The Port of Antwerp has seen its container volumes increase and limit the damage caused by the decline in throughput from other shipping sectors.

In September, Antwerp’s box throughput surpassed 1 million TEU again for the first time since April with the Far East and intra-Europe trades generating the majority of the port’s container traffic in the third quarter.

Apart from that, the number of blank sailings has been declining since August with shipping companies organising extra runs outside of the regular sailing schedules, which is largely compensating for the effect of the void services.

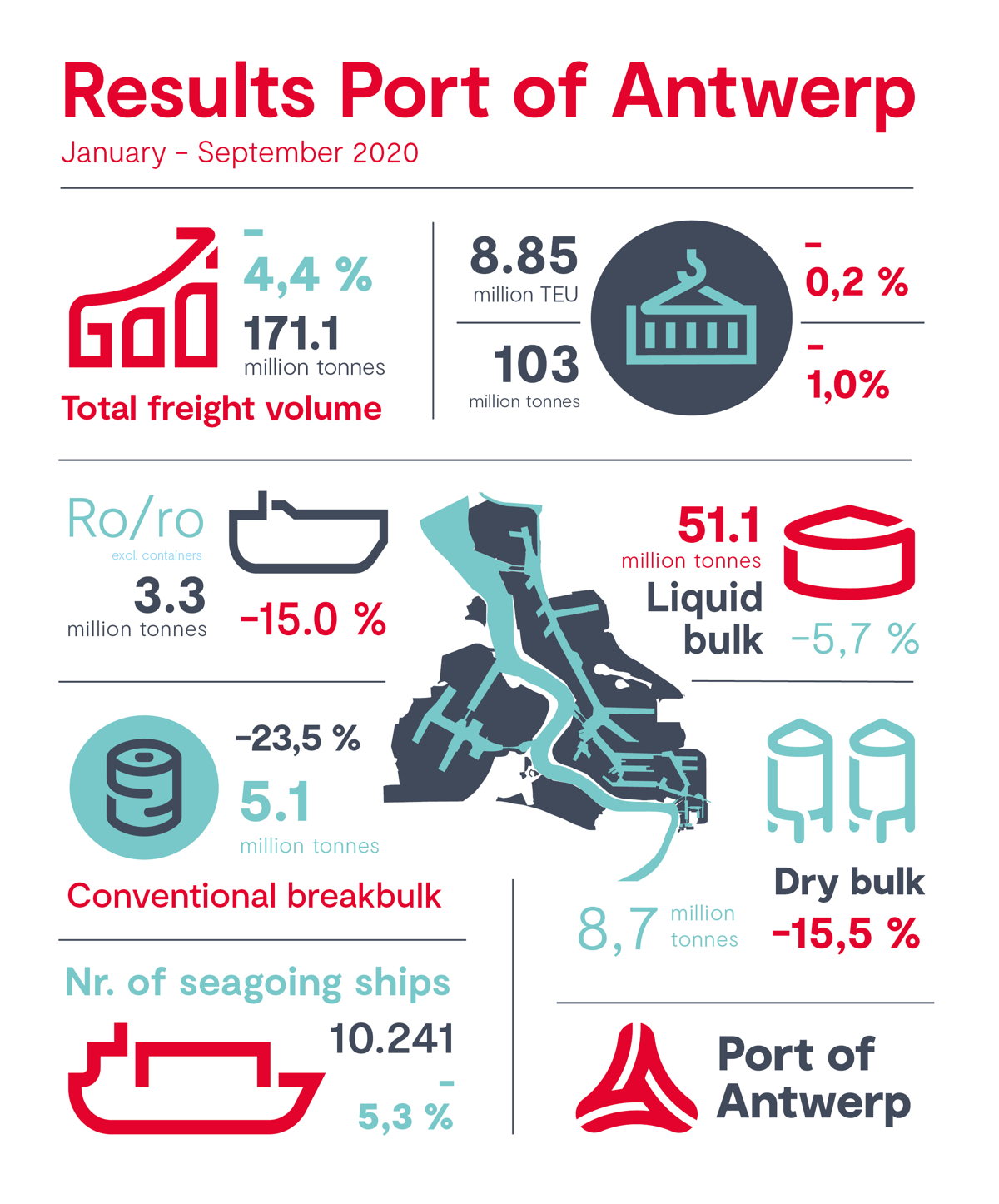

As a result, container traffic has remained almost unchanged on an annual basis, with a -0.2% decline in TEU compared to last year, a decrease which could have been significantly worse during the Covid-19 crisis period.

After nine months, the total throughput of Port of Antwerp has decreased by 4.4% compared to last year.

The port is performing better than most other ports in the Hamburg-Le Havre range, according to an announcement, despite the impact of the corona crisis on global production and logistics chains, and the following worldwide drop in demand.

The impact of the standstill of the global supply chain as a result of the corona crisis can still be felt and the prospect of Brexit is also causing uncertainty in the market, according to Port of Antwerp CEO, Jacques Vandermeiren, who said, “2020 will certainly not be a record year like the past seven years.”

Furthermore, in the period January-September, 10,241 seagoing vessels called at Antwerp, representing a decrease of 5.3% compared to the same period in 2019. Additionally, the gross tonnage of these vessels fell by 6.3%.

At the same time, the automotive sector also continues to feel the consequences of the crisis. After rising volumes in June and July, these decreased again in August, which is an annual phenomenon.

Moreover, both global trade turmoil and the corona crisis continue to have a clear negative effect on goods flows in the conventional break bulk segment, especially on steel, the main goods group within this segment.

The throughput of dry bulk fluctuates from one month to the other, while total liquid bulk dropped by 5.7% compared to the first nine months of 2019.

“The port’s versatility and resilience are the results of its great diversity of segments, its wide geographical spread, and the presence of the largest integrated chemical cluster in Europe,” commented Annick De Ridder, port alderman.

In order to continue supporting the shipping companies, inland navigation operators and concessionaires at the port of Antwerp in these difficult circumstances, the Port Authority, in consultation with Alfaport Voka and MLSO, has decided to grant a further postponement of payment for domain concessions and for shipping and inland navigation dues.