BIMCO’s December 2025 Container Shipping Market Overview highlights a potential shift in 2026–2027 market conditions, driven by changes in Suez Canal routings and other supply-demand factors.

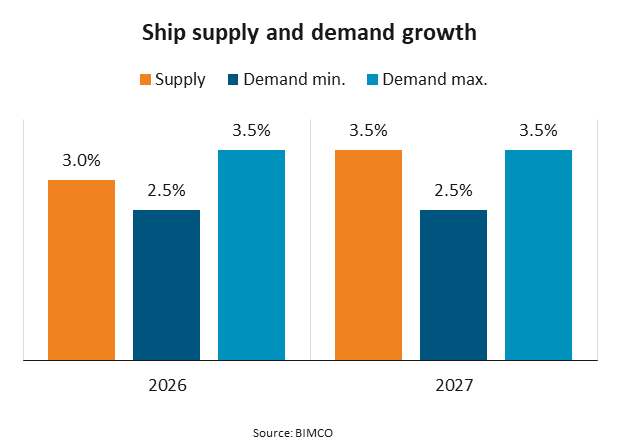

Assuming higher recycling of older ships and reduced average sailing speeds, BIMCO forecasts that 2026 conditions will be similar to 2025, with slightly weaker conditions in 2027. Ship demand is expected to grow 2.5–3.5% annually, while supply may increase 3% in 2026 and 3.5% in 2027.

The return to normal Red Sea and Suez Canal routings could reduce ship demand by up to 10%. CMA CGM’s INDAMEX and MEX services are set to resume Suez Canal operations in early 2026, with other carriers potentially following.

North American import container volumes are projected to decline 3% in 2025, with modest growth of 2% expected in both 2026 and 2027. BIMCO notes that up to 70% of US economic growth in 2025 may be driven by AI-related investments, and a downturn in AI markets could impact container demand globally.

The report includes an estimated 750,000 TEU of ship recycling in 2026–2027. A shortfall in recycling could add to oversupply, while increased port congestion and slower sailing speeds (forecasted reduction of 0.25 knots) will influence capacity utilization.

BIMCO cautions that while market conditions are expected to remain mostly stable, the return to Suez Canal routings and other uncertainties could make the next two years more eventful than the headline forecast suggests.