO index declined by US$8.02, dropping from US$476.38/MT last week to US$468.36/MT. The VLSFO index also decreased, falling by US$10.65. The MGO index experienced the sharpest decline, losing US$25.83 and settling at US$766.51/MT.

”At the time of writing, the global bunker market was showing early signs of an upward correction, suggesting a potential reversal in the current trend,” said Sergey Ivanov, Director, MABUX.

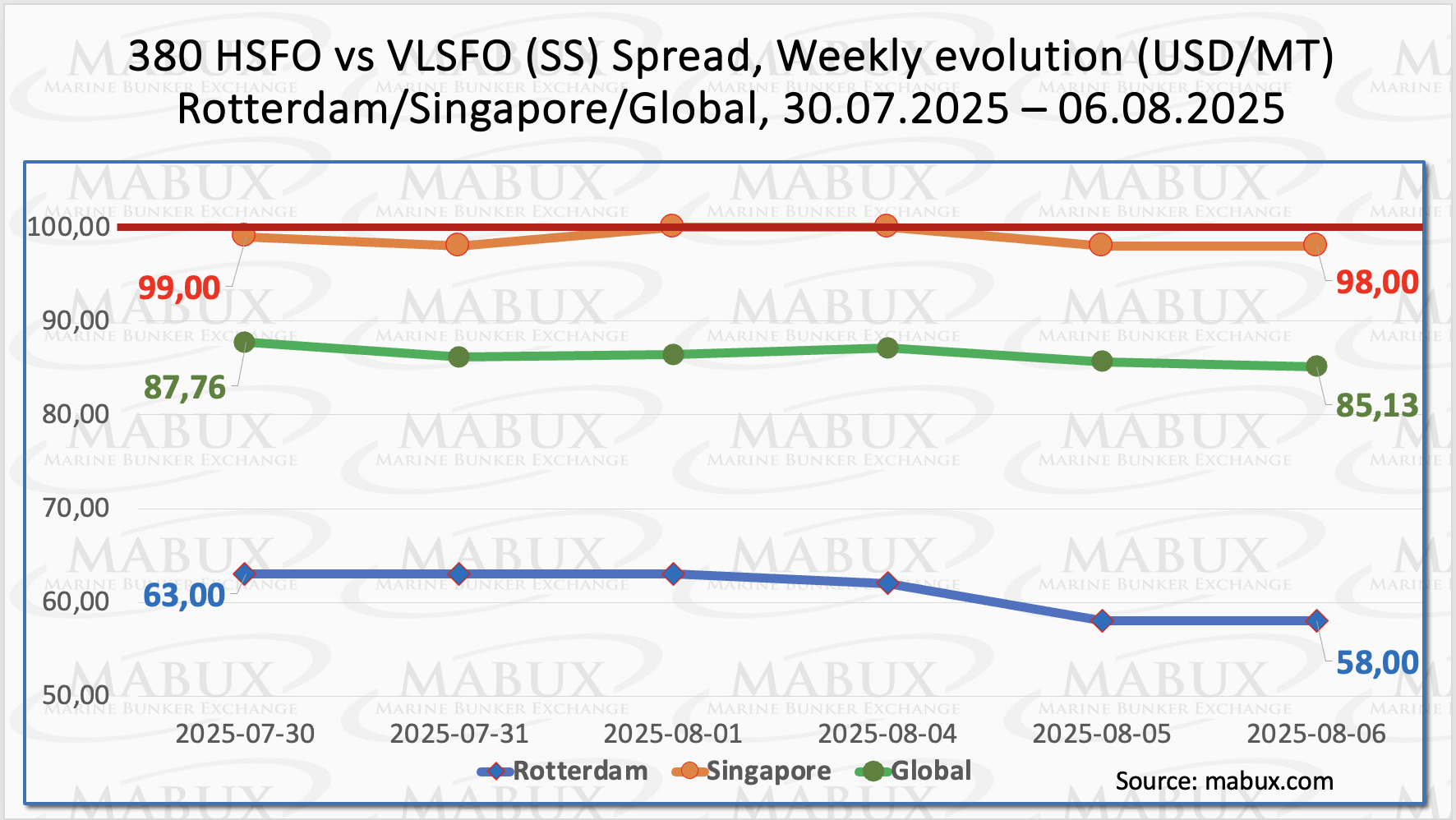

The MABUX Global Scrubber Spread (SS), the price difference between 380 HSFO and VLSFO, continued its moderate decline, dropping by US$2.63 to US$85.13. It remained confidently below the psychological threshold of US$100.00, known as the SS breakeven level.

The weekly average of the index also fell by US$2.17. In Rotterdam, the SS spread declined by a further US$5.00, with the weekly average in the port down by US$3.16. In Singapore, the price differential between 380 HSFO and VLSFO narrowed by US$1.00, also slipping below the $100.00 mark. The port’s weekly average dropped by US$0.84.

