The era of the 2M Alliance officially came to a close with the final voyage of the MSC Isabella, a 23,656 TEU vessel that symbolized the last joint sailing under the Maersk–MSC partnership.

According to Alphaliner, this marks the end of the traditional alliance structure that long dominated the East-West trades, comprising 2M, THE Alliance, and the OCEAN Alliance.

The termination of the 2M Agreement was driven by Maersk and MSC’s strategic decision to end their collaboration, opening the door for a reshuffling of global partnerships. Maersk has now partnered with Hapag-Lloyd to form the Gemini Cooperation, prompting Hapag-Lloyd’s exit from THEA.

The remnants of THEA were reconfigured into the Premier Alliance, while OCEAN Alliance remained unchanged structurally.

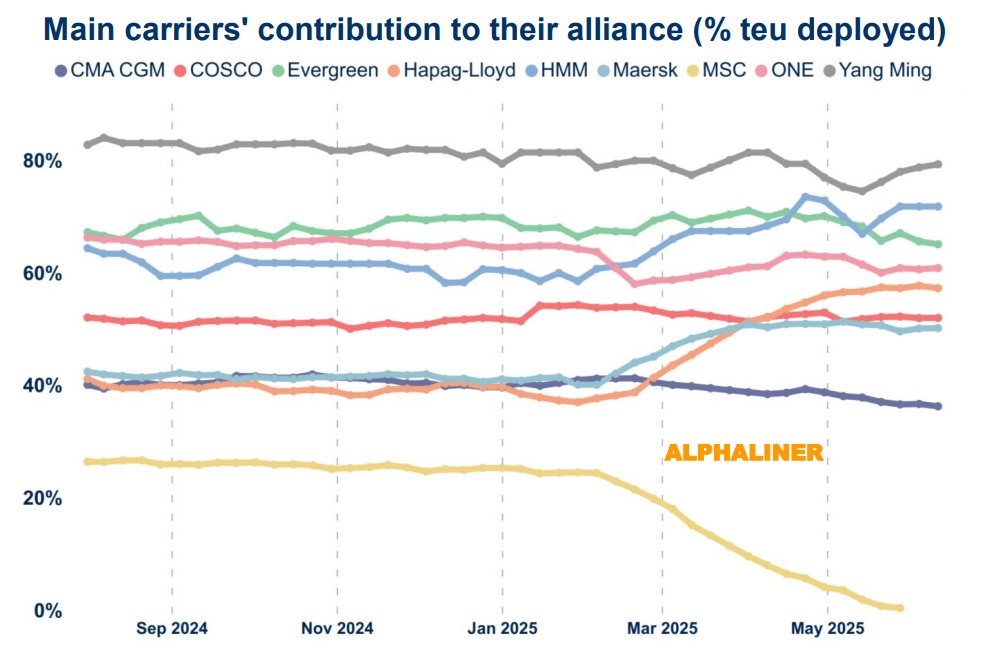

According to Alphaliner’s latest assessment, the new alliance configurations vary significantly in scale.

The OCEAN Alliance remains the largest, deploying a fleet capacity of 4.37 million TEUs. Gemini Cooperation follows with 3.69 million TEUs, and the Premier Alliance accounts for 2.42 million TEUs. Meanwhile, MSC now operating as a standalone carrier commands 3.27 million TEUs on East–West routes, excluding Canada and India.

However, comparing these alliance capacities is increasingly complex.

In contrast to the earlier symmetry in alliance structures, 2025 has seen the rise of varied network strategies.

Some carriers have adopted a ‘hub-and-spoke’ model with regional shuttles operating under alliance agreements. Others maintain traditional frameworks or opt for standalone networks strengthened through slot exchange agreements.

What remains clear is that carriers continue to assign up to 80% of their East–West capacity to alliance fleets, highlighting the enduring importance of collaborative operations even amid structural transformation.

As the industry transitions into this new alliance landscape, flexibility and differentiated strategies are becoming essential components of global network planning.