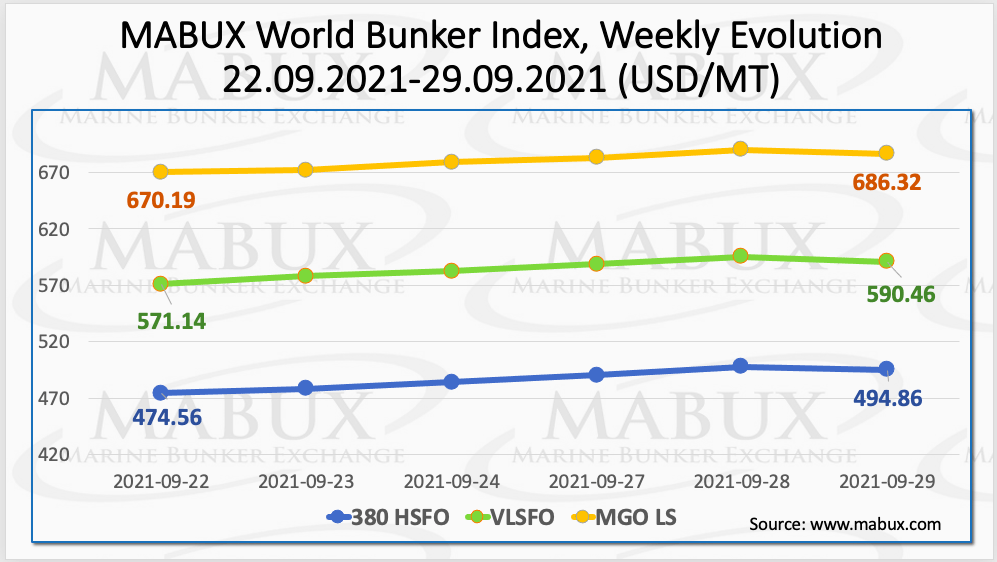

The Marine Bunker Exchange (MABUX) World Bunker Index on week 39 showed a strong upward trend, with the 380 HSFO Index rising to US$494.86/MT, the VLSFO Index increasing to US$590.46/MT, and the MGO index growing to US$686.32/MT.

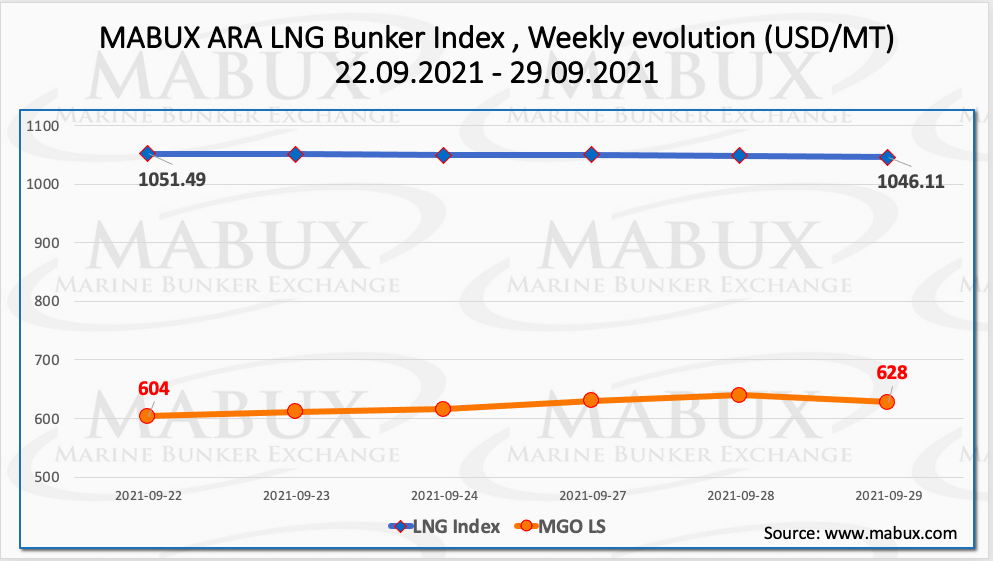

The MABUX LNG Bunker Index in the Amsterdam-Rotterdam-Antwerp (ARA) region, calculated as the average price of LNG as a marine fuel, did not have any significant changes in the period from 22 to 29 September and showed a moderate decline to US$1,046.11/MT.

At the same time, the average LNG Bunker Index decreased by US$5.27 compared to the previous week. The average MGO LS price in Rotterdam increased by US$19.67/MT over the same period, and the average price difference between bunker LNG and MGO LS in Rotterdam fell to US$427.57/MT.

