A new study of marine shipping traffic on Canada’s Pacific Coast has highlighted the environmental impact of vessels diverting to avoid sulphur emission control areas (SECA) to save on fuel costs.

[s2If is_user_logged_in()]Comparing the snapshots of traffic from 2014 – a year prior to the introduction of the 0.10% sulphur cap – and 2016 show that even by 2014 some ships had begun to use the longer route that minimised the time spent burning low-sulphur fuel, said Marine Bunker Exchange (MABUX) in its report.

The added distance, multiplied by the number of cargo ships travelling this path in 2016 and the extra fuel they burned, generated 24 kilotonnes CO2eq of greenhouse gas emissions, or the equivalent of 5,161 cars on the road per year – an unintended consequence of the implementation of air pollution regulations.

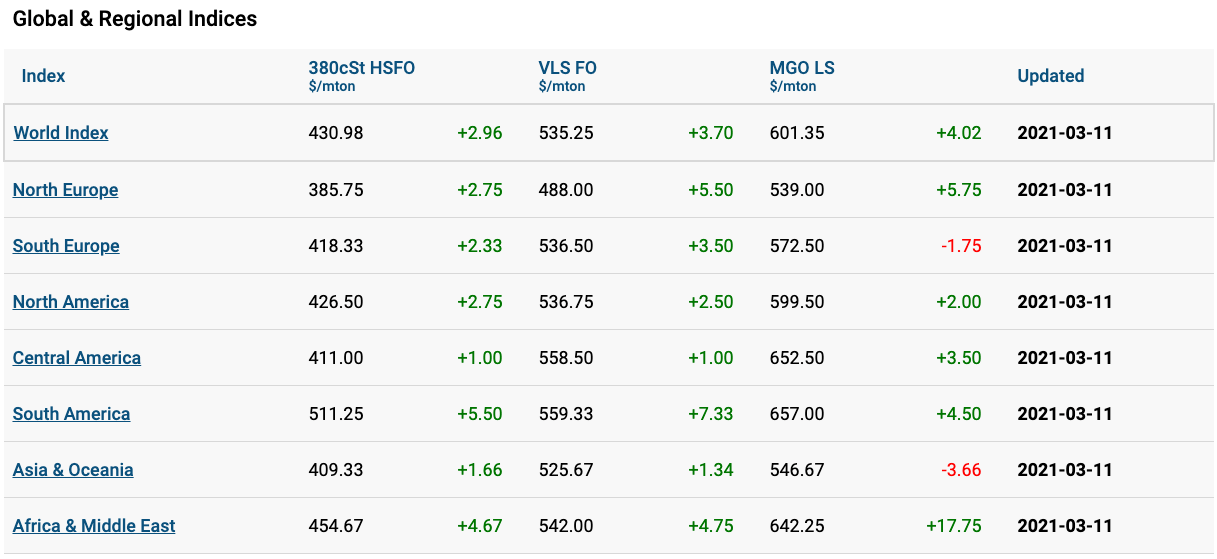

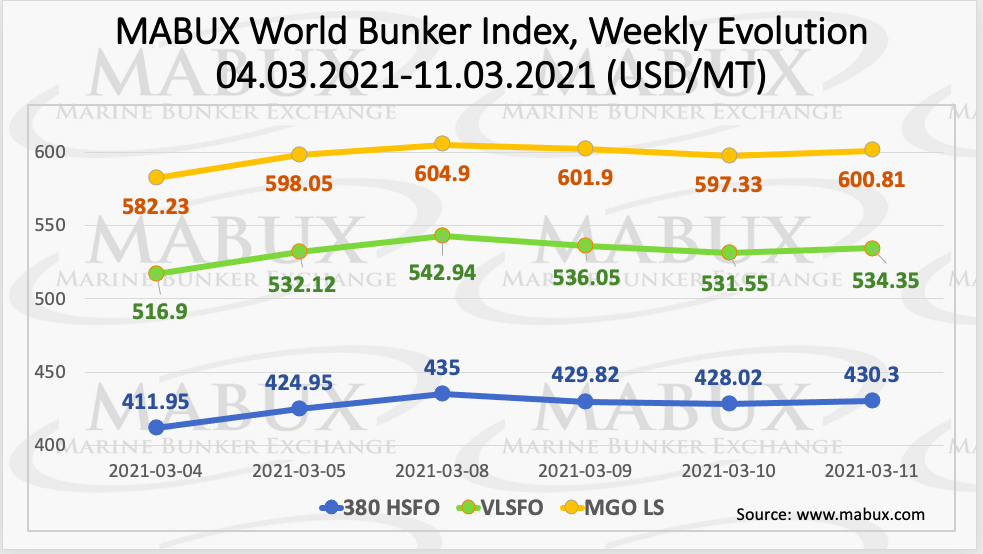

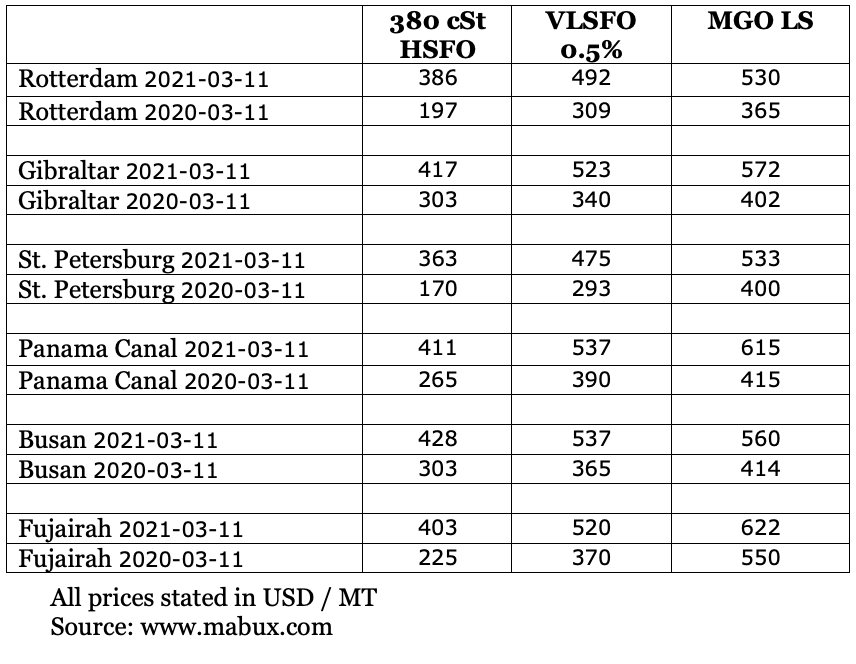

Meanwhile, MABUX World Bunker Index is back to a firm uptrend after a slight decline a week earlier. The 380 HSFO Index has risen to US$430.30/MT, VLSFO Index has increased to US$534.35/MT, while MGO Index also has climbed to US$600.81/MT.

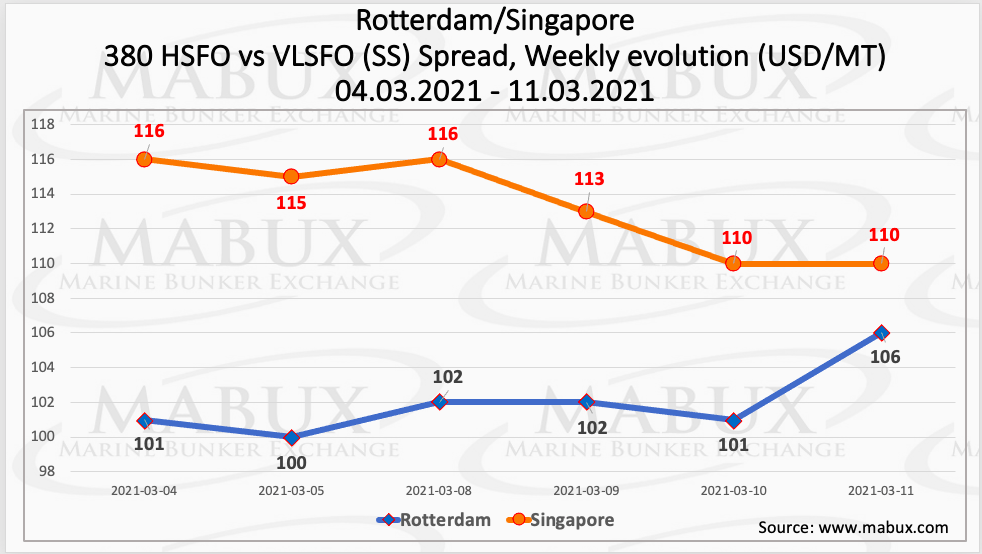

