Baltic and International Maritime Council (BIMCO) is concerned that the inclusion of shipping in the European Union (EU) Emissions Trading Scheme (ETS) will inhibit global action on reducing CO2 emissions.

Instead, BIMCO urges the EU to work with the international community at the International Maritime Organization (IMO) to get a global market-based measure established, when the required technology is available, which would ensure the industry operates on a level playing field.

When the EU attempted to unilaterally enforce its ETS on airlines flying in or out of EU in 2012, it was met with stiff opposition from large countries, such as China, India and the United States.

There can be no guarantees that an EU-imposed regional ETS for shipping will not lead to similar responses, and there are many concerns about the consequences of such a failure.

However, IMO has reported that the implementation of its 2020 fuel regulation had been smoother than expected with only 55 Fuel Oil Non-Availability Reports (FONARs) submitted since the introduction of the 0.50% global sulphur cap this year.

In the meantime, oil market fundamentals continue to be weak especially with increasing Covid-19 cases globally, according to the Marine Bunker Exchange (MABUX).

This surge in infections raises the concerns of new lockdown measures on the European continent over the next few months, which may lead to a slower recovery of global oil and fuel demand.

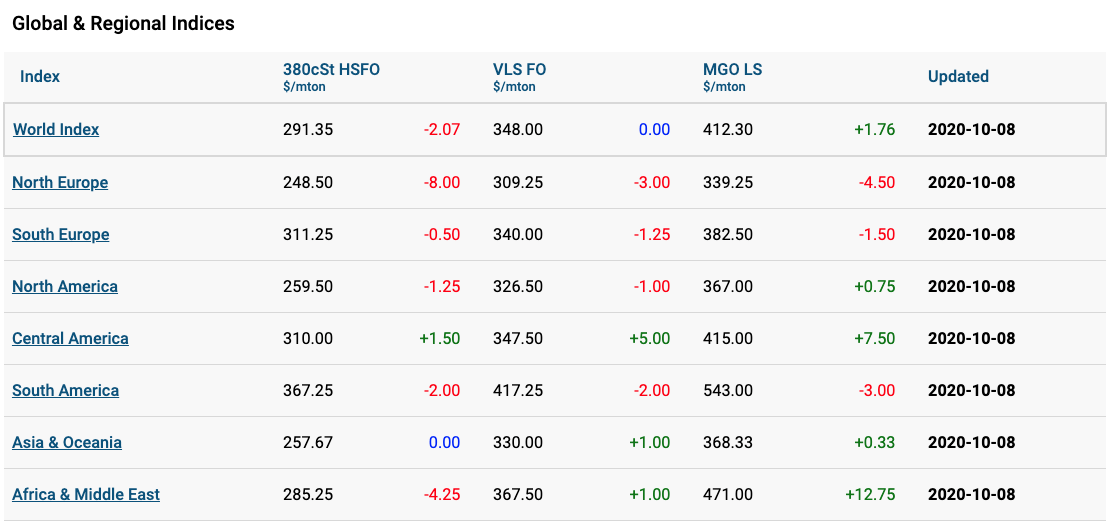

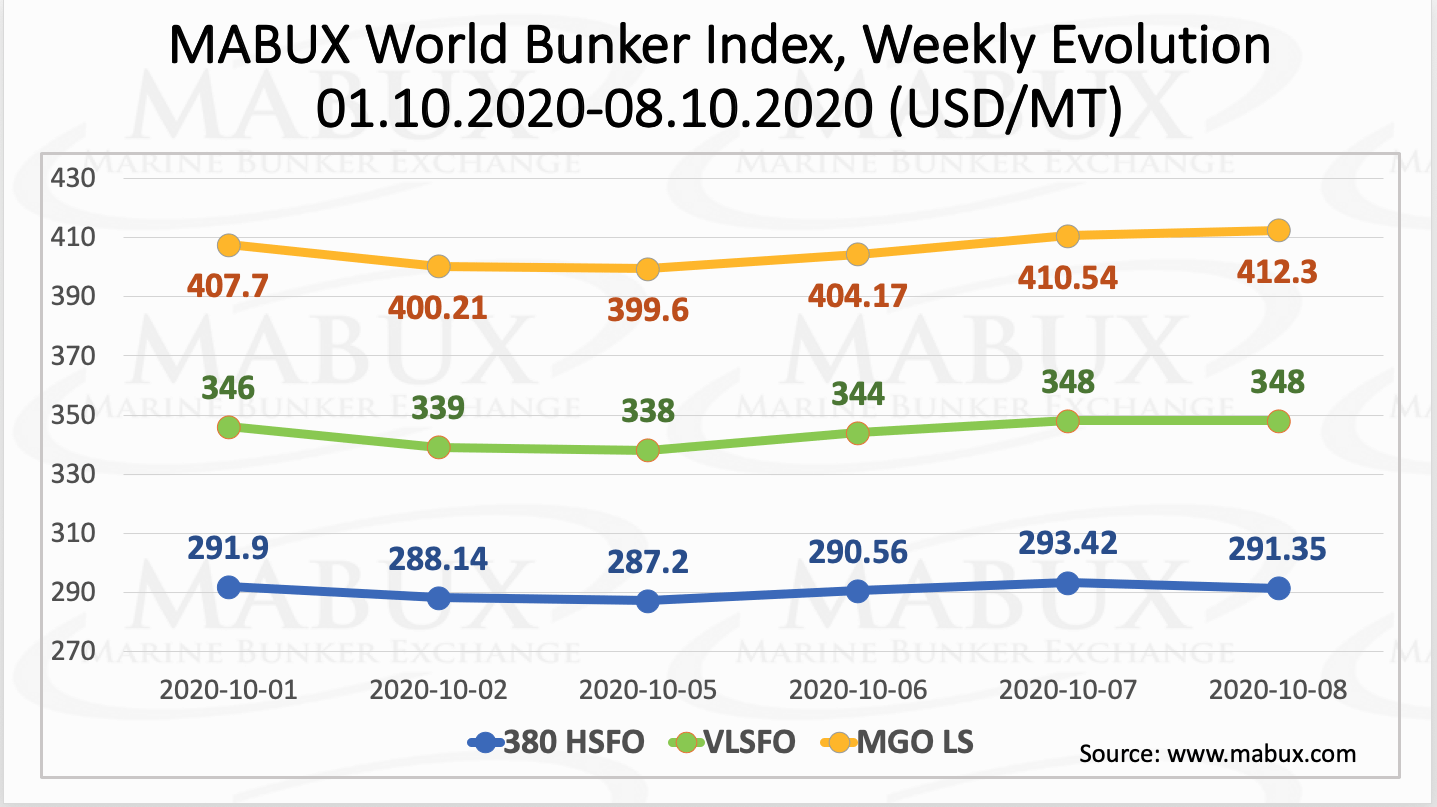

At the same time, the World Bunker Index MABUX has been steady and demonstrated slight irregular changes for a week.

In particular, the 380 HSFO index fell by less than US$1 to US$291.35 / mt, VLSFO gained US$2 to reach at US$348 / mt while MGO increased by US$4.60 to US$412.30 / mt.

Additionally, it is noticed no significant changes in the global scrubber spread (the price difference between 380 HSFO and VLSFO), as it has added only US$1.57 and averaged US$53.41.

The spread in Rotterdam is lagging behind Singapore’s index significantly, which has reduced over the past three weeks. The spread in Rotterdam changed during the week to a range of US$54-66, while the weekly average increased by US$6.50 to US$60.50.

In Singapore, the spread rose slightly during the week and climbed to US$72, while the weekly average gained US$2.00 to reach at US$68.33.

In the meantime, bunker sales volumes are starting to pick up again in some ports, with Singapore being an example of such a trend, said MABUX.

Preliminary estimates from the Maritime and Port Authority of Singapore on 14 September showed that in August bunker fuel sales in Singapore, added 0.27% on the month and rose 13.6% on the year to 4.17 million mt.