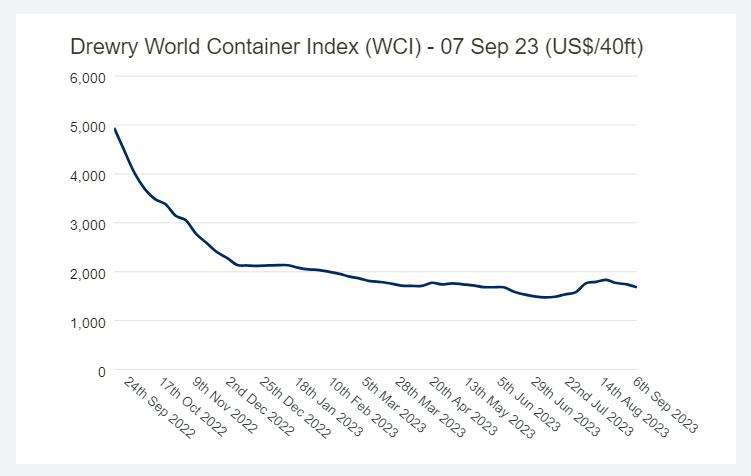

Drewry’s composite World Container Index (WCI) decreased by 3.4% to US$1,680.73 per 40ft container this week, 84% below the peak of US$10,377 reached in September 2021.

The latest Drewry WCI composite index is 37% lower than the 10-year average of US$2,681, indicating a return to more normal prices, but remains 18% higher than average 2019 (pre-pandemic) rates of US$1,420.

The average composite index for the year-to-date is US$1,769 per 40ft container, which is US$912 lower than the 10-year average, US$2,681 mentioned above.

The composite index decreased by 3.4% to US$1,680.73 per 40ft container and is 68.8% lower than the same week in 2022, while freight rates on Shanghai – Rotterdam trade lane dropped 10% or US$166 to US$1,449 per 40ft container.

Similarly, spot rates from Shanghai to Genoa also declined 7% or US$150 to reach US$1,888 per FEU. Additionally, rates on Rotterdam – Shanghai lane diminished 3% or US$16 and stood at US$500 per 40ft box.

Likewise, rates from New York – Rotterdam and Shanghai – New York inched down by 2% to US$739 and 1% to US$3,398 per 40ft container respectively. Conversely, rates on Shanghai – Los Angeles increased by 2% or US$37 to US$2,254 per FEU.

Moreover, spot rates from Los Angeles – Shanghai and Rotterdam – New York remained static at the previous week’s level.

Drewry expects East-West spot rates to remain stable in the next few weeks.