To mark the Lunar New Year, we take a look at the Chinese new building order book, using VesselsValue data. The infographic highlights the Chinese order book by top Chinese ordering companies and insight into the ships currently being built at Chinese yards.

Of the top Chinese companies ordering vessels last year, China Merchants Shipping ranks first, with contracts agreed for 28 new vessels—worth an impressive US$4.4 billion. This investment is mainly in the Tanker and LNG sectors, which each accounted for a share of c.33%, but also included new orders for Bulkers and Vehicle Carriers.

In second place with a spend of US$3.06 billion is COSCO Shipping Lines with 18 New Panamax Container vessel orders ranging from 13,400 to 14,000 TEUs.

Ranking third is COSCO Shipping Development, which ordered 20 Bulkers last year, ranging from the Ultramax to the Kamsarmax sub-sectors and valued at US$929 million.

COSCO Shipping Bulk ranks fourth, spending US$822 million on 10 new vessels including eight Newcastlemax and two ore carriers, scheduled to be delivered between 2026-2028.

In fifth place is China Shipbuilding Trading which placed 22 new orders last year, valued at US$778 million with their en bloc order of 22 Panamax newbuildings of 80,000 DWT, scheduled to be built at Chengxi Shipbuilding and delivered between 2027-2028.

Seacon Shipping Group also deserves an honourable mention, ranking second in terms of vessel numbers with 26 new orders placed, which mainly consist of Tanker newbuilding projects, valued at US$738 million.

New building prices are at the highest levels since 2009 due to high steel prices, lack of yard availability and demand. The supply and demand imbalance caused by the Red Sea crisis boosted sentiment and expectations for high earnings. This triggered owners to place orders across the Container, Tanker and LNG sectors.

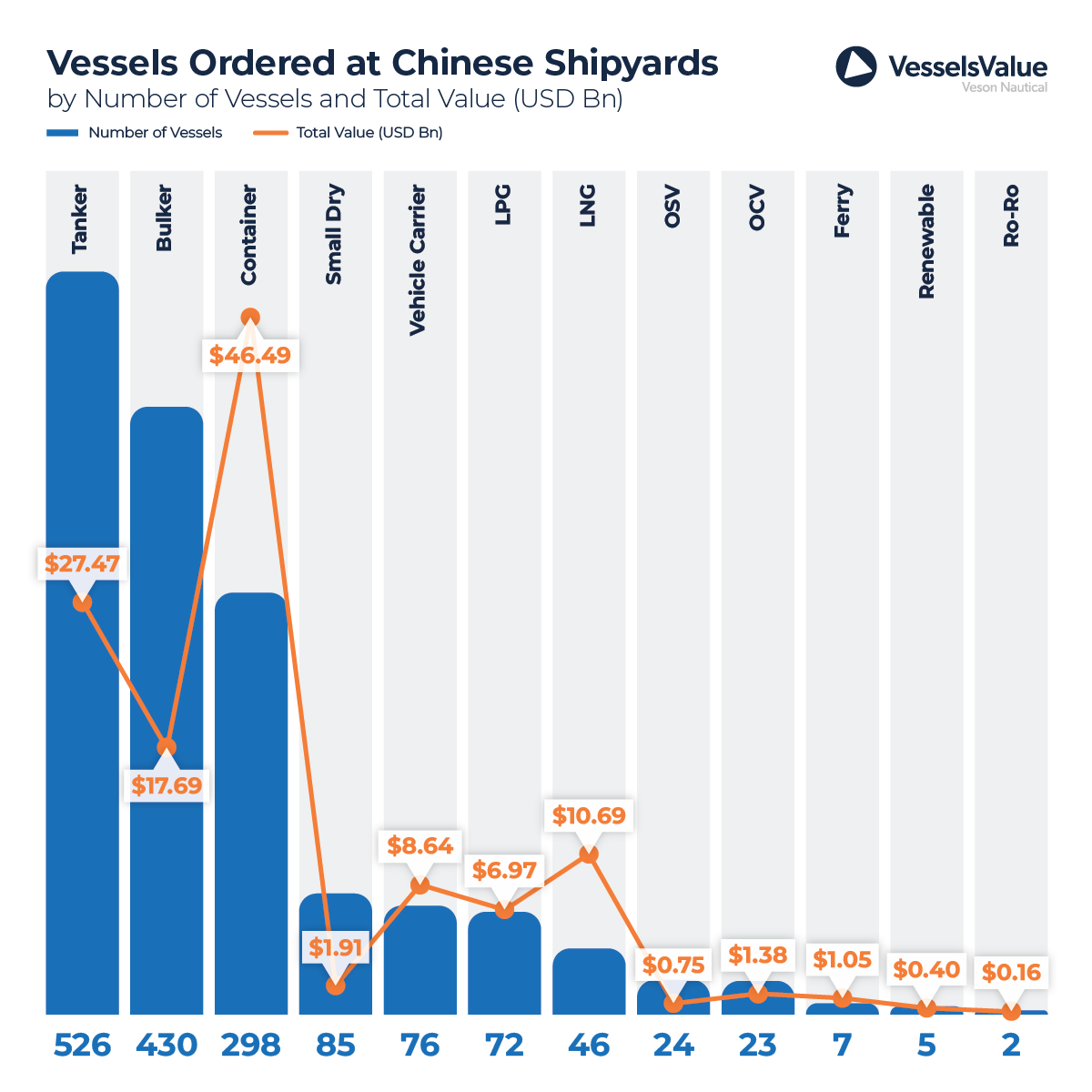

Tankers were the most popular vessel type ordered at Chinese yards in 2024 with 526 new vessels ordered, valued at US$27.4 billion. Throughout 2024, Tanker new building prices were at the highest levels since 2009 due to high steel prices, lack of yard availability, and demand. The supply and demand imbalance caused by the Red Sea crisis boosted sentiment and expectations for high earnings. This triggered owners to place orders across the key sectors i.e. Tankers, Bulkers, and Containers.

In second place was the Bulker sector with 430 new vessels ordered, worth US$17.7 billion. Ranking third in terms of the number of vessels is the Container sector, with 298 new orders placed. However, the value of these orders far exceeds any other sector, worth US$46 billion; this comes as values for this sector saw significant gains over the past year, across all sub-sectors and size ranges.

However, Container new buildings rose the least, making them appealing investments despite the time lag. For example, values for Post Panamax new buildings of 7,000 TEU rose by c.14.45% from US$101.99 mil to US$116.73 million. In contrast, 20 YO Post Panamaxes rose by as much as c.114.99% year-on-year from 20.62 million to US$44.33 million.

Author of the Article: Rebecca Galanopoulos, Senior Content Analyst at Veson Nautical