MABUX commented that the surge in natural gas prices is still due to a massive supply shortage in Europe, a situation that is quickly spilling over into other countries and other markets—including the coal and oil markets as demand for power exceeds supply.

Furthermore, the natural gas crisis is set to intensify as winter heating season approaches, with supplies insufficient to keep up with current demand, let alone build stockpiles for what will be increased demand in the cold season.

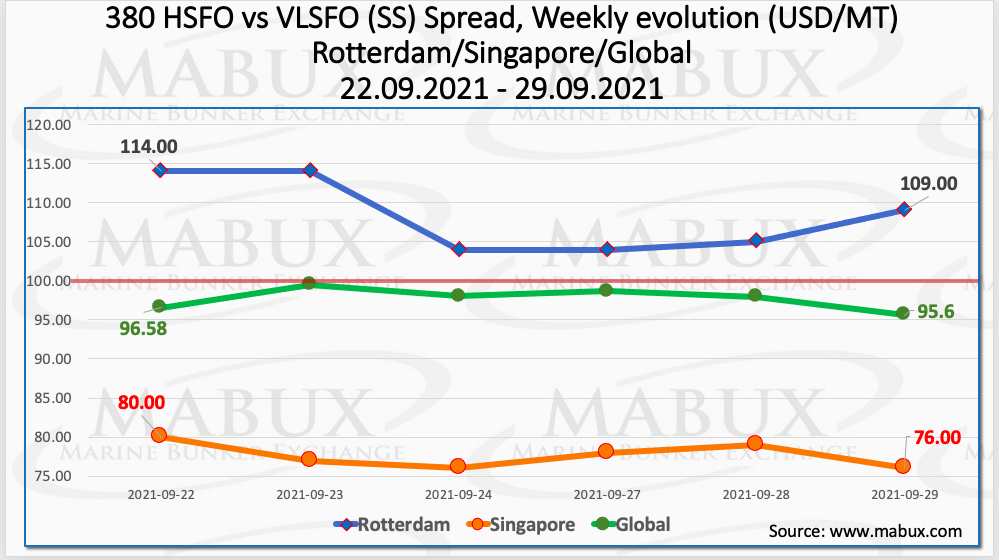

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – has not changed significantly over the week and stands at US$97.72.

In particular, the average weekly SS Spread in Rotterdam decreased slightly to US$108.33, while in Singapore, it also showed a moderate decline, reaching US$77.67.

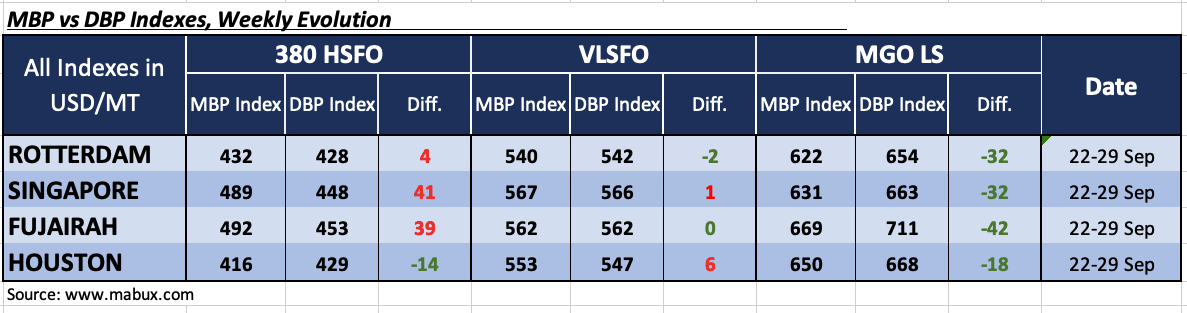

Over the past week, correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs showed that 380 HSFO fuel was overvalued in all selected ports, with the exception of Houston, where the index recorded an underpricing by US$14.

In other ports, the 380 HSFO overcharge margins were: in Rotterdam plus US$4, in Singapore plus US$41 and in Fujairah plus US$39.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, was overvalued in two ports out of four: in Singapore by plus US$1 and in Houston by plus US$6.

However, in Rotterdam, the MABUX MBP/DBP Index showed VLSFO underestimation by US$2, while in Fujairah the two indexes stood at the same point (US$562/MT).

“In general, the VLSFO market prices at all ports almost completely follow the DBP Index,” noted MABUX.

Last but not least, MGO LS remains the only fuel that was underestimated by the MABUX MBP/DBP Index at all selected ports: minimum value in Houston, minus US$18, and maximum value in Fujairah, minus US$42.