![]()

Ocean carriers have reported strong first-quarter results, despite geopolitical challenges and an uncertain market environment.

Nearly all major container lines (that officially publish their financial figures) have reported double-digit Y/Y revenue growth, while also recording a combined 2025-Q1 EBIT of US$5.89 billion, according to Sea-Intelligence.

“If we look at a comparable set of shipping lines from 2012 onwards i.e., minus CMA CGM since they don’t have a 2025-Q1 figure, and minus ONE since they don’t have historical reference points, 2025-Q1 EBIT of US$5.67 billion, although significantly lower than the 2021-2022 pandemic period, is almost on par with the 2023-Q1 EBIT, and higher than the combined EBIT of the remaining years (2012-2020 & 2024),” explain the analysts of the Danish maritime data firm.

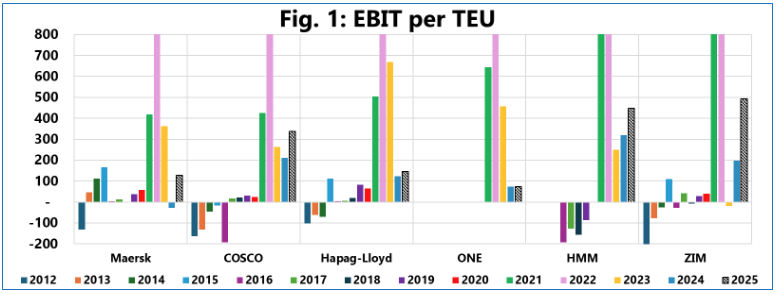

The figure presents the EBIT/TEU of the shipping lines that report both their EBIT and global volumes on an annual basis.

Ocean Network Express (ONE) (US$73/TEU) is the only shipping line with a 2025-Q1 EBIT/TEU of under US$100/TEU, with the remaining lines all recording EBIT/TEU between US$146/TEU (Hapag-Lloyd) and US$492/TEU (ZIM).

“Strong volume growth was also recorded on a global level, while some shipping lines recorded exceptional volume growth on the Transpacific and Asia-Europe,” commented Alan Murphy, CEO of Sea-Intelligence.