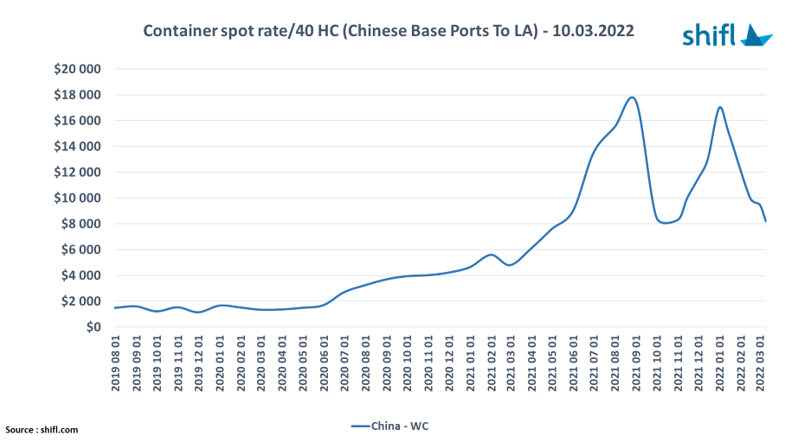

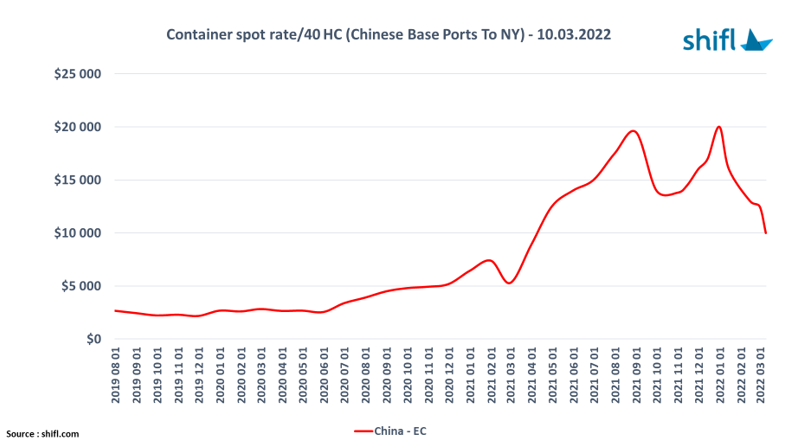

Transpacific container spot rates between China and the US West Coast and US East Coast have been on a steady decline since peaking in early January, says a report by the digital freight forwarding platform Shifl.

Particularly, West Coast rates dropped by 52% and East Coast rates by 50% in March 2022 compared to January 2022, as inbound volumes continue to fall.

“As we predicted, we have seen a sharp decline in freight rates in the last three months due to a decrease in sales and full inventories as we enter the traditional post Chinese New Year lean season,” stated Shabsie Levy, CEO and founder of Shifl.

Economists from the United Nations are expecting the economic drivers of 2021 to settle, resulting in lesser growth in 2022 compared to 2021, while US inflation remains a concern.

Shifl also estimates that global supply chains will still face some of the residual pressures of the Covid-19 pandemic.

While the drop in spot freight rates due to reduced volumes and inflation is more prevalent in the US, as per reports from Shifl China offices, recent Covid-19 lockdowns in major Chinese manufacturing hubs are also impacting the decline, as factories and ports such as Shanghai, operate at a much slower pace, impacting operational throughput inside and outside the ports.

“While the drop in China-West Coast spot freight rates has been substantial, it is still significantly higher than pre-covid levels when rates to Los Angeles in the slow season were on average at US$1,200-1,500/40’ and New York on average at US$2,400-2,800/40’,” noted Levy.

“We expect the rates to continue its downward trend up to the 2022 peak season at which time the rates will go up, albeit not to the levels seen in 2021,” added Levy.

There is also a possibility that the US West Coast ports may be caught in a new supply chain storm when operations head back to normal in China, according to Shifl.

The return to normalcy in Chinese operations may be at an “inopportune moment,” as it coincides with the International Longshore and Warehouse Union (ILWU) longshoremen contract negotiations, which have traditionally seen port operations being stalled across the ports of Los Angeles and Long Beach, lengthening vessel queues that could therefore put pressure on the rates.

Furthermore, data from Lloyd’s Intelligence shows that there are already 140 container ships waiting outside the ports of Shanghai and nearby Ningbo as of 4 April, reflecting the extent of the slowdown and a possible under-utilisation of all these ships, which could lead to a further drop in rates.

“Shippers must plan their inventory and order placements around these possibilities and be wary of committing to fixed long-term rates at the current numbers,” warned Levy.