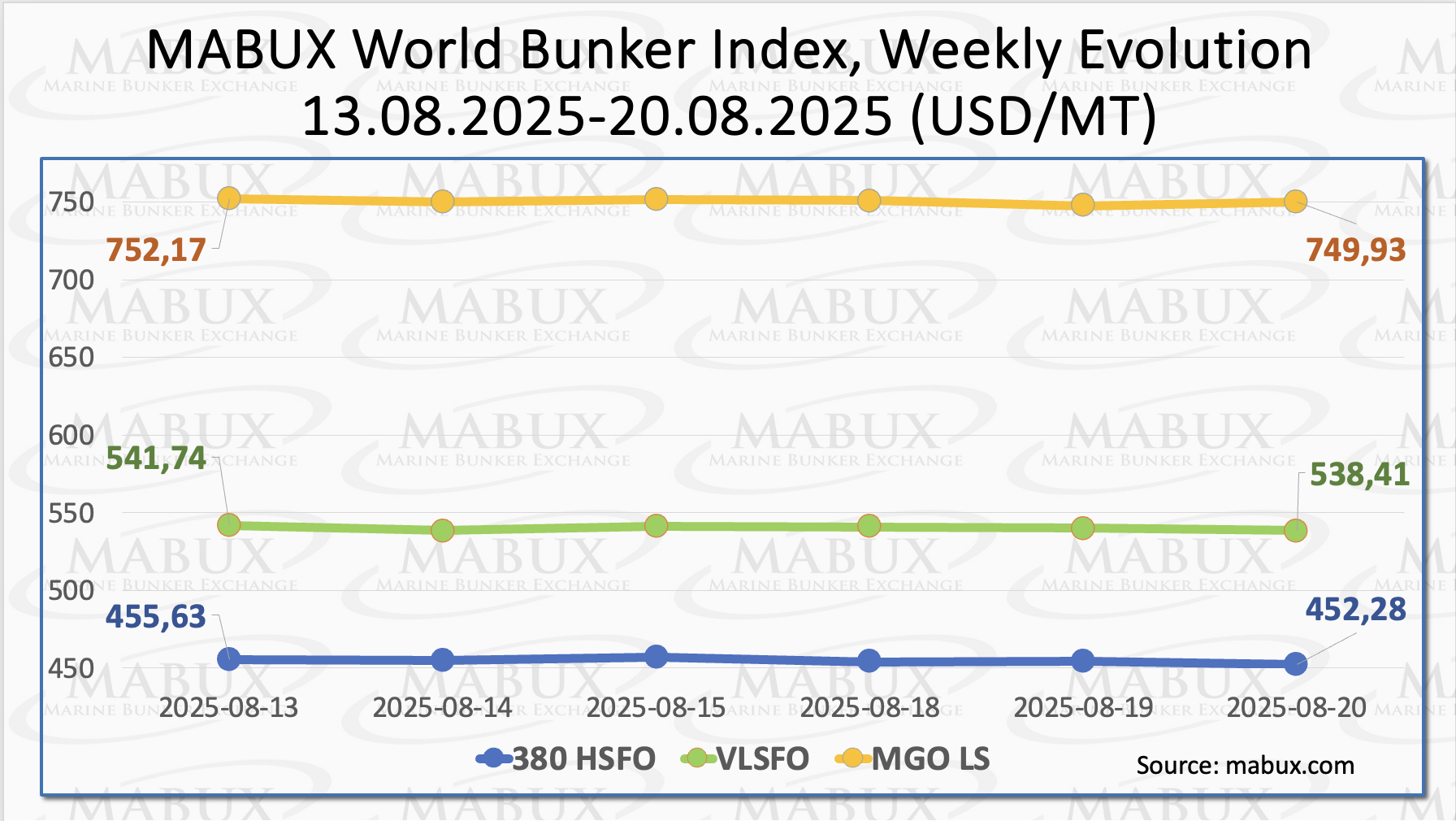

Global bunker indices tracked by Marine Bunker Exchange (MABUX) continued their moderate downward trend. The 380 HSFO index fell by US$3.35, moving closer to the US$450 mark. The VLSFO index declined by US$3.33, down to US$538.41/MT. The MGO index also decreased, losing US$2.24, thus breaking below the US$750 threshold.

”At the time of writing, the global bunker market showed no clear trend, with indices fluctuating in mixed directions,” said Sergey Ivanov, Director, MABUX.

