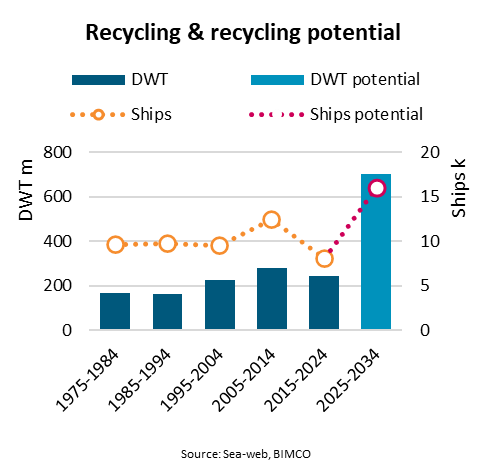

“As the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships (Hong Kong Convention) enters into force we have updated our estimate for the ship recycling potential over the next 10 years. We now estimate the potential to be 16,000 ships, or 700m deadweight tonnes (DWT), from previously 15,000. The new estimate equals twice the number of ships, and nearly triple the DWT, recycled over the last 10 years and highlights the need for investments in compliant recycling facilities,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Applying the recycling patterns seen between year 2000 and 2019 for each ship segment and type, we have calculated the recycling potential for the next 10 years. If on average 10% of all 20-year-old capesizes were recycled between 2000 and 2019, we have assumed the same recycling frequency for the coming 10 years. The 2000-2019 period saw both very low and high recycling wherefore we believe it provides a good foundation for calculating the future potential.

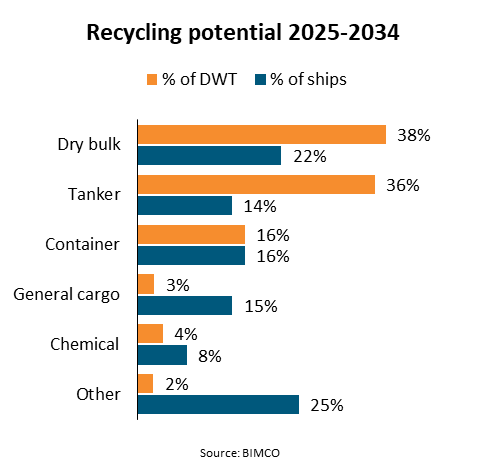

“During the 2015-2024 period, ships built in the 1990s made up 35% of the ships and 62% of the DWT recycled. During the 2000s, 31% more ships were built equal to a 115% DWT increase. The ships built in this period are expected to dominate recycling in the coming 10 years,” says Rasmussen.

“As the Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships (Hong Kong Convention) enters into force we have updated our estimate for the ship recycling potential over the next 10 years. We now estimate the potential to be 16,000 ships, or 700m deadweight tonnes (DWT), from previously 15,000. The new estimate equals twice the number of ships, and nearly triple the DWT, recycled over the last 10 years and highlights the need for investments in compliant recycling facilities,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

Applying the recycling patterns seen between year 2000 and 2019 for each ship segment and type, we have calculated the recycling potential for the next 10 years. If on average 10% of all 20-year-old capesizes were recycled between 2000 and 2019, we have assumed the same recycling frequency for the coming 10 years. The 2000-2019 period saw both very low and high recycling wherefore we believe it provides a good foundation for calculating the future potential.

“During the 2015-2024 period, ships built in the 1990s made up 35% of the ships and 62% of the DWT recycled. During the 2000s, 31% more ships were built equal to a 115% DWT increase. The ships built in this period are expected to dominate recycling in the coming 10 years,” says Rasmussen.

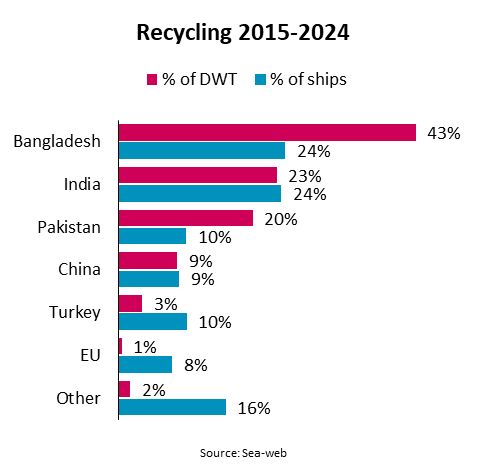

During 2015-2024, Bangladesh, India and Pakistan continued to be the largest recycling destinations, making up 86% of DWT and 58% of ships recycled. The three countries’ dominance was even more pronounced after 2017 as China stopped recycling international ships and has since recycled less than 2% of DWT.Outside of South Asia, Turkey remains a sizeable recycling location, especially for offshore ships.

Even though projects exist to expand recycling capacity elsewhere, we expect the majority of recycling will still take place in South Asia for some time to come.The current record high recycling volume was achieved in 2012 with nearly 1,800 ships and 60m DWT recycled. The potential recycling volume for the coming 10 years is meantime so high that DWT volumes recycled in every year starting from 2027 could exceed this record.

“Actual recycling may naturally end lower than our calculated potential if the supply/demand balance is particularly strong. On the other hand, it could end higher due to weak markets and the need for replacing older tonnage to reduce greenhouse gas emissions. In either case, we find it overwhelmingly likely that recycling will end significantly higher than in the past while recycling facilities at the same time need to ensure compliance with the stricter requirements of the Hong Kong convention,” says Rasmussen.

Note: Ship sectors included in the data and forecast are dry bulk, tanker, container, gas tankers, general cargo, other dry cargo, offshore and inland waterways.