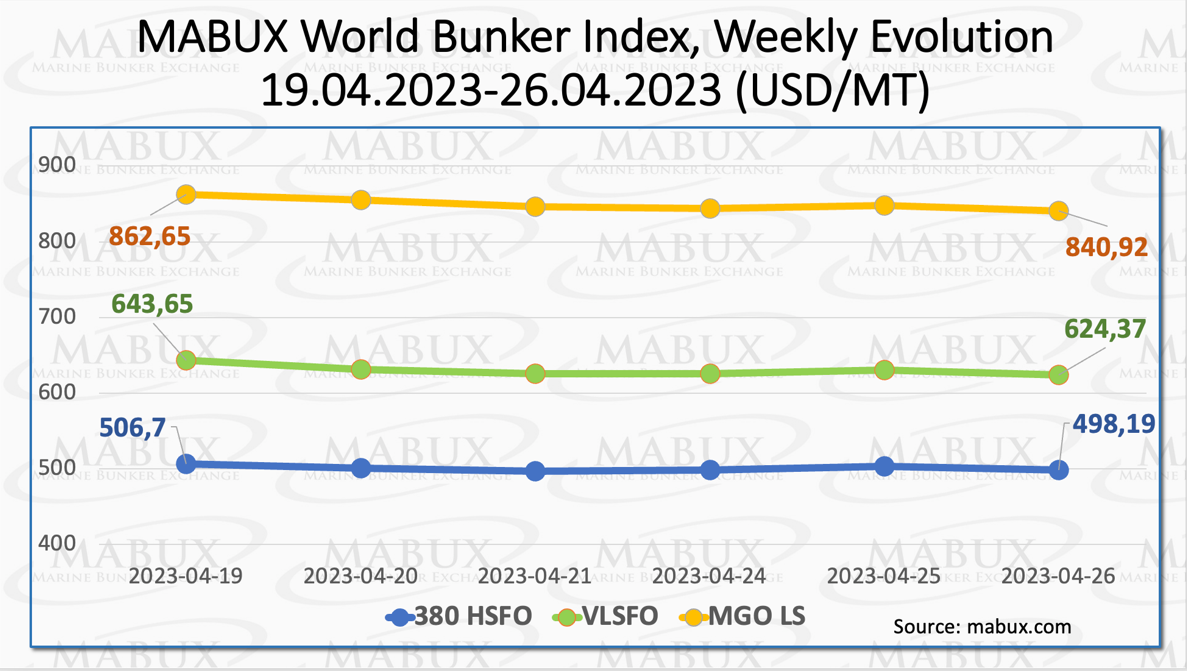

Global MABUX bunker indices showed a consistent downward trend. The 380 HSFO index dropped by US$8.51 to US$498.19/MT. Similarly, the VLSFO index also declined by US$19.28 to US$643.55/MT and the MGO index experienced a decrease of US$21.73, falling to US$840.92/MT.

“As of the time of writing, the market continued to show downward momentum,” pointed out a MABUX representative.