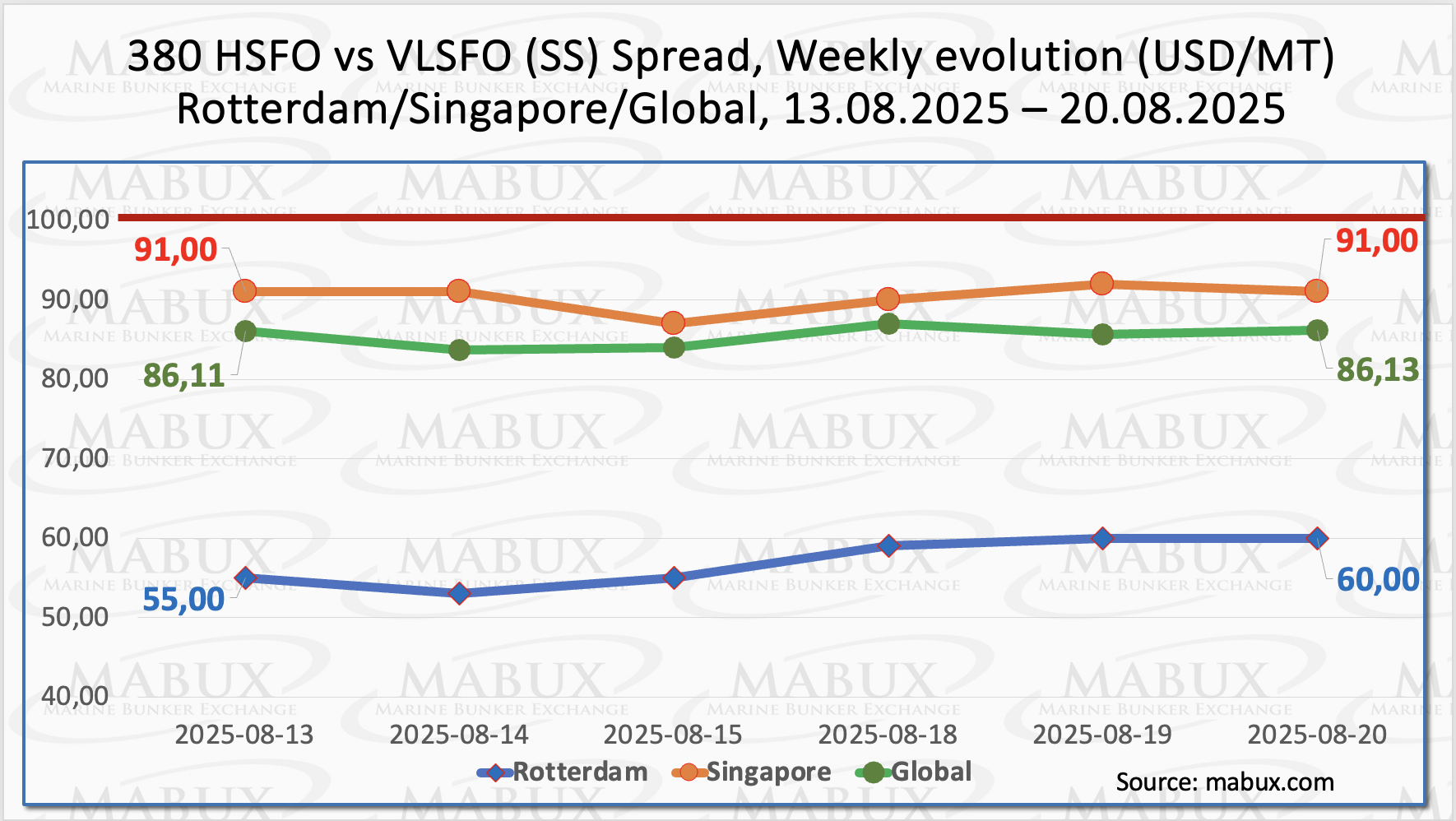

The MABUX Global Scrubber Spread (SS), remained virtually unchanged over the week, edging up by just US$0.02. The indicator continues to stay firmly below the psychological breakeven mark of US$100.00. The weekly average of the index also showed a slight increase of US$0.62.

In Rotterdam, the SS Spread rose by US$5.00, reaching US$60.00, with the port’s weekly average gaining US$3.17. In contrast, Singapore recorded no change in the 380 HSFO/VLSFO differential, which remained at US$91.00, while the port’s weekly average slipped by US$1.84. Amid the current stabilization of the global bunker market, significant shifts in the SS Spread are unlikely in the coming week. Conventional VLSFO fuel is expected to retain higher profitability compared with the HSFO plus Scrubber option.

