The European Parliament’s Environmental Committee has advised that Europe should phase out the use of open loop scrubbers and restrict the discharge of scrubber wastewater as soon as possible.

The report on scrubbers is part of a wider ranging report from the Transport Committee which will recommend the banning of the use high sulphur fuel with scrubbers. Such a move would be a grave blow to owners that fitted high cost scrubber equipment to their vessels. The move would follow the collapse of the oil price earlier this year and the decline in demand caused by the pandemic.

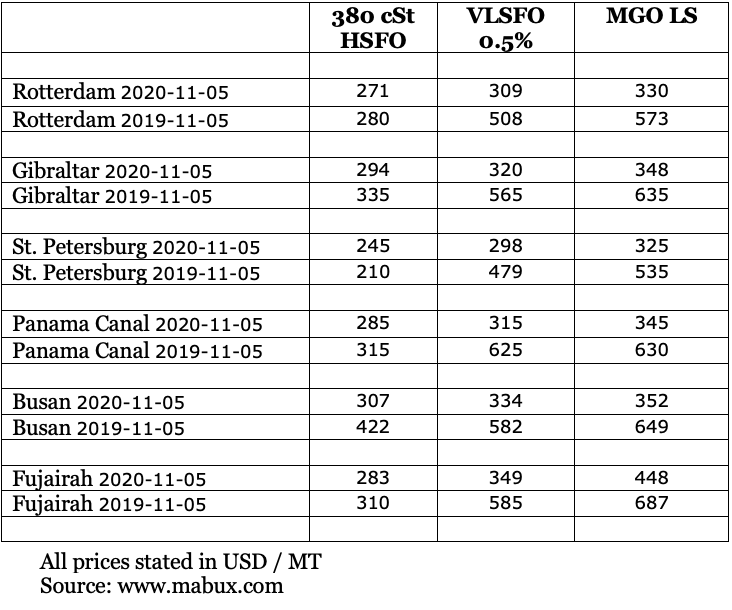

Up to around 5,000 vessel owners invested in scrubber systems with a view to gaining a competitive advantage through the lower price of HFO compared to very low sulphur fuel oil (VLSFO), known as the spread. The spread was US$300 at one point earlier this year but the collapse in oil prices have left these owners out of pocket.

Any ban on the use of scrubbers, or even a ban on the use of open loop scrubbers in Europe could prove to be the final blow to the scrubber industry with many owners having refused to fit scrubbers earlier this year as the development of the IMO 2020 regulation and its implementation did not happen in the way that was expected.

Nevertheless, MABUX says there has been better news for bunker fuel sellers with global oil indexes having rallied on 3 -4 November on US election day as equity markets around the world also bracing for the outcome of the election.

However, the pandemic effects are raising the levels of anxiety with a number of uncertainties putting downward pressure on fuel prices, including the uncertainty as to when an effective vaccine could be available to fight against Covid-19 that would allow economies around the world to recover.

