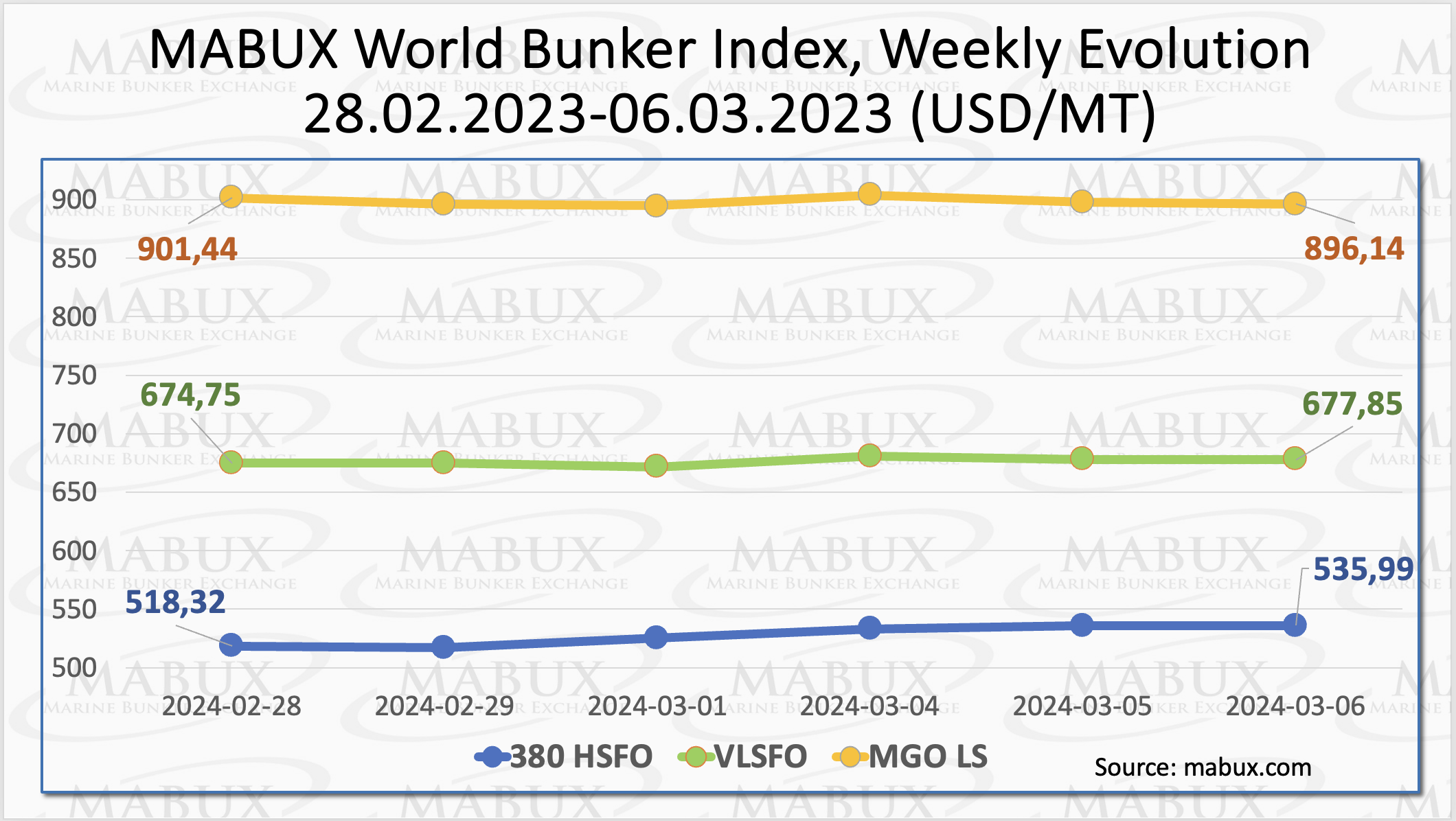

During the tenth week of the year, global Marine Bunker Exchange (MABUX) indices did not have a firm trend, fluctuating sideways.

The 380 HSFO index saw a notable increase of US$17.67 to US$535.99/MT. Similarly, the VLSFO index saw a modest rise of US$3.10, reaching US$677.85/MT. However, the MGO index experienced a decline of US$5.30 to US$896.14/MT, thereby falling below the US$900 mark.

