The French shipping company CMA CGM has reported strong financial results for the first quarter of 2022.

“During the first quarter, our Group accelerated the deployment of its strategy to become a world leader in integrated logistics,” said Rodolphe Saadé, President and CEO of CMA CGM Group.

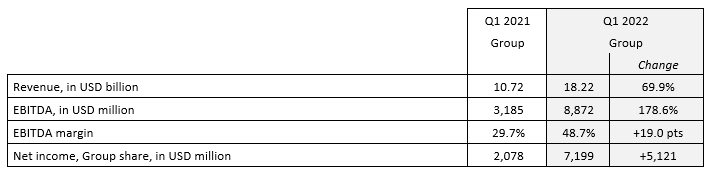

In the first three months of the year, the company’s revenues reached US$18.2 billion, which translates to a 70% growth compared to 2021 Q1, mainly thanks to the group’s shipping activities. Additionally, CMA CGM’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) stood at US$8.9 billion, marking an outstanding increase of 178.6%. At the same time, net income, Group share was US$7.2 billion.

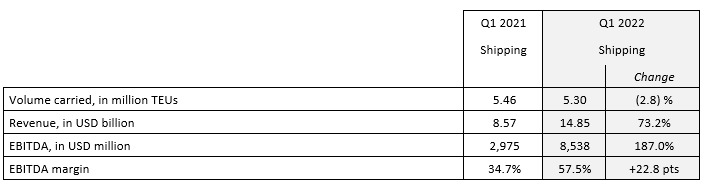

Meanwhile, CMA CGM has transported 5.3 million TEU in the first quarter of 2022, which represents a decrease of 2.8% compared to the first quarter of 2021. The company’s revenues from shipping activities amounted to US$14.8 billion, representing an increase of 73.2% compared to the corresponding period of 2021, while EBITDA of shipping activited amounted to US$8.5 billion.

Furthermore, operating expenses increased by more than 16% compared to the same period of 2021, while bunker costs have increased too.

“We have also taken further steps in our energy transition by forging innovative partnerships to develop low-carbon fuels and by deciding to diversify the energy sources for our future vessels,” noted Rodolphe Saadé.

To support the development of the transport market in the coming years, the Marseille-based ocean carrier continued its investments to strengthen its shipping, port, logistics and air freight network. These investments will enable CMA CGM to provide integrated solutions and improve the quality of service to its customers, while accelerating its energy transition, according to a statement.

“Due to strong demand, lack of available transport capacity and persistent port congestion, tensions in global supply chains are expected to continue,” pointed out Saadé.

The recent deterioration in the geopolitical situation has led to significant increases in energy prices, which have led to a 46% increase in bunker costs between the first quarter of 2021 and the first quarter of 2022, according to CMA CGM’s announcement.

“We are also vigilant in the face of the risk of a deterioration in the global economic situation, linked to the pandemic, the rise in inflation and the war in Ukraine,” Saadé said.