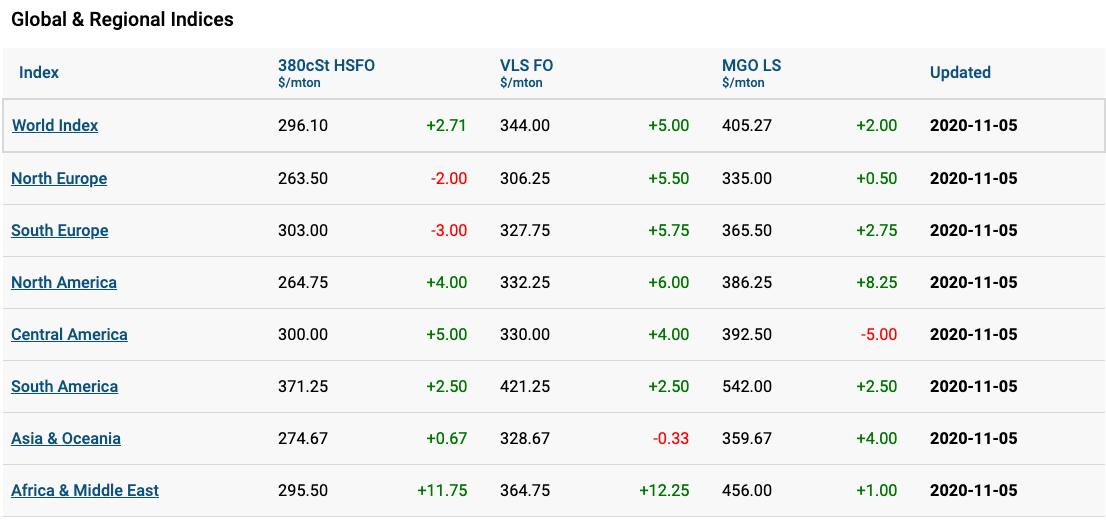

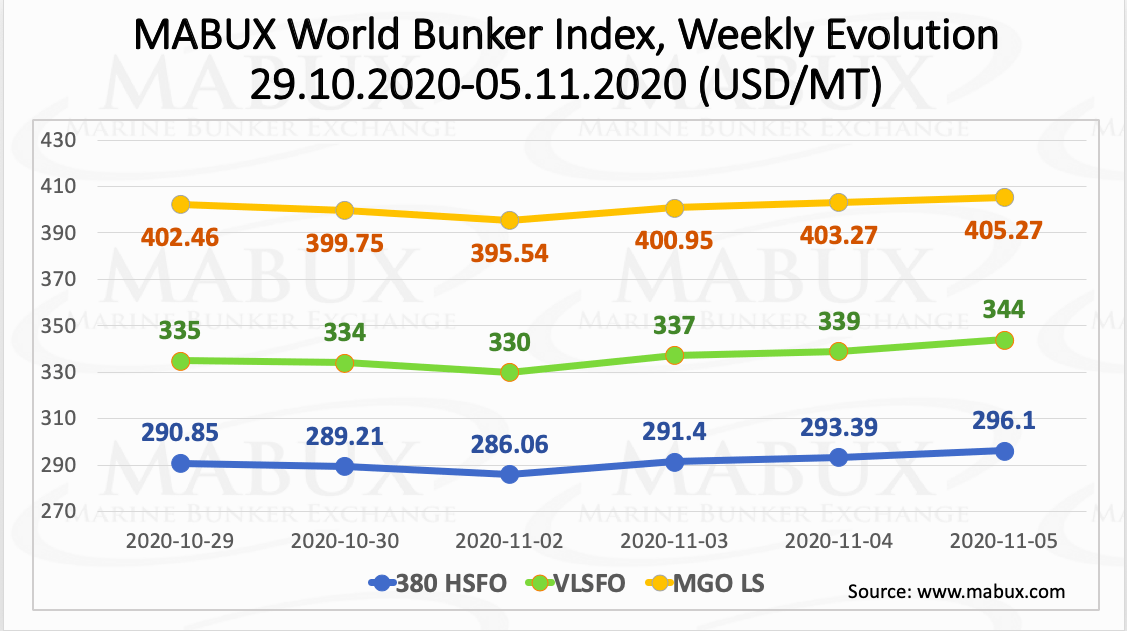

MABUX’s World Bunker Index moved up slightly this week, with the 380 HSFO index rising from US$290.85 to 296.10 /MT (+US$5.25), VLSFO added US$9.00 globally: from US$335 to 344 /MT, while MGO gained only US$2.81: from US$402.46 up to US$405.27/MT. There were no significant changes in the scrubber spread, it has narrowed by US$1.72 and averaged US$45.33.

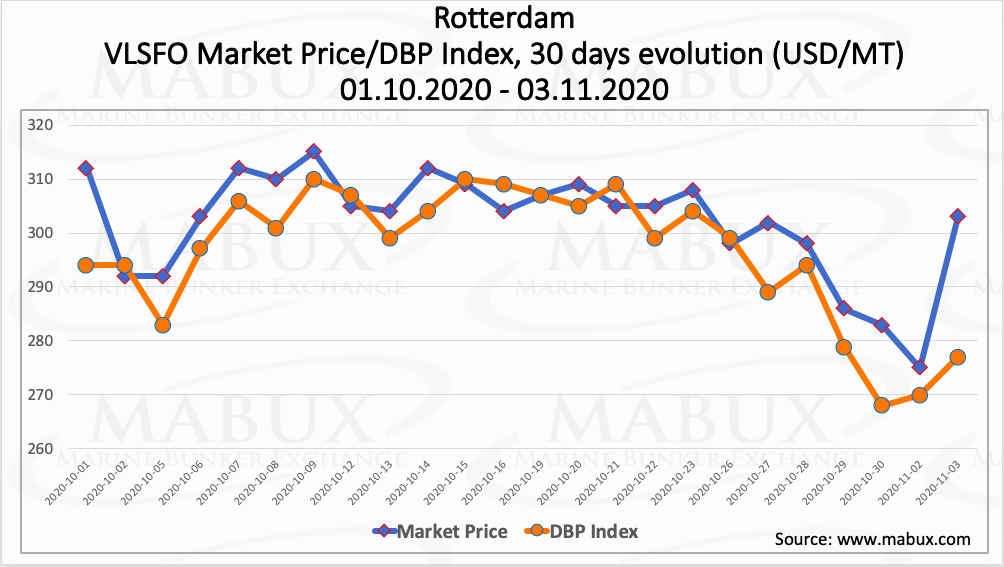

In Rotterdam the average value of the VLSFO DBP Index for the past 30 days is US$302/MT – the average Market Price, US$296 /MT – in MABUX’s newly developed Digital Bunker Price (DBP) Index, which means that the market price of VLSFO bunker fuel has been slightly overestimated. As for 380 HSFO, the latest trend also shows it was overcharged by an average of US$5, US$251 /MT on average, with the market price, US$246 /MT on the DBP.

MABUX has recently launched its new Bunker Price Benchmark – Digital Bunker Price (DBP) – which relates entirely to Oil Future differentials. Among other features DBP is a tool to identify overcharge/undercharge bunker prices and shows real-time bunker price trends updating every 1 minute. The function is available in 35 world major ports (more details at www.mabux.com).