By Filibe Gouveia, Shipping Analysis Manager at BIMCO

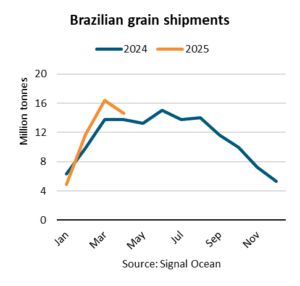

“Between January and April 2025, Brazilian grain shipments rose 9% y/y, supported by strong Chinese purchasing. As China imposed higher tariffs on cargoes from the US, the country sought alternative suppliers, such as Brazil,” noted Filipe Gouveia, Shipping Analysis Manager at BIMCO.

The ramp-up in exports has been supported by a 9% increase in the soya bean harvest, according to estimates by the United States Department of Agriculture (USDA). Shipments were weakest in January due to a delay in the harvest, but they quickly ramped up in February, driving an increase in ship congestion. Soya beans account for 71% of Brazilian grain shipments, while maize accounts for 27%.

China is a key importer of global and Brazilian grain shipments, making up respectively 25% and 53% of total shipments. Due to lower prices, China has gradually increased purchases of Brazilian cargoes over the last 10 years at the expense of US shipments. Since March 2025, US-China grain shipments have reduced further due to a 125 percentage points increase in import tariffs on US grains. Year-to-date, this has contributed to a 54% y/y reduction in US-China grain shipments while Brazil to China shipments have risen 9%,

“The pick-up in Brazilian grain exports has been positive for tonne mile demand in the Panamax segment, which transported 82% of cargoes in 2024. Due to their above-average sailing distances, grain shipments from Brazil account for 19% of the segment’s tonne-mile demand, despite comprising only 9% of its cargo volume. However, this has not been enough to keep the Baltic Panamax Index from falling 35% y/y so far in 2025,” says Gouveia.

While total loadings on Panamax ships have grown, reductions in total coal and grain shipments have increased competition between segments, pressuring rates.

Looking ahead, the Brazilian maize harvest is expected to strengthen by 6% y/y, according to the USDA, which would support shipments. The country’s second and larger maize crop typically starts being harvested and exported in June, and weather conditions currently appear favourable.

“The outlook for Brazilian grain shipments appears largely positive for the rest of 2025, amid strong supply and the trade war between the US and China. However, China’s next grain harvests could pose a downside risk to the overall strength of global grain shipments. The country has set ambitious targets for its harvests to reduce import dependency, and if successful, it would affect import demand,” says Gouveia.