Danish maritime data company, Sea-Intelligence, analysed what the removal of capacity from the market (due to ship delays) means for the efficient development of the global fleet and its impact on the global supply/demand balance.

As a starting point, the company modeled the underlying structural development of the fleet, taking into account global fleet unavailability due to vessel delays.

“While the nominal fleet grew at a steady rate of roughly 4% Y/Y in 2020-2022, there was a substantial decline in the available fleet as delays started to become severe, with a sizable difference between the two,” noted Alan Murphy, CEO of Sea-Intelligence.

As a better basis for comparing global demand with global fleet size, Sea-Intelligence used TEU*Miles.

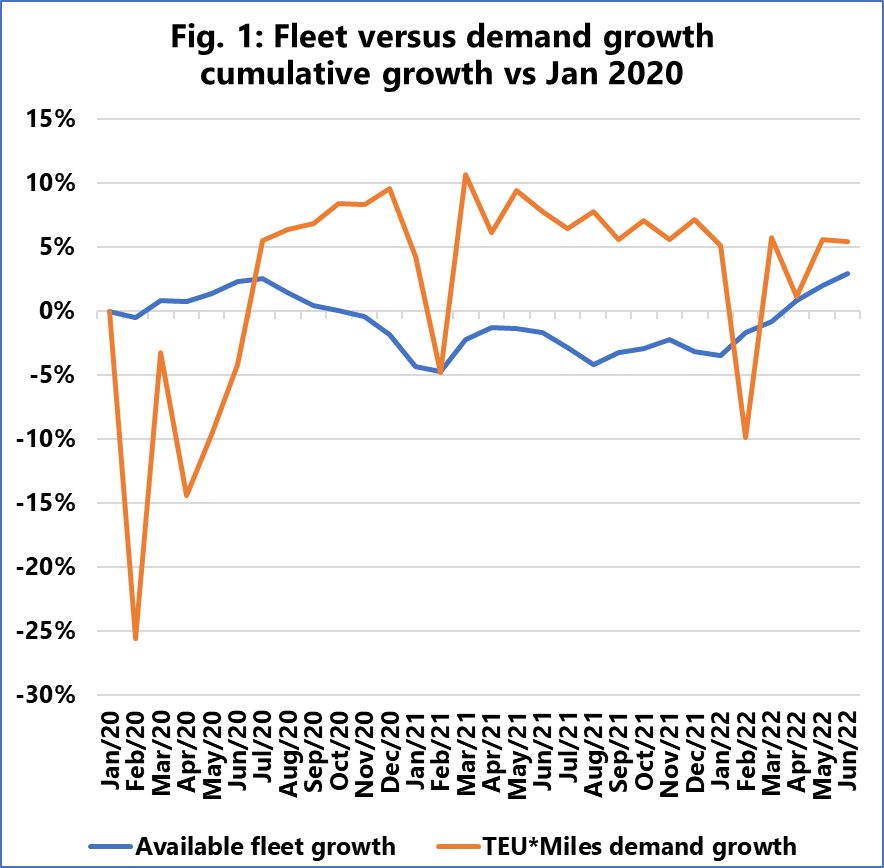

Figure 1 shows the cumulative increase in available fleet size and demand in TEU*Miles compared to January 2020.

“The large spikes in demand in February 2021 and 2022 are purely a Chinese New Year effect, and do not signal any underlying shifts,” pointed out Murphy.

Understandably, the extreme strength in favor of carriers in 2021 is due to consistently higher cumulative demand growth than the available fleet. This effect started in July 2020 and only began to taper in the last few months.

In fact, demand was consistently 10% higher than capacity from November 2020 to January 2022. However, the gap is narrowing and is now down to 2% from pre-pandemic levels, according to the Sea-Intelligence report.

“All in all, what the data shows is that the extreme spikes in freight rates in 2021 were indeed driven by a situation where demand suddenly exceeded capacity at a global level, primarily driven by the unavailability of capacity,” said Murphy.

He concluded, “the recent trend towards normalisation has in turn also been primarily driven by gradual improvements in schedule reliability and vessel delays, and as long as improvements continue, we should expect that the supply/demand balance will also continue to decline, and freight rates will be under increasing downward pressure.”