At the same time, the global scrubber spread (SS) – the difference in price between 380 HSFO and VLSFO – has not had any significant changes during the week and averaged US$105.65.

The SS in Rotterdam has shown a slight increase during the week reaching US$106, however, the average SS for the week decreased to US$102.

In Singapore, the SS has shown a further narrowing of the difference between 380 HSFO and VLSFO by US$6 to US$110, while the average weekly SS index has decreased to US$113.33. In general, the SS values have now stabilised at levels close to US$100.

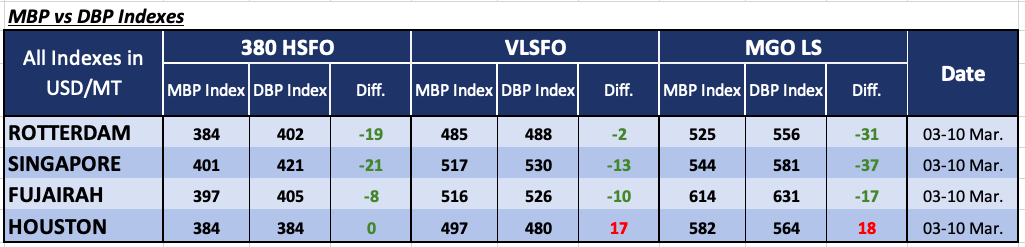

Correlation of MBP Index (Market Bunker Prices) vs DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO, VLSFO and MGO LS were undervalued in three of four selected ports.

According to DBP Index, 380 HSFO was undercharged on average from US$8 in Fujairah to US$21 in Singapore, VLSFO fuel, which a few weeks ago was consistently overvalued in all ports, now records an underestimation from US$2 in Rotterdam to US$13 in Singapore.

Additionally, MGO LS was also underpriced, ranging from US$17 in Fujairah to US$37 in Singapore. In the meantime, in Houston, there was a 100% correlation of MBP vs DBP indices registered for 380 HSFO fuel grade, while VLSFO and MGO LS were overpriced by plus US$17 and plus US$18 dollars, respectively.

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]