On behalf of the inauguration of Cambodia’s Sihanoukville Port’s new 450,000 TEU box terminal, Container News conducted a comparative analysis to assess the competitive dynamics of Cambodia and its neighboring countries.

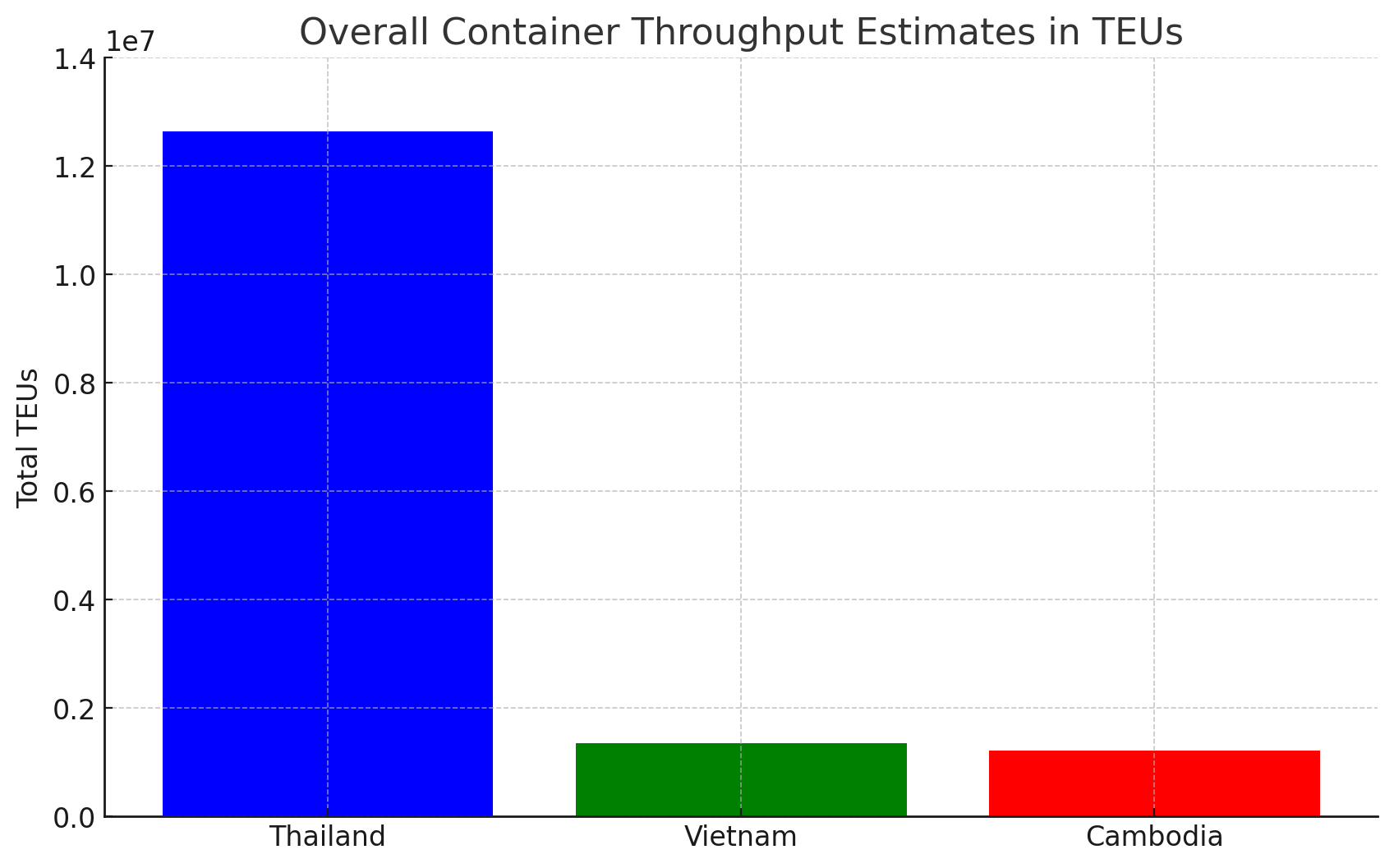

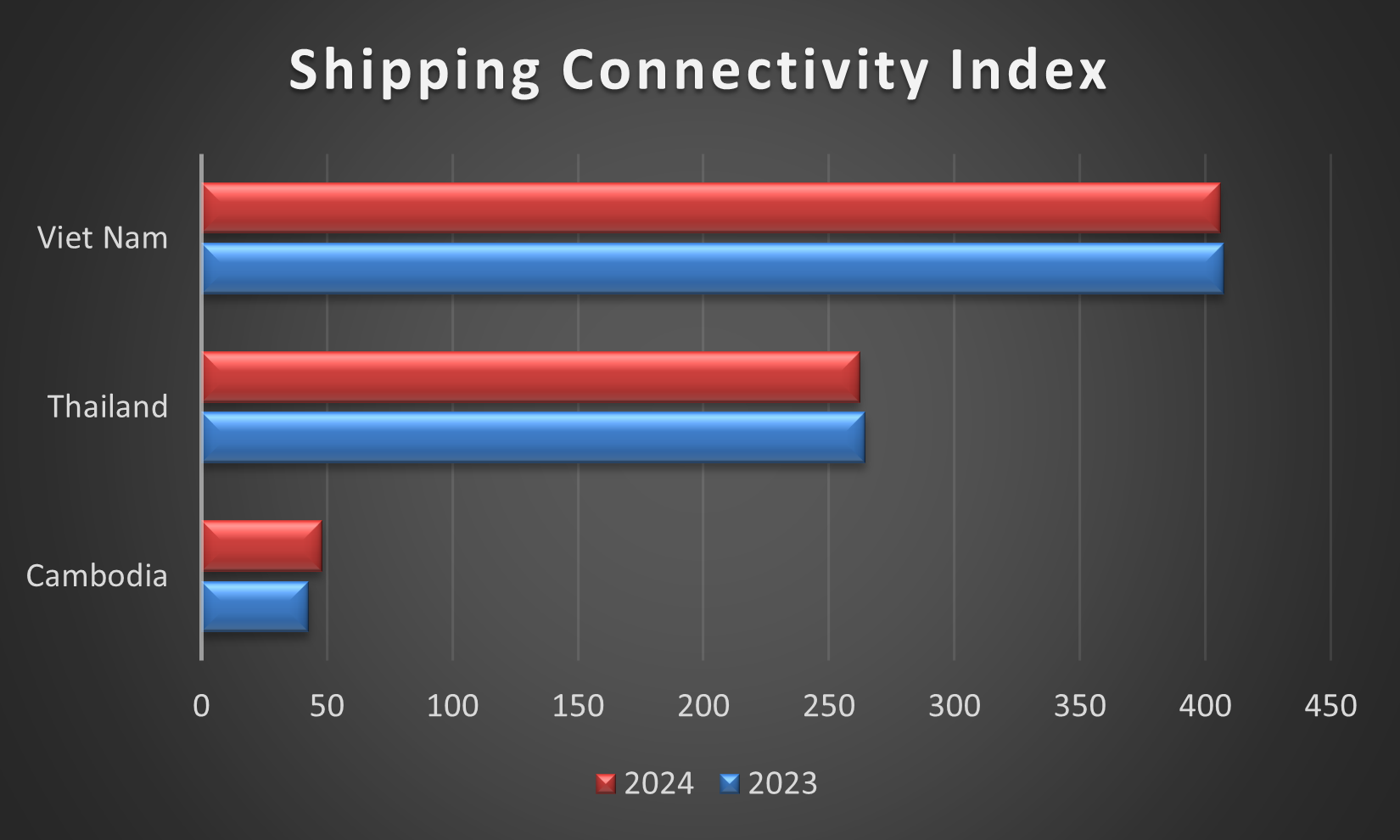

The analysis considered two main indicators: the most recent data on shipping connectivity and the estimated overall TEU capacity for Thailand, Cambodia, and Vietnam. The data on main container port capacities, derived from various open sources, are estimated values.

This synthesis revealed some interesting conclusions about the maritime trade dynamics among these three nations.

Thailand possesses, by far, the largest port capacity compared to the others. However, with Sihanoukville’s announced capacity expansion, both Vietnam and Cambodia are poised to enter a highly competitive state, as their capacities are nearly level.

However, the Shipping Connectivity Index paints a different picture. Vietnam leads in terms of connectivity capabilities, maintaining a significant lead over both Thailand and Cambodia. This advantage could be attributed to its more extensive port facilities, boasting at least five major container ports.

Meanwhile, Cambodia saw a notable increase in its connectivity in 2024, with an annual change of 9.7%, indicating a major improvement. Vietnam also experienced a growth trend with a 5.2% increase, although the changes have been modest so far. Thailand faced a slight decrease due to a moderate annual change of 3.3%.

Overall, the analysis concludes that Cambodia has notably improved both its connectivity and capacity, signaling its ambition to compete with Vietnam, at least in terms of capacity.

However, Vietnam’s integrated port infrastructure and extensive network provide it with a significant competitive edge.

Both Cambodia and Vietnam face challenges in competing with Thailand in terms of volume handling. Additionally, Thailand’s strategic location in the Straits of Malacca offers it an undisputed logistical advantage.

In response, Vietnam has heavily invested in connectivity to counterbalance this. On the other hand, Cambodia appears focused on competing with Vietnam in capacity while also striving to enhance its connectivity.

Improving connectivity is crucial for Cambodia as its limited coastline restricts further capacity expansion.