Danish maritime data analysis company noted the different approaches of container shipping lines to the demand decrease at the beginning of 2020 caused by the Covid-19 pandemic outbreak and in the recent container demand collapse, which started in September and continued until the end of 2022.

In the first case, Sea-Intelligence said that carriers reacted swiftly, reducing liner capacity at a pace matching the drop in demand.

“This means that the carriers clearly had both the ability and the willingness to adjust capacity on a tactical level, in order to maintain vessel utilisation,” commented Danish analysts.

In the second case, according to Sea-Intelligence, the structural setup in the market – at the end of 2022 – was relatively unchanged compared to 2020, and as such, the container shipping companies must be assumed to still have the same ability at the end of 2022 as they did in 2020, to reduce capacity in line with the collapse in demand.

However, container lines have not made the same decision this time.

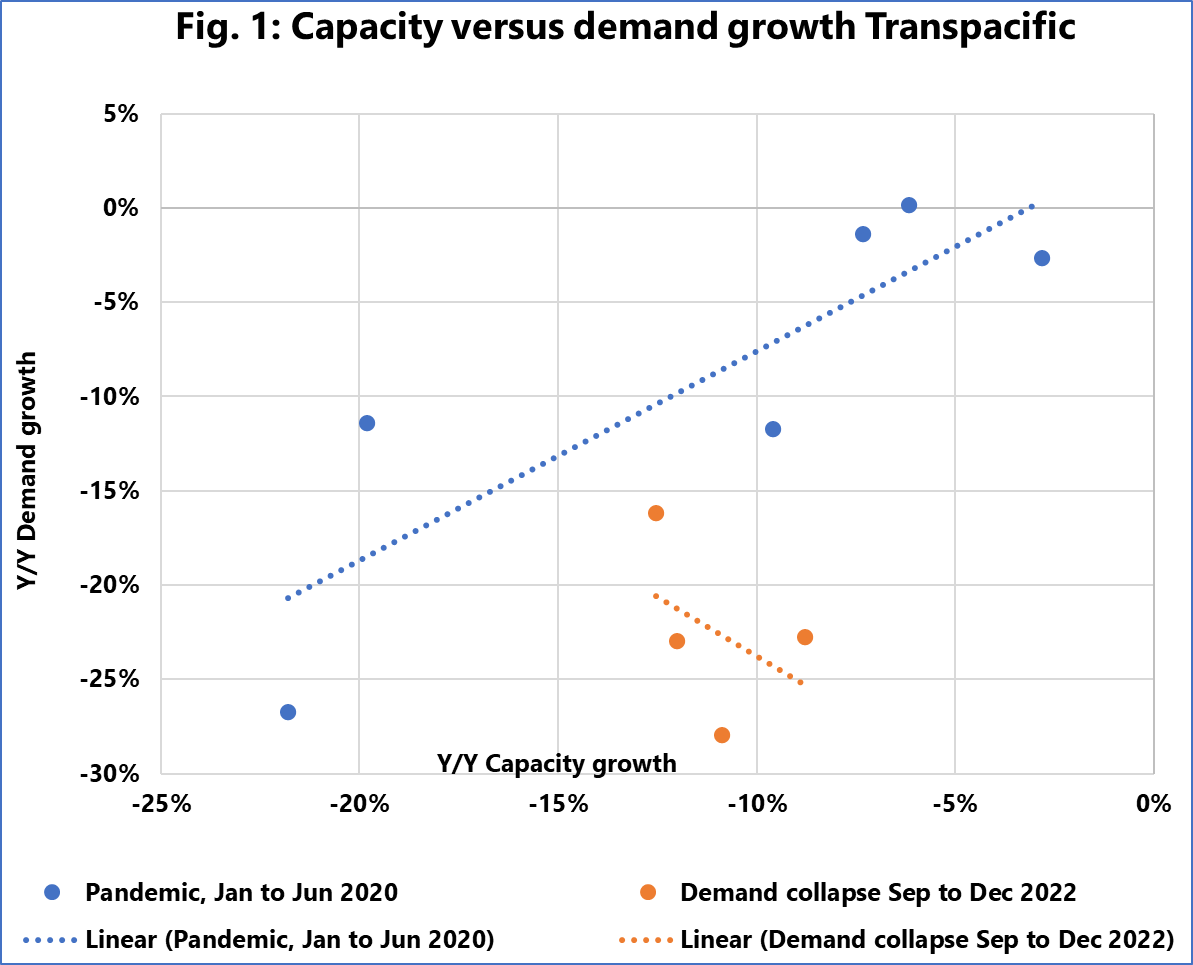

The above figure depicts a cross-plot of Transpacific capacity and demand year-on-year contraction for individual months during either the initial pandemic crisis in early 2020 (shown with blue dots) or the current demand crash (marked with orange dots).

Carriers appear to have chosen not to exercise their option to reduce capacity in response to the present demand slump. In contrast to the scenario in 2020, there is no evident correlation between changes in demand and changes in capacity by the end of 2022.

The pattern is the same for Asia-Europe as it is for the Transpacific. During the early pandemic phase, capacity was adjusted to meet the drop in demand very effectively, but towards the end of 2022, the trend in demand shrinkage diverges drastically from that of capacity contraction.

“This can only be seen as a choice on the part of the carriers,” said Alan Murphy, CEO of Sea-Intelligence.

“A choice to allow overcapacity to persist is also a choice to allow for low utilisation, and thus to allow for freight rates to continue to drop. This is a behaviour we know by a different word: A price war,” he concluded.