“At the time of writing, the market appeared to be in the process of establishing a stable trend,” pointed out a MABUX spokesperson.

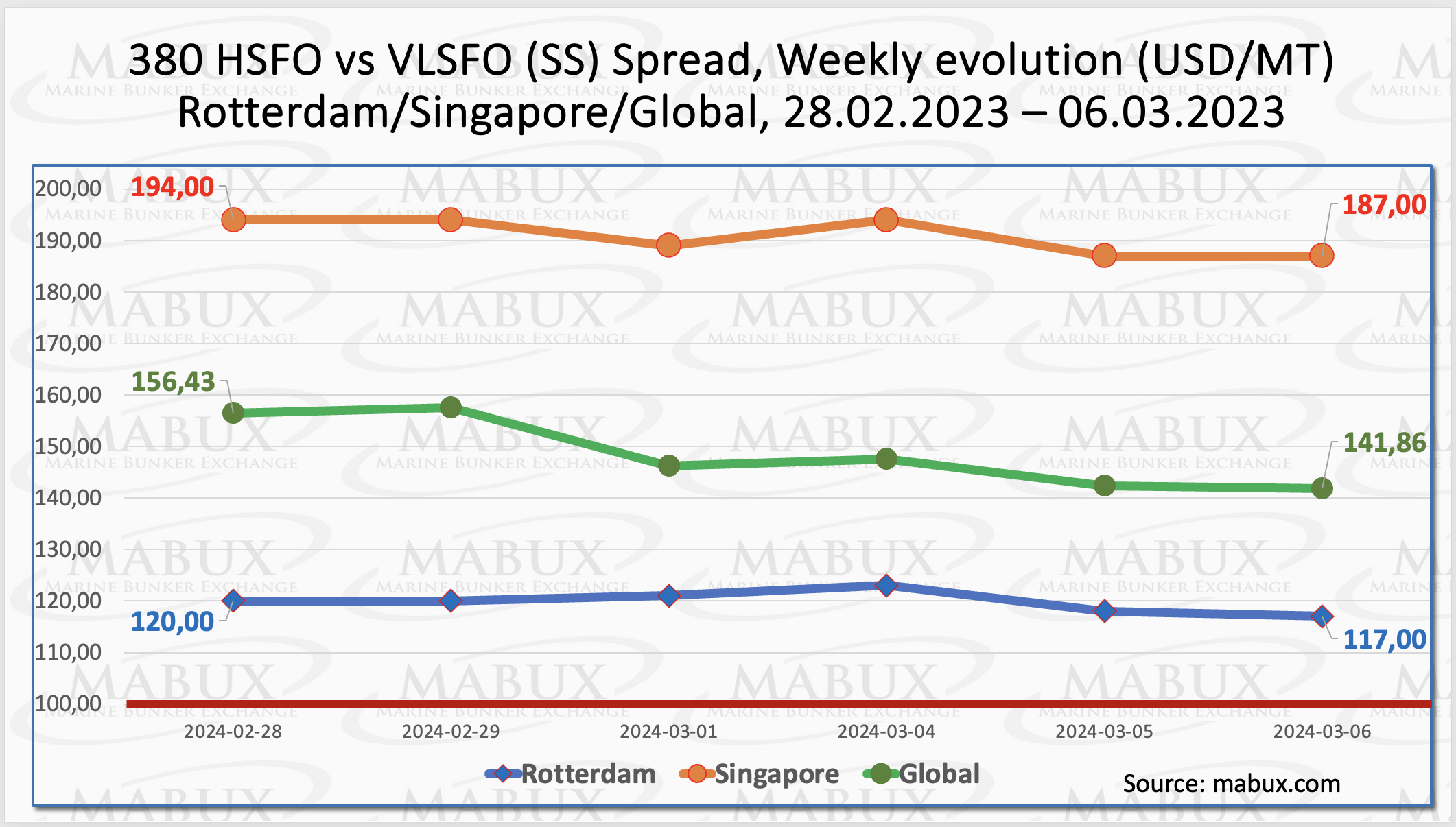

The MABUX Global Scrubber Spread (SS), representing the price difference between 380 HSFO and VLSFO, saw a decrease, now standing at minus US$14.57. Additionally, the weekly average declined by US$4.88.

