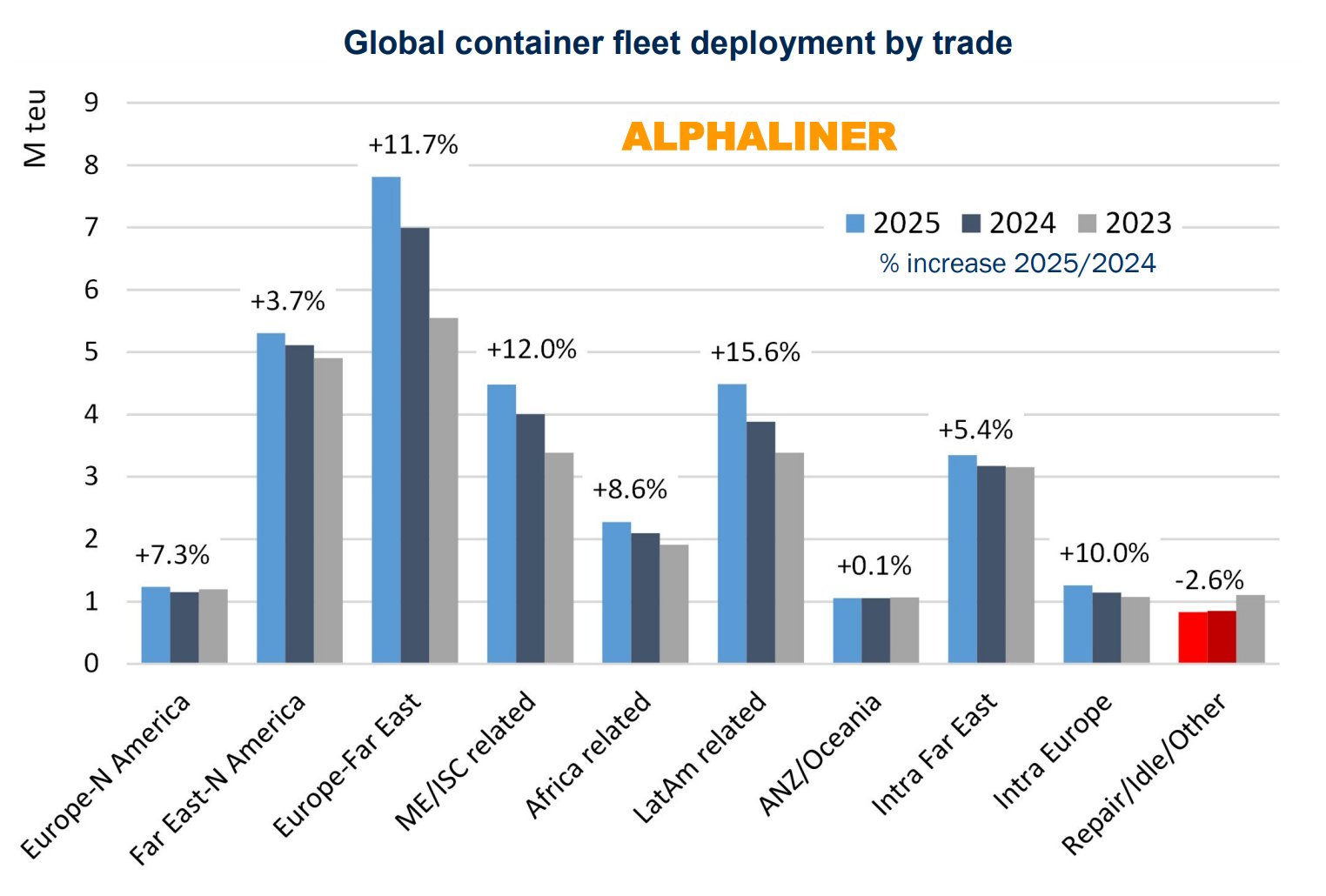

The Far East–Europe trade lane continues to dominate global liner shipping, reinforcing its position as the largest corridor for containerized cargo.

Over the past twelve months, the capacity of the global container fleet expanded by 8.9%, reaching 32.1 million TEUs, according to Alphaliner.

During this period, an additional 2.62 million TEUs of new slot capacity was added to the fleet.

Once again, the Far East–Europe route absorbed the majority of this new capacity.

Vessel deployment on the corridor rose by 11.7% year-on-year, with 817,000 TEU slots added since May 2024, accounting for 31% of all new global fleet capacity added during that time.

When comparing capacity levels between May 2023 and May 2025, the increase is striking: 40.8% growth over two years.

This dramatic rise is largely attributed to the ongoing Red Sea crisis, which has forced carriers to reroute vessels via the Cape of Good Hope, necessitating additional tonnage to maintain schedules.

In total, 2.26 million TEUs of capacity has been added to the Far East–Europe corridor since May 2023, bringing the total capacity on the route to 7.8 million TEUs. This represents 24.4% of the global container fleet, up from 20.8% two years ago, firmly establishing this trade as the most heavily serviced by capacity.

Meanwhile, the fastest growth in percentage terms was recorded on Latin America-related trade routes.

Over the past year, 606,500 TEUs of capacity were added to these services, reflecting a 15.6% increase, well above the global average.

As of last month, 14% of the global container fleet was deployed on services to and from Latin America, further confirming the region’s growing role in global liner shipping.