Written by Rebecca Galanopoulos, Senior Content Analyst at Veson Nautical

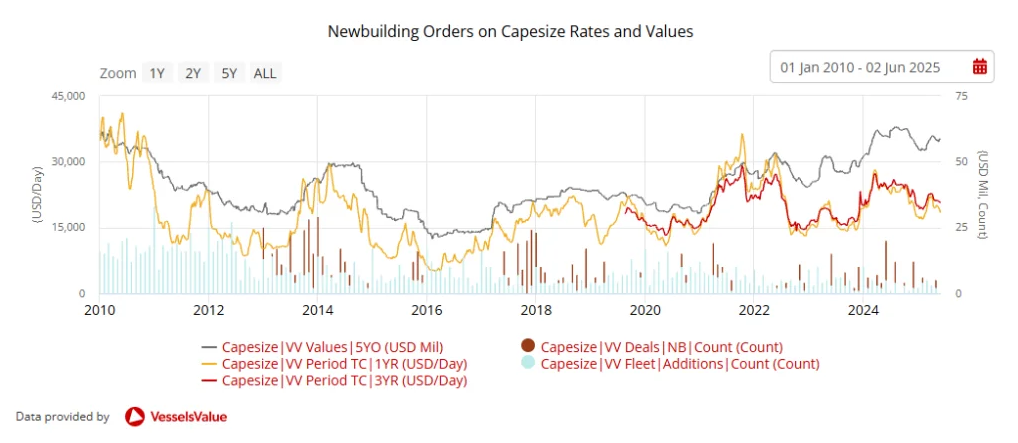

Using VesselsValue Timeseries, we examine how historical orderbook trends have influenced time charter rates and asset values for the Capesize segment.

The data visualisations underscore the importance of tracking orderbook activity as a key driver of future fleet supply. This supply, in turn, directly impacts earnings potential across the fleet.

In essence, the historical orderbook acts as a forward indicator of fleet growth.

An expansion typically signals more supply coming into the market, which, if not matched by demand, can weigh on TC rates.

Conversely, a shrinking orderbook points to reduced future tonnage, which can help support or lift rates. By overlaying orderbook data with TC rate movements, we can better understand the lagged, but very real, impact that changes in fleet supply have on earnings.

The Capesize market offers a clear example of how orderbook activity, or the lack thereof, affects vessel earnings and asset values over time.

The volume of Sale & Purchase (S&P) transactions has fallen by c.48% year-on-year, with just 46 sales reported so far this year, compared to 89 during the same period in 2024.

The average age of vessels sold has also shifted from 12 years last year to 16 this year, suggesting a slowdown in fleet renewal.

Demolition levels remain very low, with only two Capesizes scrapped so far this year, despite the Bulker fleet continuing to age. If TC rates soften further, there is capacity for scrapping to increase. Asset values are already under pressure: since the start of Q2 2025, values for Capes have dropped across nearly all age categories, with the sharpest fall seen in 20YO tonnage, down by c.3.62%.

Capesize one-year TC rates are currently just below 19,000 USD/Day, down roughly 22% year-on-year. While rerouting away from the Red Sea has added some ton-mile demand, sentiment remains cautious due to economic uncertainty and tariff risks.

At the same time, the orderbook continues to shrink.

New Capesize orders are down by c.33% year-on-year, with just 18 vessels ordered so far in 2025—around 61% of which are being built at Chinese yards. This decline in newbuilding activity, coupled with weak S&P and scrapping, points to a tightening in future supply.

In summary, the historical orderbook remains one of the clearest indicators of where rates are headed. For Capesizes, the sharp drop in new orders seen over the past year has not translated to improvements in rates, largely due to weaker demand drivers and limited vessel removals.

But as the effects of reduced ordering and low fleet renewal begin to play out, pressure on the supply side is likely to build, highlighting the value in using historical orderbook trends to anticipate shifts in both earnings and asset values.