The Covid-19 pandemic’s spread is taking centre stage again and markets are getting increasingly worried about the long duration of the European lockdown as well as the new restrictions in China, according to the weekly report from Marine Bunker Exchange (MABUX).

Border closures, social distancing measures and shutdowns will continue to constrain fuel demand until vaccines are more widely distributed, said the member of the International Bunker Industry Association (IBIA).

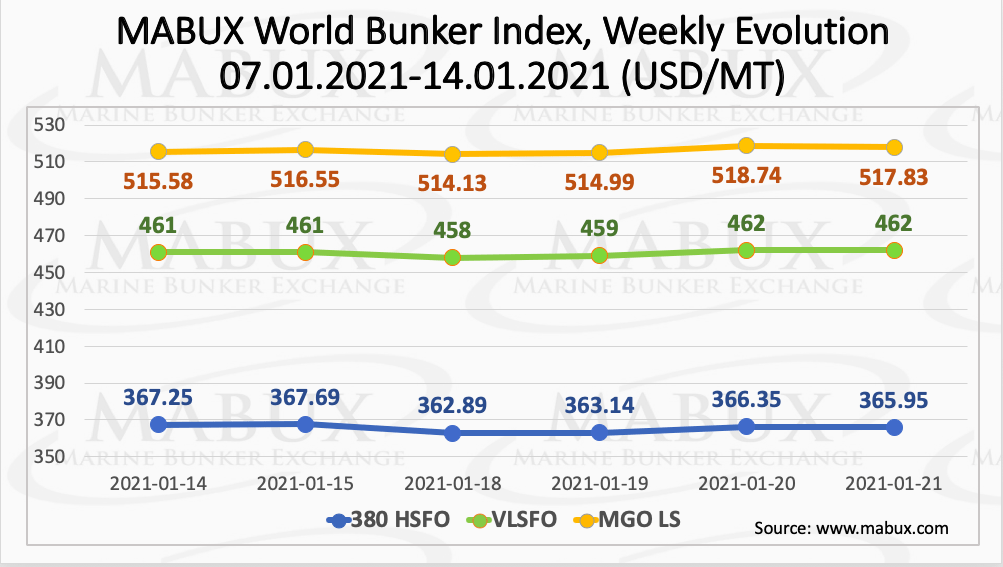

In particular, the World Bunker Index MABUX displayed irregular fluctuations over a week. As a result, the 380 HSFO index fell to US$365.95/mt, VLSFO increased slightly to US$462.00/mt while MGO climbed to US$517.83/mt.

The global scrubber spread (SS) (the price difference between 380 HSFO and VLSFO) continues a firm widening trend, as it has risen by US$6.40 and averaged US$94.96.

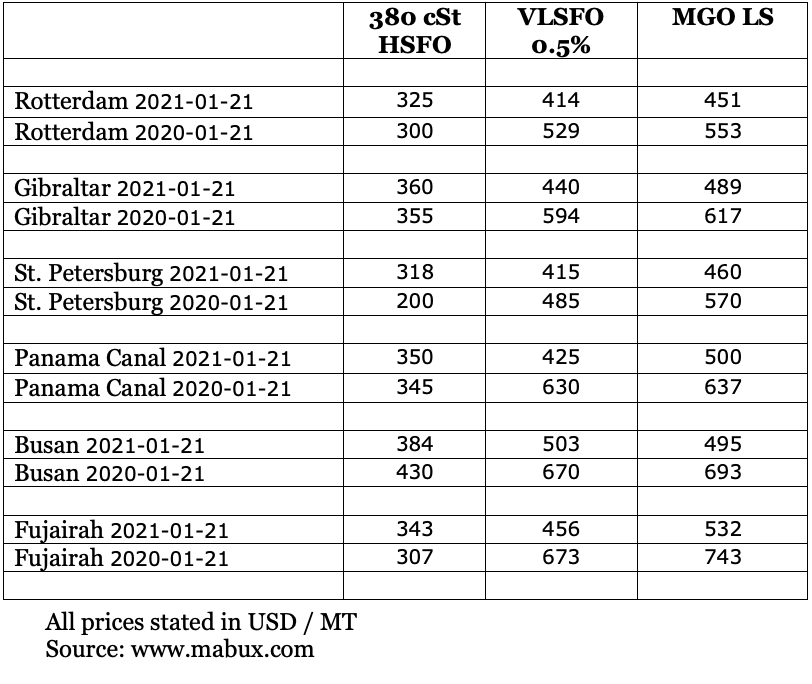

In the meantime, the correlation of MBP Index (Market Bunker Prices) vs DBP Index (Digital Bunker Prices) in the four largest global hubs over the past week showed that 380 HSFO remains undervalued in the ports of Rotterdam and Singapore, by US$9 and US$10 respectively, while it is slightly overcharged in Fujairah by US$1 and in Houston by US$12.

At the same time, VLSFO, according to DBP Index, was still slightly overpriced in all selected ports ranging from US$6 in Singapore to US$25 in Houston.

In addition, DBP Index also showed that MGO LS was undervalued in all ports ranging from minus US$19 in Rotterdam to US$34 in Singapore, with the exception of Houston, where MGO LS was overvalued by US$8.

Despite the continued moderate growth in bunker prices in early 2021, this trend is largely hampered by the high rate of coronavirus pandemic and related concerns about a recovery in energy demand, according to MABUX.

Pressed by this factor, the MABUX long-term forecast up to January 2023 for the port of Rotterdam (based on active oil-futures contracts as of 20 January 2021) shows a possible reversal of the 380 HSFO and VLSFO indices into a moderate downward trend, while prices for MGO LS remain quite stable. Therefore, “It is too early to speak about a sustainable recovery on the bunker market,” pointed out MABUX.

“We expect that in 2021 VLSFO and MGO LS will remain the main types of bunker fuel with a fairly stable demand,” added MABUX, which said that despite concerns regarding the availability of the new conventional VLSFO fuel in the first half of 2020, this problem has now been completely resolved in the vast majority of ports worldwide. Additionally, by the end of 2020, quality issues of the VLSFO were mainly resolved, according to MABUX report.

The Swedish bunker organisation reported that traditional high-sulphur fuel 380 HSFO will retain its segment in the market in 2021 and the gradual rise in the SS index again added to the attractiveness of using scrubbers in combination with the 380 HSFO.

“However, in the medium term, one should hardly expect an increase in demand for this type of fuel, both in terms of the further availability of 380 HSFO and in view of the likely tightening of restrictions on the use of non-ecological fuels, discussions on which have already entered into an active phase,” said MABUX.

As for alternative types of bunkering fuel, primarily LNG, despite the significant results achieved in 2020 in creating the infrastructure for LNG bunkering (at the end of 2020, LNG bunkering was available in 96 ports of the world, and in 55 ports LNG bunkering terminals were under construction), it is still premature to talk about a significant growth in this segment of the global bunker market in 2021.

According to DNV GL, there was no significant growth of the LNG fleet in 2020, as only 29 LNG vessels were added in the fleet during 2020. Now, there are 305 LNG-powered ships, while in 2021, the number is expected to reach 445, but this only amounts to about 1% of the world’s total commercial fleet.

Overall, MABUX expects better results for the global bunker market in 2021, as the roll-out of coronavirus vaccination programmes could stimulate global economic activity, which in turn could ultimately lead to higher refinery runs and growing demand for all types of fuels, including marine fuels.