In Rotterdam, the SS Spread narrowed by US$3 to US$117, although the weekly average widened by US$5.50. In Singapore, the 380 HSFO/VLSFO price differential dropped by US$7 to US$187, with the weekly average increasing by US$1.33.

“Overall, SS Spread still does not have a sustained trend, changing slightly and in different directions,” noted a MABUX official.

According to estimates from Avenir LNG, the global demand for LNG bunkering is expected to reach approximately 5.7 million metric tons this year, marking a significant increase from the 3.8 million metric tons recorded last year.

Avenir LNG’s projection exceeds the approximately 5 million metric tons forecasted by Shell, a prominent oil and gas company, for the same period. The company expresses strong optimism regarding the maritime sector’s interest in LNG, anticipating consumption growth to reach 8.3 million metric tons next year and a substantial surge to 36.9 million metric tons annually by 2033.

Also, this growth trajectory is supported by the gradual deployment of LNG-powered ships. As of the beginning of 2023, there were 389 LNG-fueled ships in operation, marking an almost tenfold increase over the past decade. Avenir LNG anticipates LNG bunker demand to surpass the sector’s LNG bunkering capacity starting next year. The company predicts a need for 31 additional LNG bunker vessels by the end of the upcoming year and another 31 by 2026 to meet the increasing demand for LNG bunkering in the shipping industry.

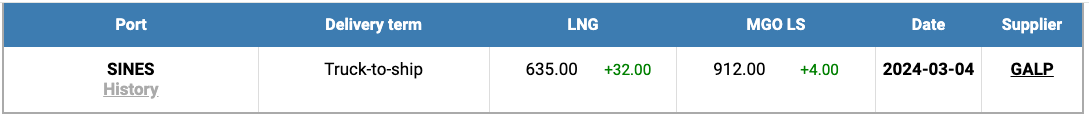

The price of LNG as bunker fuel in the port of Sines (Portugal) experienced a rise, reaching

US$635/MT on 4 March, marking a US$32 increase compared to the previous week.

Concurrently, the price gap between LNG and conventional fuel on 4 March narrowed to

US$277 in favour of LNG. On that same day, MGO LS was quoted at US$912/MT in the port of Sines.

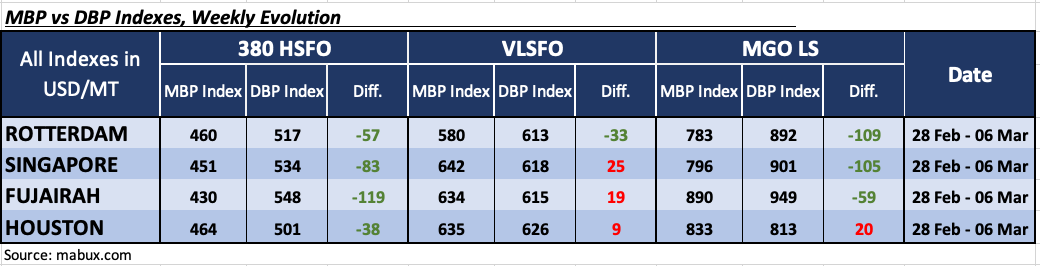

Throughout Week 10, the MDI index (comparing market bunker prices – MABUX MBP Index – to the MABUX digital bunker benchmark – MABUX DBP Index) indicated various trends across four selected ports: Rotterdam, Singapore, Fujairah, and Houston.

In the 380 HSFO segment, all four selected ports were in the undercharge zone. Rotterdam saw an increase of 3 points in the average weekly underpricing, while Fujairah increased by 1 point and Houston by 6 points. The MDI index remained unchanged in Singapore, while Fujairah maintained a position above the US$100 mark.

In the VLSFO segment, Rotterdam was the only undercharged port according to MDI, with a decrease of 3 points in the weekly average. The other three ports were overcharged, with Singapore experiencing a 2-point increase in the average weekly premium, Fujairah seeing a rise of 3 points, and Houston witnessing a decrease of 7 points.

Regarding the MGO LS segment, Houston continued to be the only overpriced port, with an increase of 11 points in the average weekly margin. The remaining three ports were in the undercharge zone. Rotterdam and Singapore saw increases of 12 points and 7 points, respectively, in the average weekly premium, while Fujairah experienced a decrease of 6 points. The MDI index in Rotterdam and Singapore once again surpassed the US$100 mark.