”This ongoing decline in SS spread indices reflects a renewed downward trend in the global bunker market. Under current conditions, the use of conventional VLSFO fuel remains more cost-effective than the HSFO plus scrubber combination,” stated Ivanov.

Floating liquefied natural gas (FLNG) terminals are rapidly gaining momentum in the global LNG market, with capacity expected to triple by 2030, according to Rystad Energy. Once limited by technical and operational challenges, FLNG terminals now boast utilisation rates comparable to onshore facilities, marking a significant leap in reliability and performance.

Driven by rising LNG demand and the increasing viability of smaller gas fields, FLNG is emerging as a faster, more flexible, and cost-effective solution that can better respond to shifting market dynamics. Rystad Energy projects global FLNG capacity to reach 42 million tonnes per annum (mtpa) by 2030 and 55 mtpa by 2035—nearly quadrupling from 14.1 mtpa in 2024. FLNG terminals commissioned before 2024 recorded average utilisation rates of 86.5% in 2024 and 76% in 2025, closely mirroring the performance of their onshore counterparts.

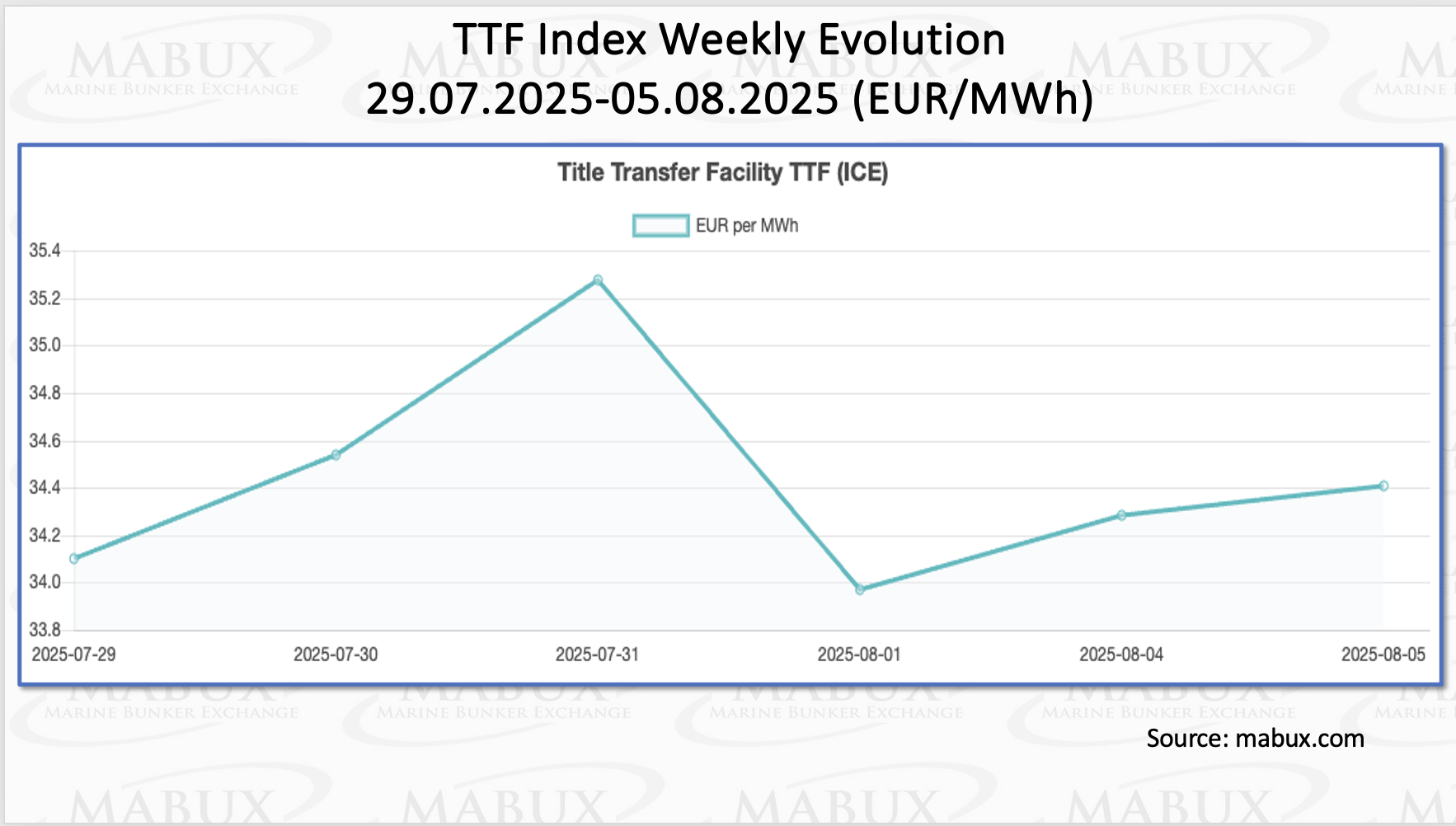

As of August 5, European regional gas storage facilities were 69.96% full, an increase of 2.33% compared to the previous week, but 1.37% below the level recorded at the beginning of the year (71.33%). This indicates that current storage levels have nearly returned to early-year figures, and the process of replenishing gas reserves continues. By the end of the 32nd week, the European TTF gas benchmark recorded a modest increase of 0.303 euro/MWh, rising to 34.406 euro/MWh from 34.103 euro/MWh the previous week.

