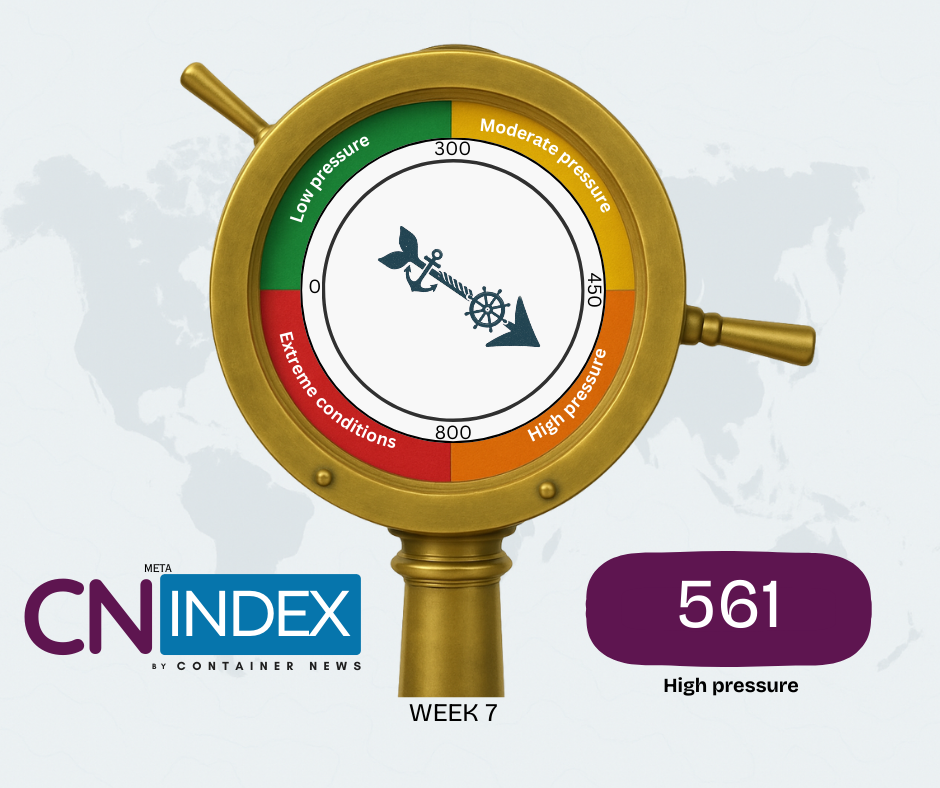

The CN Index stood at 561 this week, indicating that global container shipping remains in the High Pressure range despite a modest easing compared with the previous week. The latest reading reflects softer freight rates across several major trade lanes, while persistent geopolitical and operational risks continue to underpin overall market stress.

Freight Rates Show Signs of Softening

Freight pricing across the main East–West corridors declined week on week, offering limited relief for shippers. Rates on the Asia–USEC and Asia–USWC routes moved lower, pointing to slightly improved capacity availability and weaker short-term demand signals. Despite this easing, pricing on both corridors remains well above long-term averages, indicating that structural tightness has not fully dissipated.

The Far East–North Europe corridor also recorded lower rates, reinforcing signs that pressure on the Asia–Europe trade is gradually easing. However, freight levels remain elevated relative to historical norms, and carriers continue to manage capacity cautiously. On the trans-Atlantic westbound route, rate movements remain uneven, highlighting mixed demand dynamics across secondary intercontinental trades.

Regional markets broadly followed the softer trend. Intra-Asia pricing edged lower, while Mediterranean and Persian Gulf routes remained under moderate pressure. Lower-volume regional trades, including parts of Africa and Australasia, continue to operate at subdued levels, although costs remain higher than pre-disruption benchmarks.

Overall, the market component of the CN Index declined compared with last week, driven by incremental rate reductions across multiple routes rather than a sharp correction in any single trade lane.

Geopolitical Risks Continue to Set a Floor

Geopolitical and operational risks remain largely unchanged and continue to provide a structural floor for the index. The Red Sea remains the most significant source of risk, with security concerns still influencing routing decisions and cost structures. Trade and sanctions-related constraints also remain elevated, adding complexity to compliance and operational planning.

Moderate risk levels persist in the Black Sea, Gulf of Guinea, and Gulf of Aden, while major chokepoints such as the Panama Canal and Suez Canal continue to operate normally.

What the CN Index Is Indicating

At 561, the CN Index signals that global container shipping pressure is easing but far from normalized. Freight rates are softening, yet capacity discipline and geopolitical risk continue to limit downside. The index points to a market transitioning away from peak stress while still requiring careful planning and risk management.

The CN Index is an informational indicator intended solely for general analysis and monitoring. It does not constitute financial advice, operational guidance, or any form of guarantee regarding future market performance. Users should supplement the index with independent research and professional judgment when making business or strategic decisions.