U.S. liquefied natural gas (LNG) exports to Europe have risen sharply by 61% year-on-year, driven by the significant depletion of gas storage at the end of the last heating season, which required additional replenishment purchases, lower wind and hydroelectric generation, and the European Union’s commitment to increase imports of U.S. energy as part of its effort to reduce its trade surplus with the United States. In light of these factors, Europe is expected to continue buying as much U.S. LNG as possible, even though prices have already averaged US$8.34 per thousand cubic feet in the first eight months of the year.

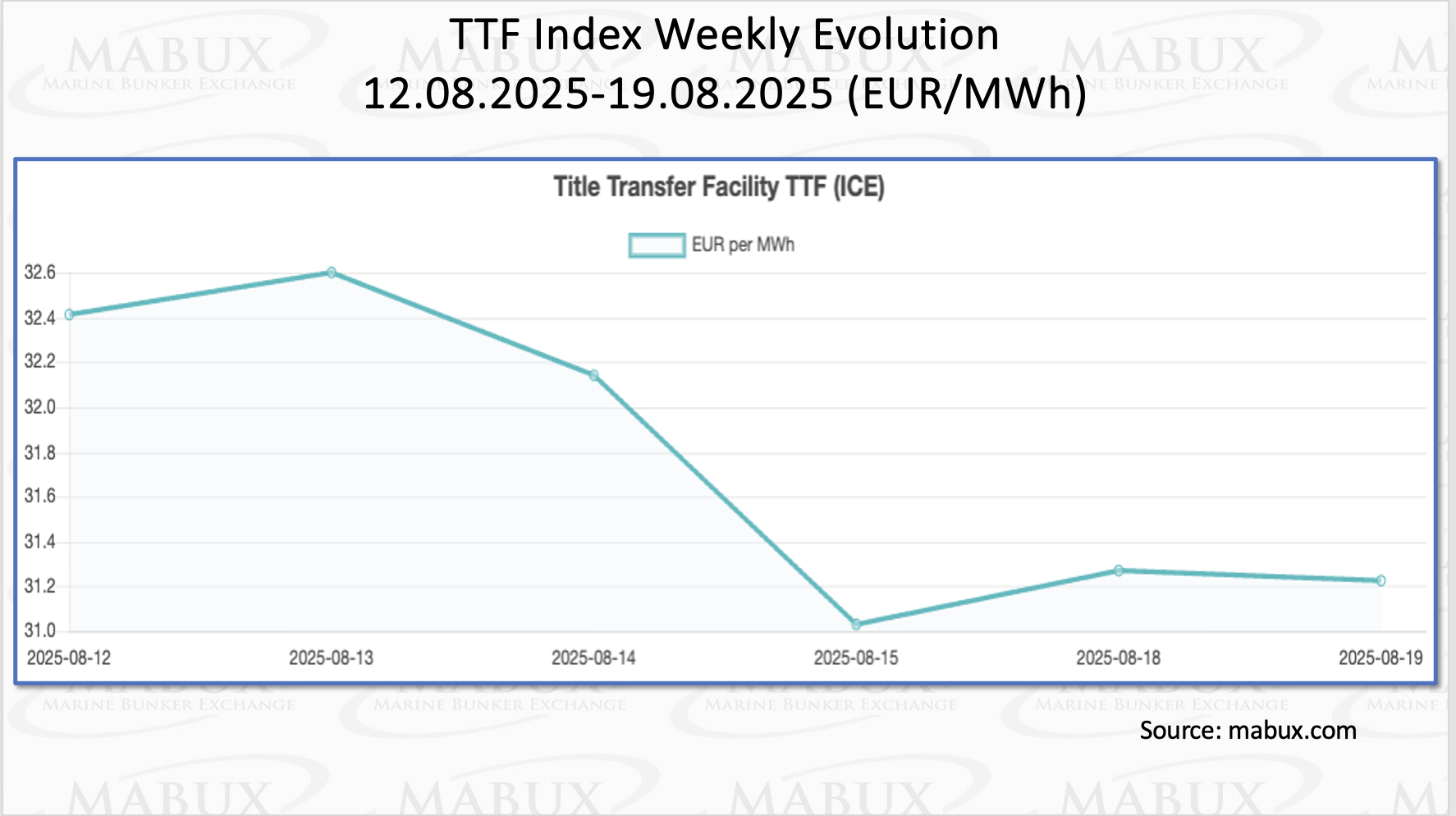

As of 19 August, European regional gas storage facilities were 74.21% full, reflecting an increase of 1.94% compared to the previous week. Occupancy levels are now 2.88% higher than at the beginning of the year, when they stood at 71.33%. However, the pace of injections into storage has slowed slightly. At the close of the 34th week, the European gas benchmark TTF continued its moderate decline, falling by 1.182 euros/MWh to 31.227 euros/MWh, compared with 32.409 euros/MWh a week earlier.

