The progress in Russia-Ukrainian talks eased concerns of a possible shortage on the bunker market and pushed the prices down during the 11th week of the year.

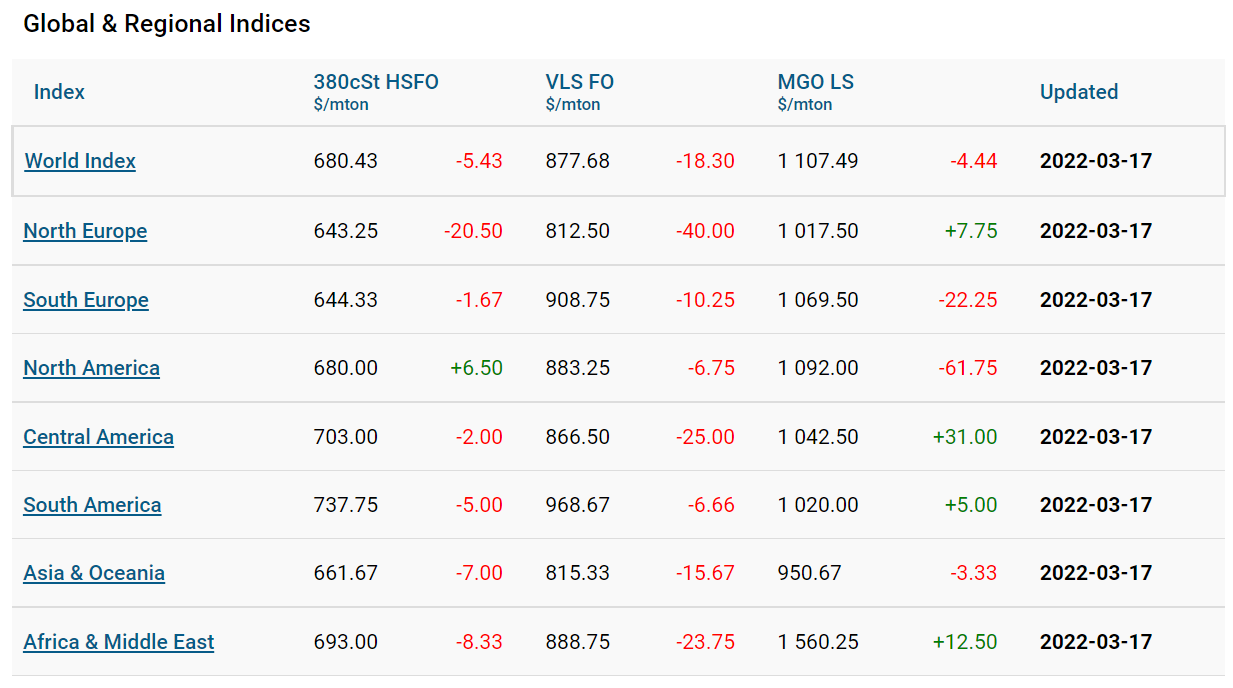

Particularly, the 380 high-sulphur fuel oil (HSFO) index fell to US$685.86/MT, the very low sulphur fuel oil (VLSFO) index declined to US$895.98/MT, and the marine gas oil (MGO) index showed the most significant decrease to US$1,111.93/MT, while bunker indices continue demonstrating high volatility.

