After two very profitable years for the shipping lines, the market is shifting into a post-pandemic normality, as reported by Sea-Intelligence.

More specifically, while the fourth quarter of 2022 gave a first glimpse into what this might look like, the first quarter of 2023 was the first quarter where the carriers’ operating profits took a real hit.

Additionally, this continued into the second quarter of 2023, with the combined earnings before interest and taxes (EBIT) dropping by 90% year on year to a little over US$3 billion.

Further to that, both ZIM and Wan Hai once again recorded operating losses. While ZIM has had profitability issues in past quarters, this was a first for Wan Hai in since 2012.

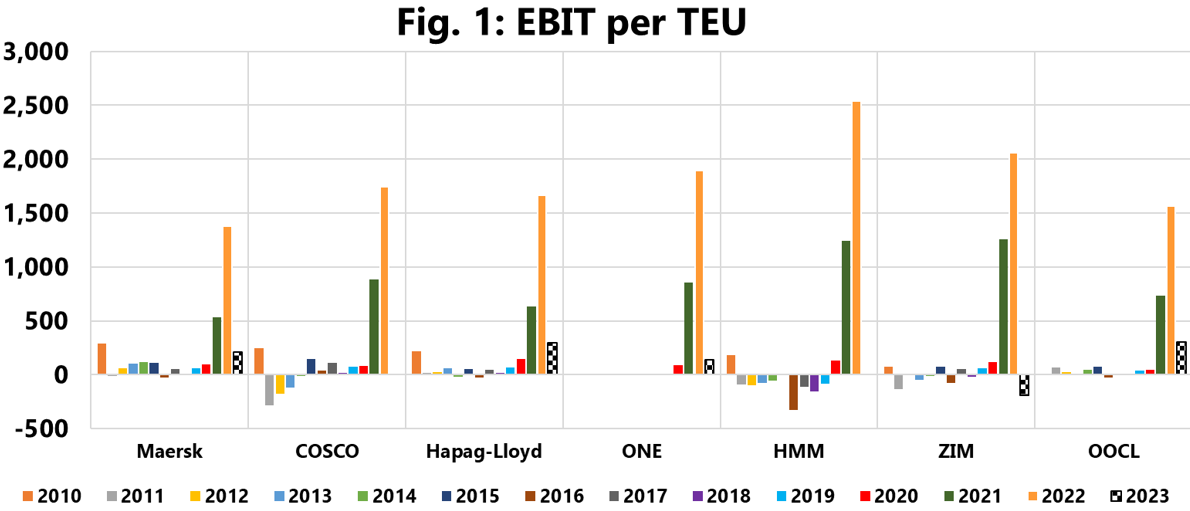

The figure shows the EBIT/TEU of the shipping lines that publish both their EBIT and their global transported volumes.

“None of these shipping lines were able to sustain their EBIT/TEU figures in 2023, with the largest 2023-Q2 EBIT/TEU recorded by OOCL of US$305/TEU. In contrast, the smallest EBIT/TEU in 2022-Q2 was US$1,377/TEU,” noted Sea-Intelligence analysts.

Also, Maersk with US$207/TEU, Hapag-Lloyd with US$298/TEU, and ONE with US$137/TEU all recorded EBIT/TEU within a much narrower range of US$130-300/TEU.

In all of this, ZIM recorded a negative EBIT/TEU of -US$195/TEU. Basically, they lost US$195 for every TEU that they moved in the second quarter of the current year.

A large reason for the decline in profitability is the decrease in the freight rates, which fell by 48% to 67%, according to shipping lines’ data. The drop in box volumes has also played a role in the lower profits.

“What is surprising, however, is that ZIM, one of the only two shipping lines to record an EBIT loss, grew their volumes 0.5% globally, and by roughly 13% on both Transpacific and Asia-Europe,” noted Alan Murphy, CEO of Sea-Intelligence.