The military conflict in Ukraine has pushed bunker prices to record levels during the tenth week of the year, with the 380 high-sulphur fuel oil (HSFO) index rising to US$765.93/MT.

At the same time, the very low sulphur fuel oil (VLSFO) index jumped to US$1038.07/MT, and the MGO index showed the most significant growth reaching US$1,271.99 US$/MT, while bunker indices continue rising amid high volatility.

The Global Scrubber Spread (SS) weekly average, the difference in price between 380 HSFO and VLSFO, also showed a sharp increase over the week to US$237.91.

On 9 March, Global SS Spread updated the absolute record held since 9 January 2020 and showed US$272.14. In Rotterdam, the SS Spread weekly average rose to US$222.17 and the SS Spread came close to the absolute record mark of US$290 as of 1 January 2020, by showing US$289.

In Singapore, the average SS Spread also continued to grow to US$278.83, while the absolute record is US$347 as of 9 January 2020.

Gas prices in Europe remain at record levels amid escalating geopolitical risks. Liquefied natural gas (LNG) as a bunker fuel is still not listed.

“We have seen an avalanche of sanctions related queries,” pointed out Jeb Clulow, shipping partner at the global law firm, Reed Smith.

“It appears that, on account of pressures from consumers/counterparts and/or the prospects of further sanctions, some shipowners and traders are ‘self-sanctioning’ and refusing to perform contracts with a Russian component. In some cases that has meant the ‘self-sanctioning’ party has put itself in breach of existing contract commitments and is thereby exposed to contract damages,” explains Clulow.

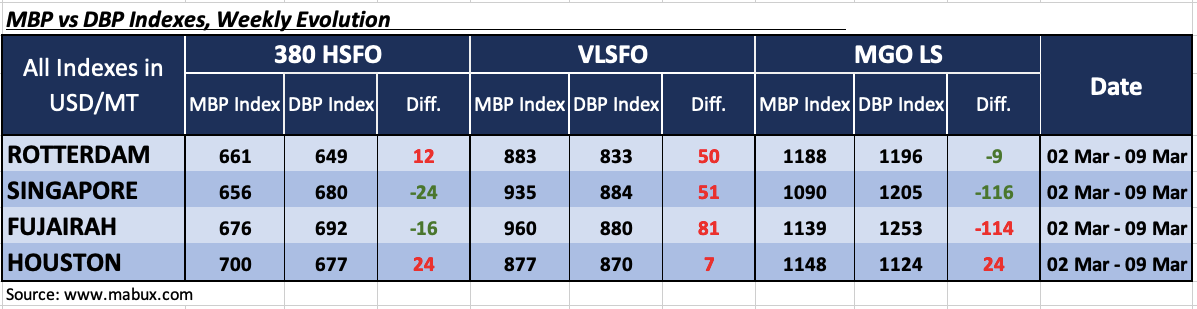

Meanwhile, over the 10th week, the average correlation of MABUX market bunker prices (MBP) index vs MABUX digital bunker benchmark (DBP) index showed that 380 HSFO fuel remained overpriced at two out of four ports selected: in Rotterdam – plus US$12 and in Houston – plus US$24.

In Singapore and Fujairah, the MABUX MBP/DBP Index registered 380 HSFO’s underpricing by US$24 and US$16, respectively. Despite the high market volatility, the MABUX MBP/DBP Index for 380 HSFO fuel had no significant changes. The market and digital indices were fairly close, according to MABUX analysts.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, remains overpriced in all selected ports: plus US$50 in Rotterdam, plus US$51 in Singapore, plus US$81 in Fujairah and plus US$7 in Houston. The most weekly significant was the reduction of VLSFO’s overcharge margin at the port of Houston by 31 points.

As for MGO LS, the MABUX MBP/DBP Index recorded an underpricing of this fuel grade in three of the four selected ports: Fujairah returned to the undercharge zone to a minus of US$114.

In Rotterdam and Singapore, MGO LS was undervalued by US$9 and US$166, respectively. The only overpriced port, according to the MABUX MBP/DBP Index, was Houston with a plus of US$24. The most significant change was a sharp increase of the underprice ratio in Singapore by 101 points at once.

According to James Willn, energy partner in Dubai at Reed Smith, Russia supplies roughly 8-10% of global crude supply, and the obvious commercial impacts of that supply being sanctioned and effectively offline, will clearly keep prices as they are (high) or potentially force them even higher.

“From a legal perspective, what is really interesting is the potential role that heavily sanctioned Iran may play in all this,” commented Willn.

He went on to add, “Will the Biden administration be able to reignite the JCPOA (the nuclear deal) and get that Iranian oil supply back into the market to slow the price surge? What isn’t helping these discussions is the fact that Russia is a party to the JCPOA itself and currently has a vested interest in stalling any progress.”