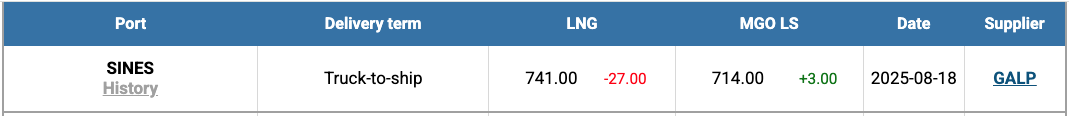

By the end of the week, the price of LNG as a bunker fuel in the port of Sines (Portugal) fell by US$27.00, reaching US$741/MT compared with US$768/MT the previous week. At the same time, the price gap between LNG and conventional fuel narrowed slightly but still favored conventional fuel. On 19 August, the difference stood at US$27, down from US$39 a week earlier, as MGO LS in Sines was quoted at US$714/MT.

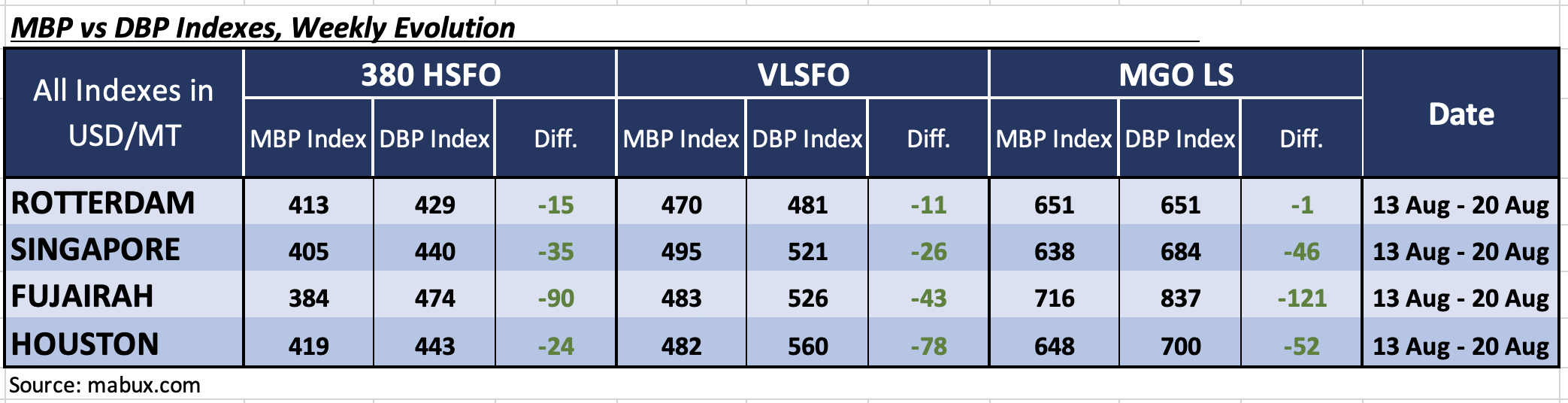

At the end of the 34th week, the MABUX Market Differential Index (MDI) continued to indicate undervaluation across all types of bunker fuel in the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: The average weekly undervaluation rose by 4 points in Rotterdam, by 5 points in Singapore, and by 8 points in Fujairah, while it declined by 5 points in Houston. Notably, Fujairah’s MDI approached the US$100 threshold.

• VLSFO segment: Undervaluation levels remained unchanged in Rotterdam but climbed by 6 points in Singapore, by 9 points in Fujairah, and by 2 points in Houston.

• MGO LS segment: MDI values fell by 3 points in Rotterdam, by 1 point in Singapore, and by 9 points in Fujairah, but edged up by 1 point in Houston. Rotterdam’s MDI remains close to the full 100% MBP/DBP correlation level, while Fujairah continues to trend toward the US$100 mark.

”Overall, the structure of overvalued and undervalued ports did not undergo significant changes during the week, though there was a noticeable shift toward overvaluation in the MGO LS segment. Based on current dynamics, the emergence of several overvalued ports is likely in the coming week,” commented Ivanov.

Sergey Ivanov added that they expect that the global bunker market will continue to stabilize in the coming week, which may in turn support the formation of a moderate upward trend in bunker prices.

STAY INFORMED

STAY AHEAD

Subscribe for smarter updates, straight to your inbox.