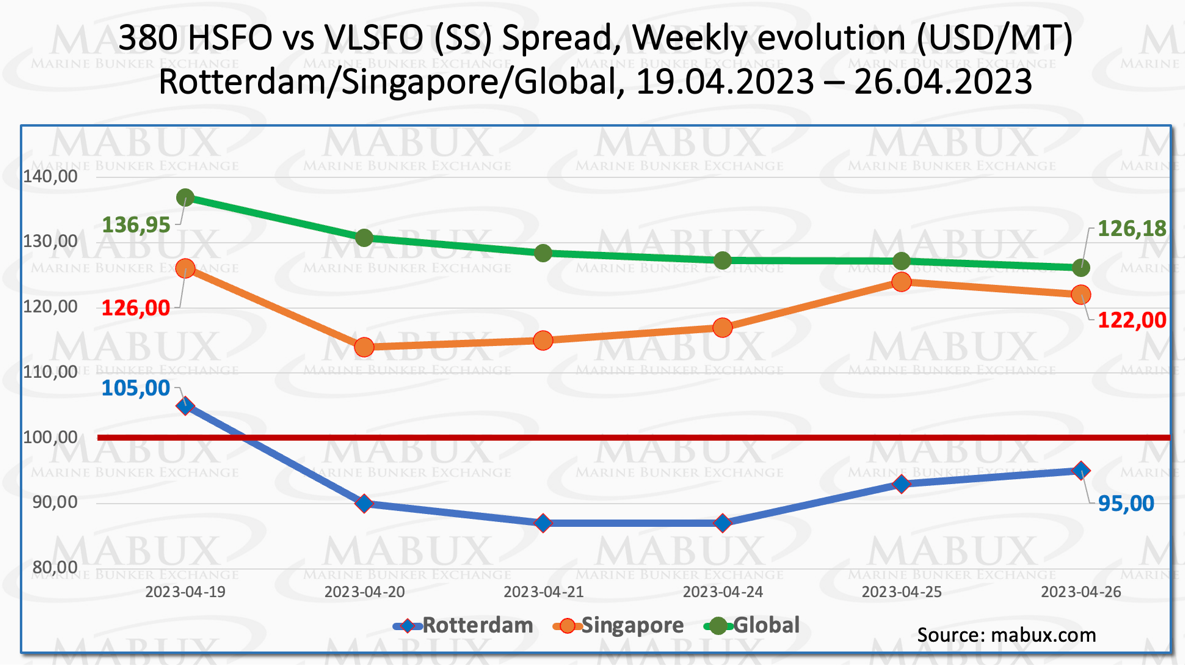

In Week 17, the Global Scrubber Spread (SS), which represents the price difference between 380 HSFO and VLSFO, continued to decline, reaching minus US$10.77, to US$126.18.

The weekly average also decreased by US$9.82. In Rotterdam, the SS Spread dropped below the US$100 mark, hitting US$87.00 within a week for the first time since 21 October 2021.

It is considered that SS Spread below US$100 makes the use of scrubbers low profitable. The weekly average of SS Spread in Rotterdam also decreased by $14.17. In Singapore, the price difference between 380 HSFO and VLSFO decreased by US$4 by the end of the week, to US$122 and the average weekly value saw a minimal decrease of US$0.50.

“It is expected that SS Spread may further reduce next week, indicating a trend of balancing in the bunker market,” commented a MABUX official.

Global inventories of liquefied natural gas have increased this month driven by weaker demand, while demand is about to recover in the summer. The increase in inventories is driven mainly by lower demand from the three biggest LNG importers in the world, China, Japan, and South Korea.

China cautioned that the outlook on the country’s LNG demand this year was uncertain, even though gas demand as a whole was seen rising. Japan, meanwhile, is looking for long-term supply. In South Korea, a reconsideration of nuclear energy is threatening

long-term demand for LNG.

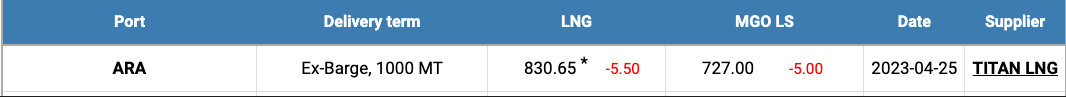

The price of LNG as bunker fuel in the port of Rotterdam continued to decrease, reaching US$830/MT on 25 April. The price difference between LNG and conventional fuel also narrowed to US$103 on 25 April, with MGO LS in the port of Rotterdam quoted at US$727/MT on that day.

“We expect that the price difference will further narrow in the upcoming week,” added a MABUX official.

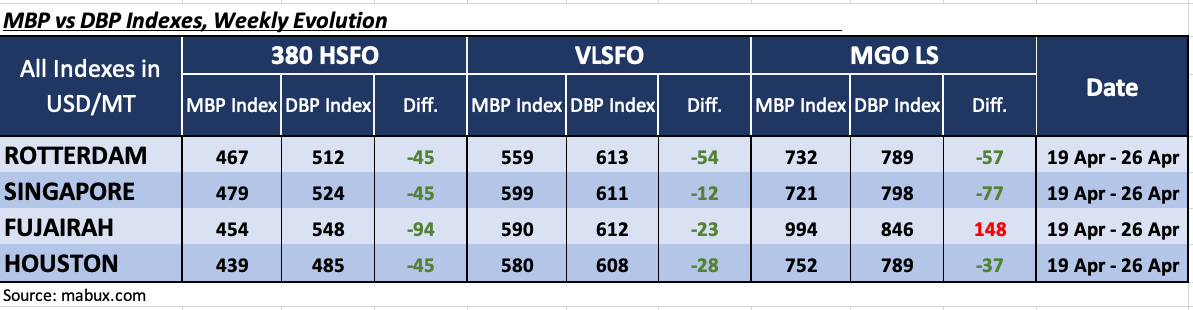

During Week 17, the MDI index, which reflects the correlation between MABUX market bunker prices (MBP Index) and the MABUX digital bunker benchmark (DBP Index), recorded an underpricing of 380 HSFO at all four selected ports.

The average weekly undervaluation ratio showed a slight reduction in Rotterdam and Fujairah. In Singapore, the MDI rose by US$1, while in Houston, it remained unchanged.

In the VLSFO segment, according to MDI, fuel also remained undervalued in all selected ports. Underprice levels remained virtually unchanged in all ports except for Houston, where the MDI showed a 6-point decline.

In the MGO LS segment, three ports are still underestimated: Rotterdam, Singapore and Houston. The average weekly undervaluation premium decreased in Rotterdam and Singapore by minus 2 and minus 5 points, respectively, but rose by 20 points in Houston. Fujairah remains the only overvalued port.

“The global bunker market is currently experiencing a moderate downtrend. In the absence

of clear drivers, it is anticipated that this trend will persist in the coming week,” commented Sergey Ivanov, director of MABUX.