Oil prices have been dropped down for a week, while the slowing economic activity around the world, restricted mobility, and fears of the second wave of pandemic and of another trade war are just a few of the key factors that will continue to weigh on oil and fuel prices and could cause more significant downward moves.

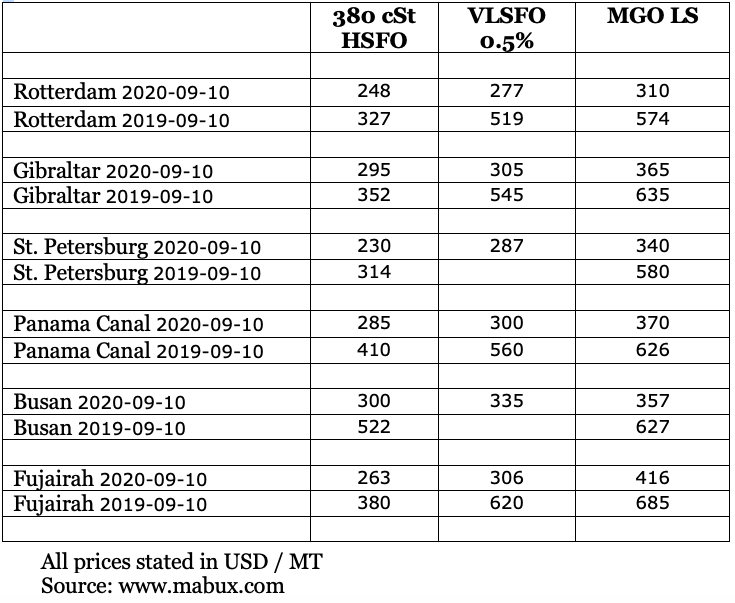

The World Bunker Index MABUX has also declined for a week with the 380 HSFO index fell to US$293 / mt, VLSFO lost US$23.00 / mt and MGO declined to US$411 / mt.

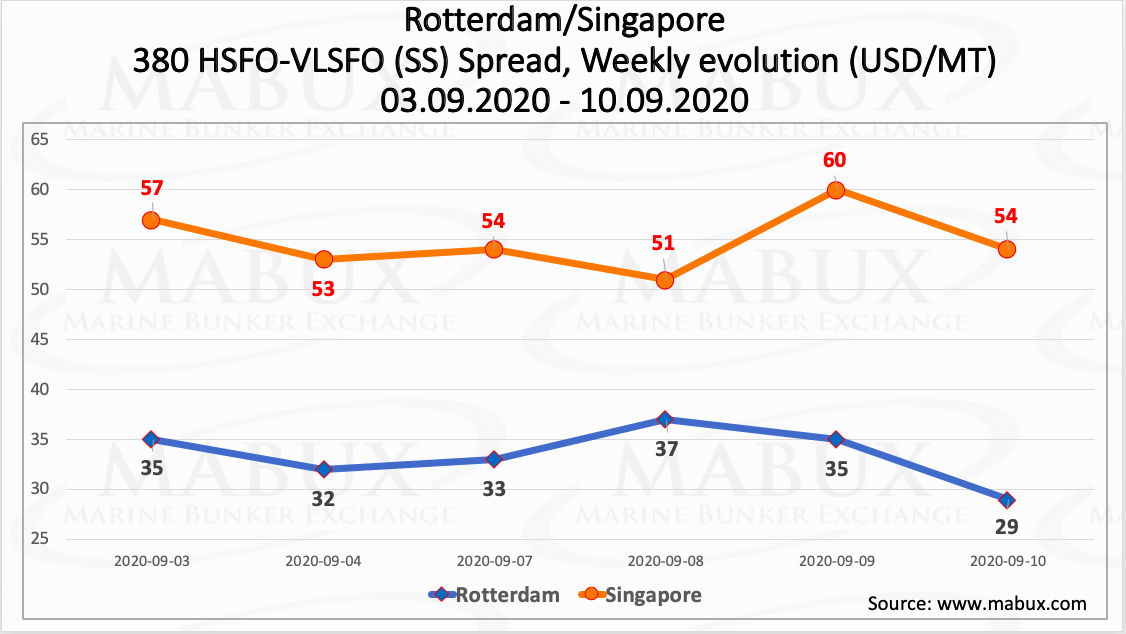

At the same time, the global scrubber spread (the price difference between 380 HSFOs and VLSFOs) continues to narrow, this week by US$5.66, averaging US$44.73.

Meanwhile, the spread in Rotterdam has dropped during the week from US$35.00 to US$29.00 today, 10 September. In addition to this, the average value of the spread for the week decreased from US$42.17 to US$33.50.

In Singapore, the spread demonstrated a downward trend as well during the week, losing US$3, although it was more steady than in ARA. Its average weekly spread declined by US$5.34 to US$54.83.

As per Integr8 Fuels, over the course of a year, the percentage of straight run-based components in very low sulphur fuel oils (VLSFO) has dropped from 44% to 17%, while the distillate blend element has increased from a small percentage to 30%. There was also an increase in the vacuum gasoil (VGO) component from 9% to 35% and, conversely, a decline in the cracked material component from 23% last July to 7% in July 2020.

Europe, one of the world’s biggest diesel consumers, faces a major glut which combined with weak demand is weighing heavily on the ability of the region’s refineries to keep running.

Having hit record lows at the height of the Covid-19 pandemic in April and May, European diesel margins are trending lower again after posting a modest recovery in July. While the easing of lockdowns in recent months across Europe has boosted diesel demand, some countries are seeing the recovery stall, including Spain and the UK. Additionally, the diesel market is afflicted with high stocks. Europe now accounts for the biggest share of global middle distillates floating storage globally.