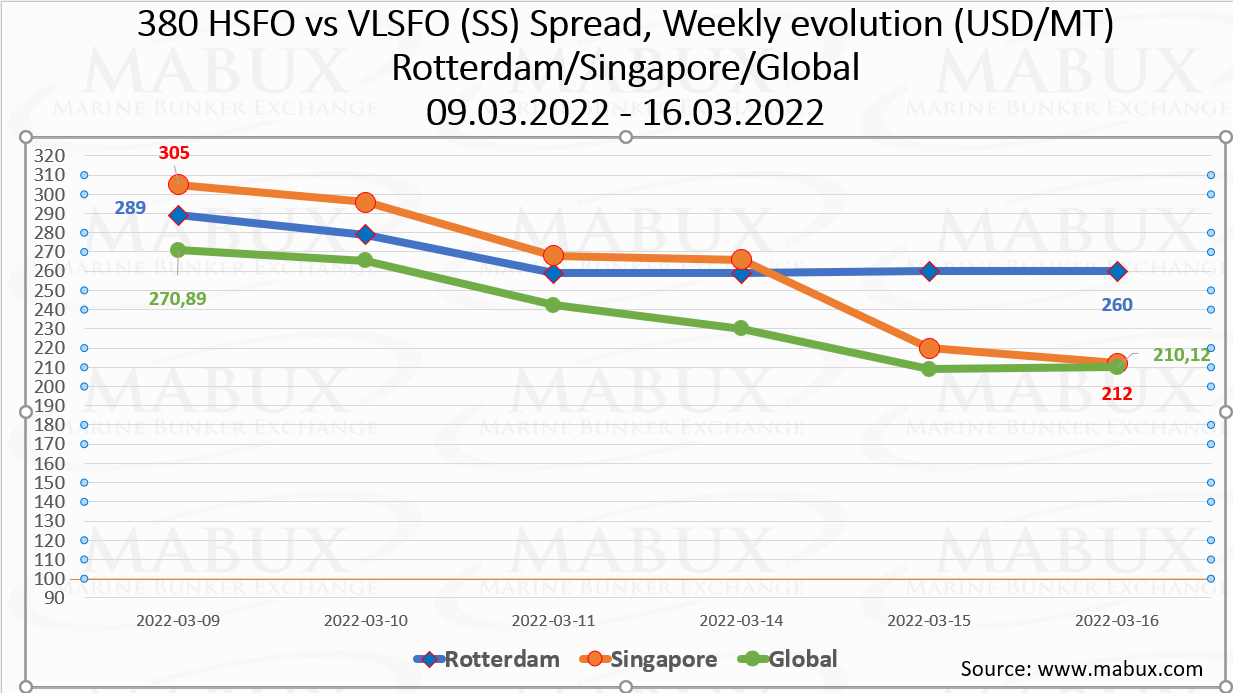

The Global Scrubber Spread (SS) weekly average, the difference in price between 380 HSFO and VLSFO, didn’t show significant changes over the week, with plus $0.09. On 16 March, Global SS Spread declined to US$210.12.

In Rotterdam, the SS Spread weekly average rose to US$267.67, and on March 16, SS Spread in Rotterdam showed US$260, while in Singapore, the average SS Spread declined to US$261.17.

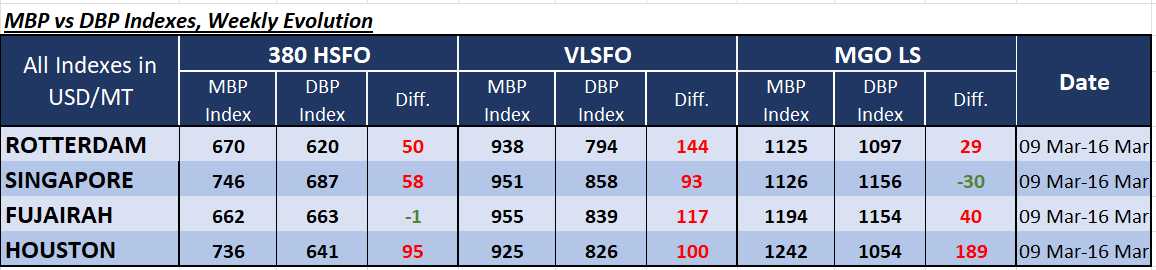

Over week 11, the average correlation of MABUX market bunker prices (MBP) index vs MABUX digital bunker benchmark (DBP) index showed that 380 HSFO fuel was overpriced at three out of four selected ports: in Rotterdam, with a plus of US$50, in Singapore plus US$58, and in Houston, plus US$95.

In Fujairah, the MABUX MBP/DBP Index registered 380 HSFO’s underpricing by minus US$1. The most significant changes were registered in Singapore where the undercharge level increased by 81 points and this fuel grade became overcharged.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, remained overpriced in all selected ports during the eleventh week: plus US$144 in Rotterdam, plus US$93 in Singapore, plus US$117 in Fujairah and plus US$100 in Houston.

The most weekly significant was the rise of VLSFO’s overcharge margin at the port of Rotterdam and Houston, by 94 and by 93 points, respectively.

As for MGO LS, the MABUX MBP/DBP Index recorded an overpricing of this fuel grade in three of the four selected ports: in Rotterdam by plus US$29, in Fujairah by plus US$40 and in Houston, by plus US$189.

The only underpriced port, according to the MABUX MBP/DBP Index, was Singapore with minus US$30, whereas the most significant change was a sharp increase of the underprice ratio in Fujairah by 154 points, and the increase of overcharge level in Houston by 165 points.

Bunker fuel sales in Singapore slipped 13.2% on the month, or 15% lower on the year, to 3.502 million mt in February, according to preliminary data by the Maritime and Port Authority of Singapore on March 13.

Sales of all bunker grades in February marked double-digit declines from the previous month, the data from the Maritime and Port Authority of Singapore (MPA) also showed, amid relatively subdued demand.

Sales of the International Maritime Organization (IMO)-compliant grades, which include 100 CST, 180 CST, 380 CST and 500 CST bunker fuel, slipped 10.7% on the month to 2.287 million mt in February, the lowest monthly sales since the IMO 2020 mandate was instated.