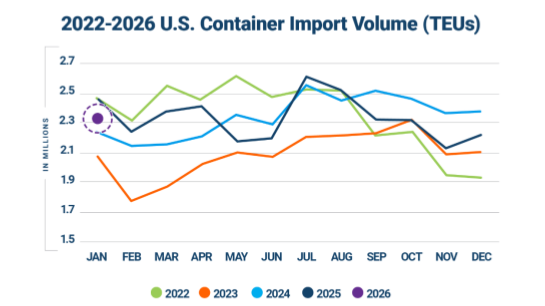

U.S. container import volumes reached 2,318,722 TEU in January 2026. The figure rose 4.1% month-over-month as volumes rebounded from December’s seasonal slowdown.

Descartes Systems Group released the data in its February Global Shipping Report. The company provides logistics metrics for supply chain professionals.

China-origin imports increased 9.3% month-over-month. However, they declined 22.7% year-over-year. Port transit delays showed modest changes in January. No signs of widespread congestion appeared.

The February update suggests a cautious trade environment. Ongoing tariff uncertainty and persistent geopolitical risk continue to complicate planning for importers.

Year-Over-Year Decline Masks Seasonal Resilience

January imports posted a 4.1% gain over December 2025. They were 6.8% lower than January 2025. Despite the year-over-year decrease, January 2026 volumes were slightly above the six-year average for the month. They rose 11.8% over January 2019.

January 2026 volumes appear to reflect a more normalized import environment. Importers are conditioned to ongoing trade policy uncertainty rather than reacting to it. This contrasts with suspected frontloading in January 2025 ahead of anticipated tariff changes.

China and India Lead Growth

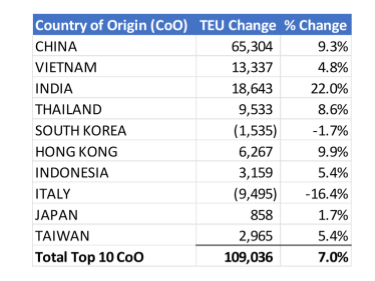

U.S. containerized imports from the top 10 countries of origin increased 7.0% month-over-month in January 2026. China led the growth, rising 9.3% or 65,304 TEU. India increased 22.0% or 18,643 TEU.

Vietnam posted a solid gain of 4.8% or 13,337 TEU. Thailand increased 8.6% or 9,533 TEU. Hong Kong rose 9.9% or 6,267 TEU.

Declines were limited to two countries. Italy fell 16.4% or 9,495 TEU. South Korea edged down 1.7% or 1,535 TEU.

January’s increase reflects broad-based strength across major sourcing countries. Renewed momentum appeared in China- and India-origin volumes.

Cautious Outlook Persists

Jackson Wood, Director of Industry Strategy at Descartes, commented on the environment. “Entering 2026, trade policy and geopolitical risk continue to create uncertainty for global supply chains,” he stated.

These factors contribute to a cautious outlook for global trade. January 2026 volumes were slightly above the six-year average for the month. They appear to reflect a more normalized trade environment. U.S. importers are becoming more conditioned to persistent volatility.

Descartes began its global shipping analysis in August 2021. The company provides monthly reports on economic and logistics factors driving global shipping