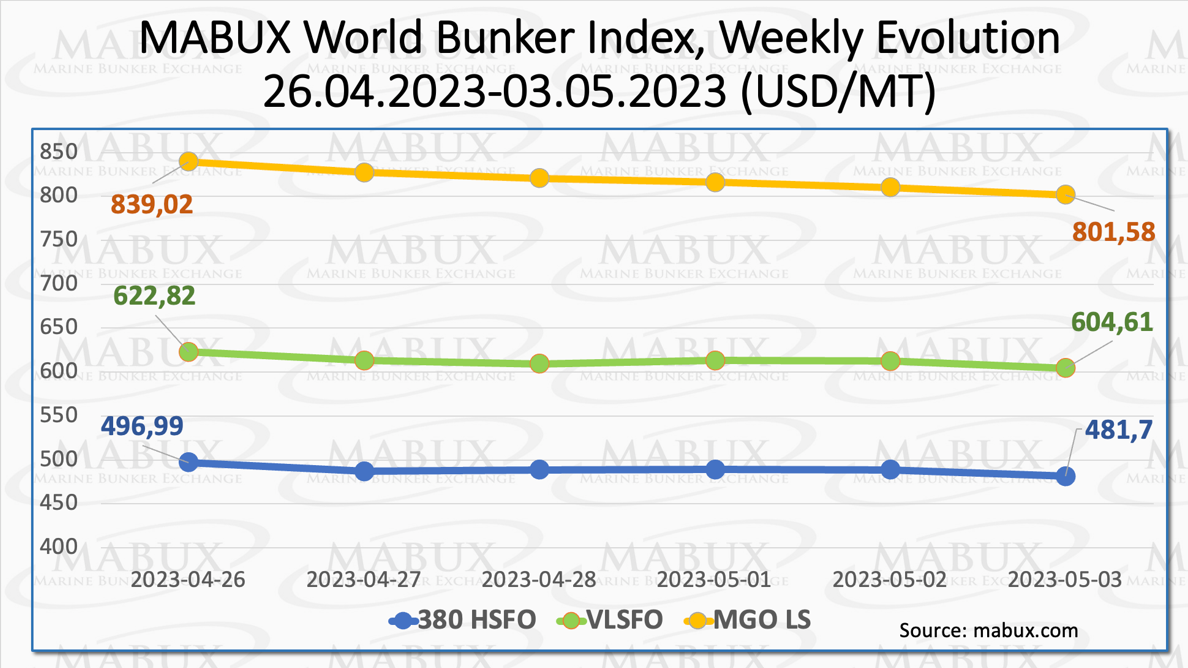

The global MABUX bunker indices demonstrated a sustainable downward trend. The 380 HSFO index experienced a further decrease of US$15.29, falling to US$481.70 /MT. The VLSFO index, in turn, also dropped by US$18.21, reaching US$604.61/MT and the MGO index declined to US$801.58/MT.

“At the time of writing, the market continued to experience downward dynamics,” commented a MABUX official.

In Week 18, the Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – continued to decrease, falling to US$122.91. The weekly average also declined by US$5.63.

In Rotterdam, the SS Spread remained constant at US$90, and the weekly average decreased by US$3.16.

In Singapore, the price difference between 380 HSFO and VLSFO increased by US$3 by the end of the week, reaching US$120 compared to US$117 in the previous week. However, the weekly average remained almost unchanged, with a minor decline of US$0.50.

“It is anticipated that the SS Spread will continue to contract in the following week,” pointed out a MABUX official.

The price of LNG as bunker fuel in the port of Sines (Portugal) rose moderately, reaching US$985/MT on 2 May.

The price difference between LNG and conventional fuel also widened to US$219 on 26 May with MGO LS in the port of Sines at US$766/MT on that day.

“At the moment, LNG prices have stabilised, and we do not expect significant changes in the LNG/conventional fuel price spread next week,” noted MABUX analysts.

In Week 18, the MDI index, which measures the correlation between MABUX market bunker prices (MBP Index) and MABUX digital bunker benchmark (DBP Index), indicated that the 380 HSFO fuel was undervalued in all four selected ports.

The average underestimation experienced a moderate decline across all ports, ranging from minus US$2 to minus US$15. In the VLSFO segment, according to MDI, the fuel also remained undervalued in all selected ports.

The underprice ratio decreased slightly in Rotterdam and Fujairah by US$5 and US$8, respectively. In Houston, the MDI increased by US$2, while in Singapore, it indicated a 100% correlation between the market price and the digital benchmark.

There are still three underpriced ports in the MGO LS segment: Rotterdam, Singapore and Houston. The average weekly undervaluation margin rose in Rotterdam by US$9, but decreased in Singapore and Houston. Fujairah remains the only overvalued port – plus US$158.

“There are still no drivers in the global bunker market that are able to form an upward

evolution. We expect the downtrend to continue next week,” commented Sergey Ivanov, director of MABUX.