Shifts in services on key trade lanes are heralding the first frost of an economic winter that promises to be severe and could be aggravated by the windchill factor blowing in from the States.

After five years of massive profits, the changes enacted in the United States since the Donald Trump election are adding to the rapidly changing supply and demand imbalance as a seemingly unending flow of new vessels continue to be delivered into a slowing global economy.

Initial signs that the economic climate is cooling have come from the reduction in capacity on some key services. The most pronounced reduction is on the Pacific with a 5% decline in capacity, this month compared to February, according to MDS Transmodal data.

Although this is not a major fall in capacity on the trade, this year’s March total of 1.686 million TEUs is 81,000 TEUs fewer than last month, and it is still 16% higher than a year ago and a significant signal of the direction of travel.

On the Asia to Europe trades, the decline is less pronounced. With a 34,000 TEU decline or 2%, from February’s 1,530,985 TEUs, compared to 1,496,000 TEUs this month, the fall in capacity could mark the beginning of a more major decline.

Dynaliner’s analyst Darron Wadey told Container News: “If indeed it is true [that capacity is falling] it is not a surprise and would appear to herald what the fundamentals have been pointing to for a long time, namely, a period of substantial overcapacity.”

According to Wadey, from the end of 2020 to the end of 2024, global container shipping capacity increased by more than a third whilst global cargo volumes grew by less than 10%.

“Maritime congestion, be that through epidemic or endemic, and the lengthening of supply chains (arising from the Red Sea situation) can only absorb so much of that difference,” added Wadey, while also pointing out that, “the Cape of Good Hope diversionary route is already saturated.”

Sustained and widespread cuts to services have not yet occurred, and Wadey believes that carriers will first blank sailings, before laying up ships.

“We’re not there yet, but when we add on top of inherent overcapacity the imposition of trade tariffs around the world that, by their nature, dampen down cargo movements, such a scenario is not inconceivable,” said Wadey.

One carrier that may avoid the worst excesses of a long hard winter is the Switzerland-based MSC, which this week agreed to buy the international terminal portfolio of CK Hutchison, an acquisition that will make it the largest private port operator in the world, as well as the largest container line.

US concerns over Hutchison’s Panama Canal operations led to blockbuster deal?

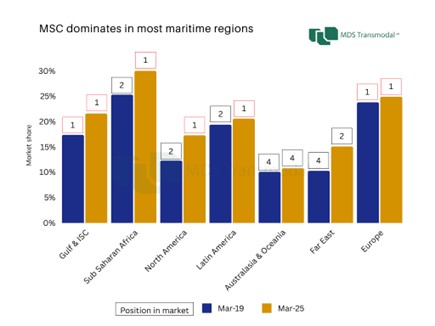

MDS Transmodal consultant Antonella Teodoro revealed MSC’s dominant position in most of the significant global trades.

“This chart highlights MSC’s commanding presence in the global shipping industry by showcasing its deployed capacity and market position across key regions as of March 2025 compared to March 2019. The data underscores MSC’s leadership, with the company holding the first position in most major markets and continuing to expand its influence,” explained Teodoro.