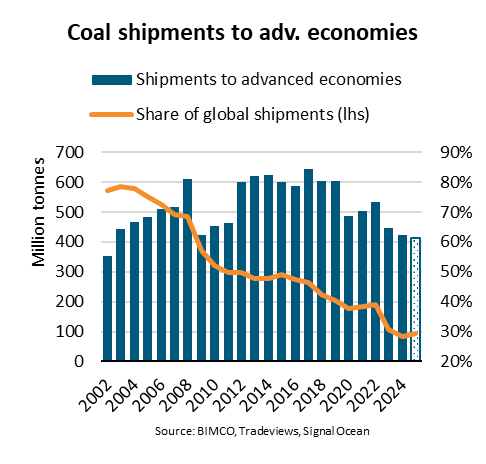

Coal shipments to advanced economies are set to fall 2% in 2025, reaching a 23-year low, according to BIMCO. This marks the third consecutive annual decline, though the pace has slowed. The drop is mainly due to weaker coking coal demand as steel production slows.

Global steel output fell 2.1% year-on-year from January to October. Coking coal imports to advanced economies dropped sharply: 3.4% in the EU, 4.1% in Japan, and 3.6% in South Korea, causing a 10% fall in shipments.

Thermal coal shipments had fallen 30% between 2022 and 2024 but rose 1% in 2025, mainly to the EU. Higher electricity demand in Germany and the Netherlands, combined with reduced wind and hydro generation, drove the increase. Shipments to Japan and Korea remained stable, supported by AI data centers and semiconductor manufacturing.

Advanced economies will account for 29% of coal shipments in 2025, down from 77% 23 years ago. Coal will still represent about 7% of global dry bulk cargoes. So far, 57% of these shipments moved by panamax ships and 30% by capesize vessels. Panamax share rose 3 percentage points due to stronger price competition.

Coking coal demand may recover next year, particularly in Europe, with steel production projected to rise 3% due to infrastructure and defense spending. However, recycled steel, which does not require coking coal, will limit long-term growth.

Thermal coal demand is expected to keep declining. Renewable energy capacity is forecast to grow 64% in Europe, 30% in Japan, and 49% in South Korea by 2030, further reducing coal imports and impacting ship demand.