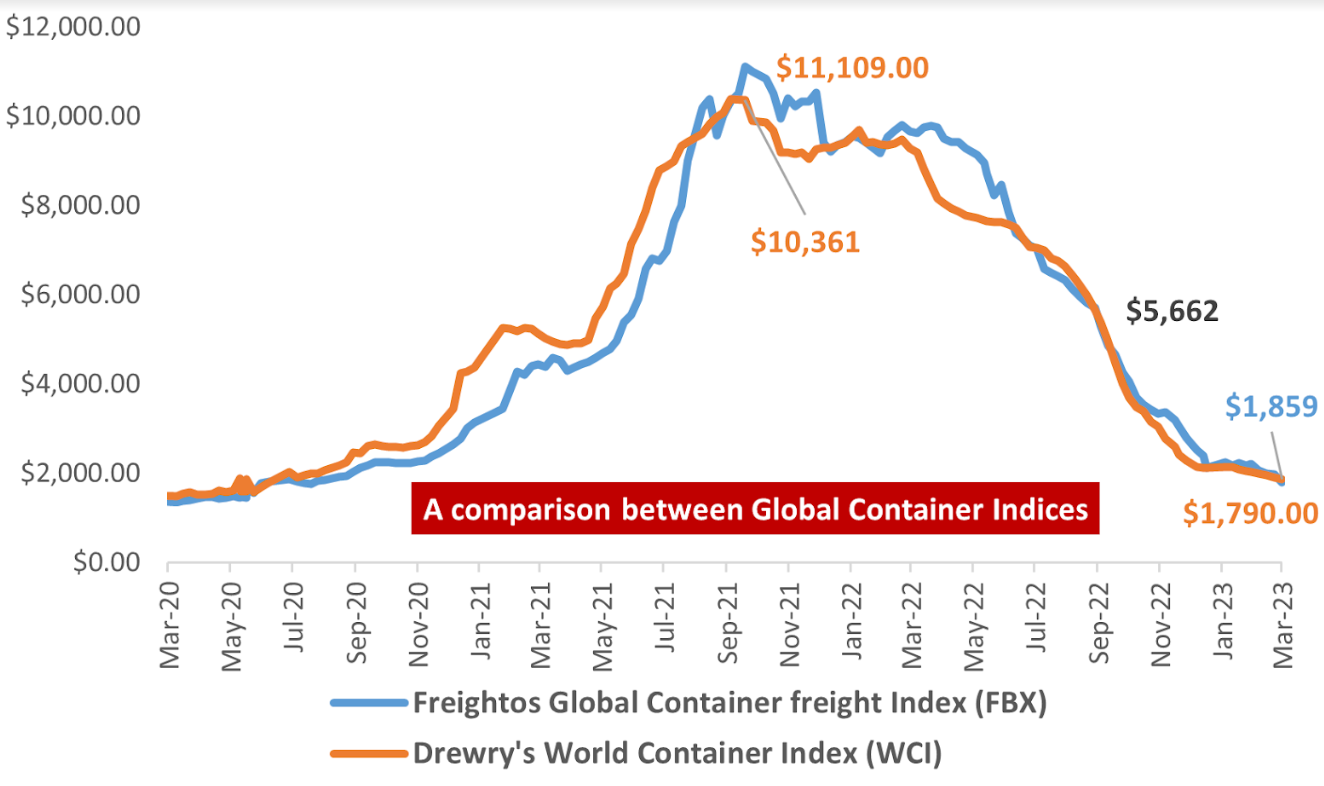

The Freightos Global Container Index (FBX) took a 10% hit in its weekly quote, only the third such instance ever since 2020, to register a rate of US$1,791. This ending on the 3rd of March, 2023 saw it tumble below the Drewry’s World Container Index (WCI) after six months.

While Drewry’s WCI and the Shanghai Containerized Freight Index (SCFI) had seen a straight down reversal, the FBX had off-late registered weekly increases and declines, alternatively but the present dip led primarily by rates from China to Europe, the United States and the Mediterranean saw it underperform the other indices. The FBX has now lost about 83.9% from its peak value of US$11,109 as against 82.1% for Drewry’s WCI and about 81.77% for the SCFI.

The fact that FBX, powered by Freightos which was listed recently on the NASDAQ (Ref: CRGO), is being used quite a lot for Freight Forwarding Agreements, Indexing and referencing throws more indication that the correction in prices is still not over. The rates have also been quite dynamic.

The China-US West Coast rates have been on a fall ever since the supply chain disruptions started cooling down. The prices hit a roof of US$20,586 in September 2021 but have since then nosedived by a shattering 94.8% to record US$1,077 as per the latest figures, just a kissing distance from the triple-digit mark.

Its equivalent futures traded in Freight Investor Services (FIS), quote a price of US$1,225 for the March 2023 contract, a 14% premium to the spot prices. But, from another perspective, even these are at a 37% discount to the FEU rates indicated by Drewry’s at US$1,948.

However, that doesn’t mean that there is a direct relationship between prices across either index, though there is a strong correlation between the price movements of both the Composite Indexes, observed post-pandemic. (Correlation Coefficient > 0.9)

The Freightos has also seen rates at a premium in certain other trade routes such as the China-Mediterranean, in comparison with Drewry’s. This is despite the trade lane prices correcting 15% for an FEU. The contract rates in trade lanes are following their spot counterparts, though the falls aren’t as profound yet.

The Xeneta Long-term average rate index dipped just 1% to end at 354.2 for January 2023 but saw its sixth consecutive monthly downtick. As cases for indexation may be used or referred to for pricing freight forwarding contracts in the industry, to reduce risk owing to the way prices have moved since 2020, the onus on the supply chain stakeholders would involve more subtle tracking of indices and rates across trade-lanes along with the relevant market and economic information to make informed decisions.

Author of the article: Gautham Krishnan

Gautham Krishnan is a logistics professional with Fluor Corporation, in the area of project logistics and analytics, and has worked in the areas of Project Management, Business Development and Government Consulting.