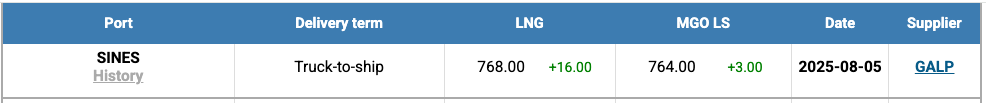

The price of LNG as a bunker fuel in the port of Sines (Portugal) rose by US$16 over the week, reaching US$768/MT, up from US$752/MT the previous week. Meanwhile, the price gap between LNG and conventional fuel shifted back in favor of conventional fuel. As of August 5, LNG was US$4 more expensive than MGO LS, compared to a US$40 advantage for LNG the week before. On that day, MGO LS was priced at US$764/MT in Sines.

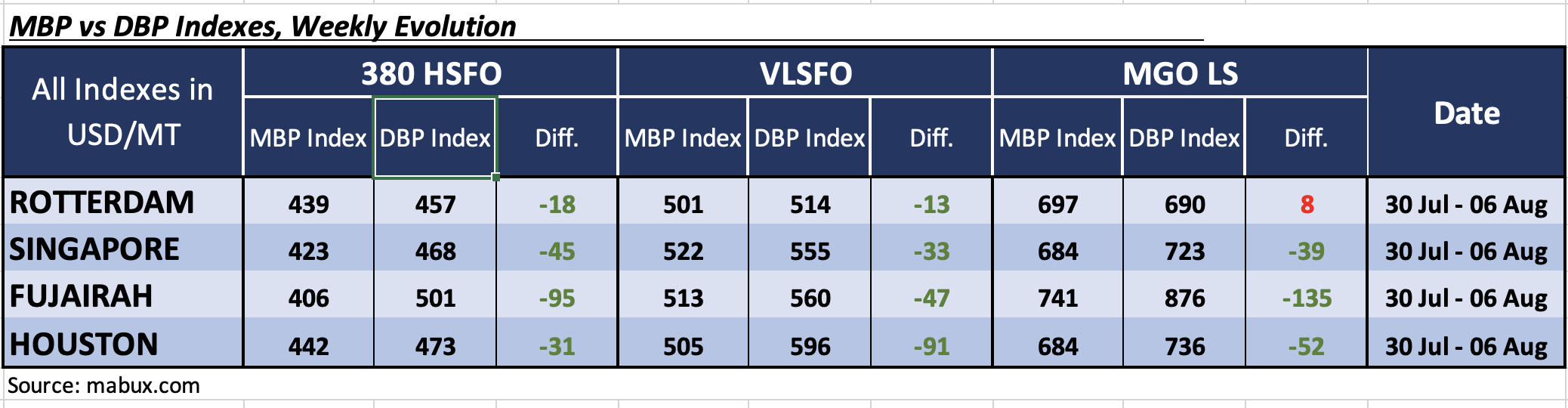

At the end of the 32nd week, the MABUX Market Differential Index (MDI), showed the following trends in average weekly bunker prices across the world’s major hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: All four ports remained in the undervalued zone. The MDI increased by 13 points in Rotterdam and by 7 points in Houston, while values in Singapore and Fujairah remained unchanged. Fujairah’s MDI continues to hold steady near the benchmark level of US$100.00.

• VLSFO segment: Rotterdam shifted back into the undervalued zone, joining the other ports which were already undervalued. The average weekly undervaluation deepened, with MDI rising by 16 points in Rotterdam, 1 point in Singapore, 4 points in Fujairah, and 10 points in Houston. Houston’s MDI approached the US$100.00 threshold.

• MGO LS segment: Rotterdam remained the only overvalued port, although its MDI declined by 3 points. The other ports remained undervalued: MDI values fell by 15 points in Singapore and 17 points in Fujairah, while Houston recorded a modest increase of 1 point. Rotterdam’s MDI moved closer to achieving 100% correlation between MBP and DBP, while Fujairah’s MDI remains consistently above the US$100.00 mark.

”Overall, the distribution of overvalued and undervalued ports continues to shift toward increased undervaluation, with only one overvalued port remaining in the MGO LS segment (Rotterdam). Based on current dynamics, we expect the trend of bunker fuel undervaluation to persist into the coming week,” commented Ivanov.

Sergey Ivanov added: ”We believe that a continued downward trend in the global bunker market is unlikely. In the coming week, bunker indices are expected to enter a phase of moderate upward correction, accompanied by short-term, multidirectional fluctuations.”