Baltic and International Maritime Council (BIMCO) reported that 71% of the year-to-date ordered container ships, and particularly 117 out of 168 with a capacity of at least 11,800TEU, will be delivered with a scrubber fitted directly from the shipyard.

Moreover, a total of 29 units will be scrubber-fitted but also LNG-ready, whereas 34 units will be delivered as ‘LNG-capable’, meaning that “they will run on gas from day one,” according to BIMCO.

A total of 17 ships appears to be without any such modifications upon delivery, while some 619 container vessels are now on order for future delivery, 381 of which have been ordered in 2021 alone.

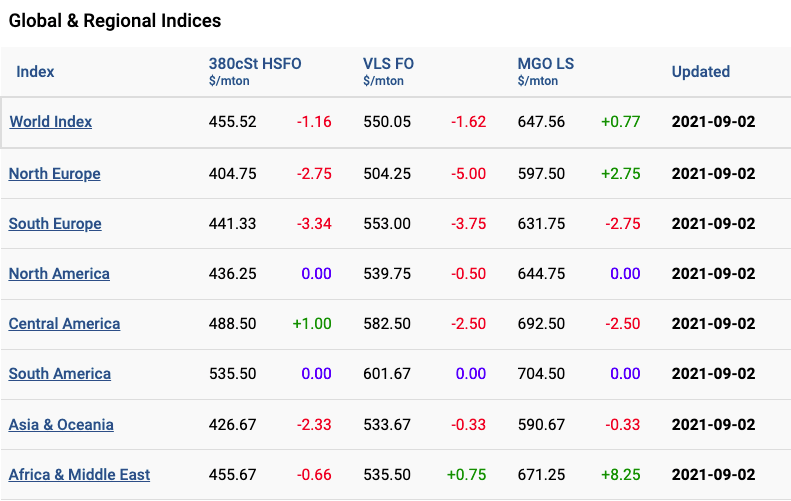

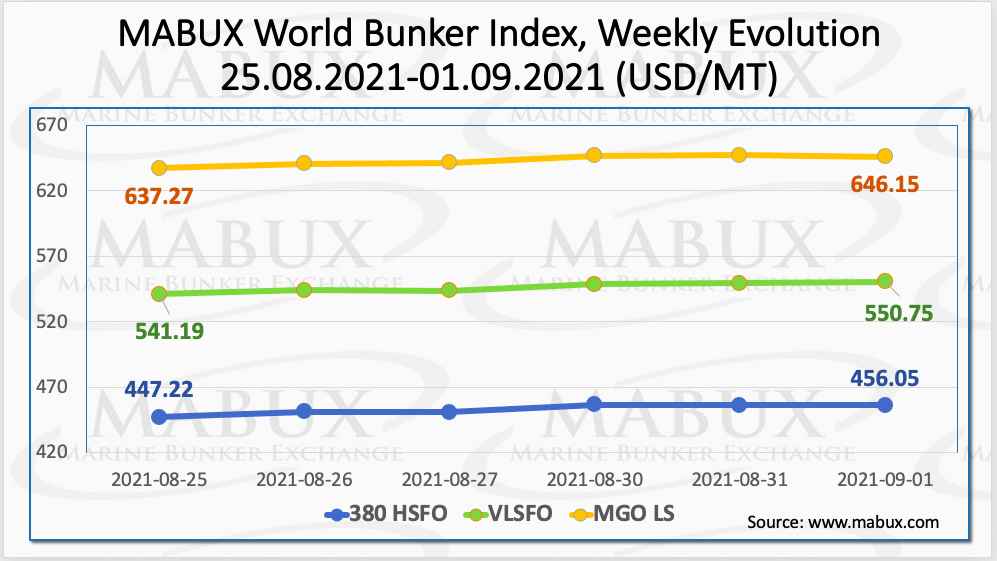

Meanwhile, during week 35, Marine Bunker Exchange (MABUX) World Bunker Index has continued its moderate upward evolution, with the 380 HSFO index rising to US$456/MT, the VLSFO index increasing to US$550.75/MT, and the MGO index climbing to US$646.15/MT.

The MABUX for the Amsterdam-Rotterdam-Antwerp region (ARA) LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the region, demonstrated a sharp increase in the period of 25 August to 1 September reaching US$1,024.35/MT.

At the same time, the average value of the LNG Bunker Index dropped by US$11.48 compared to the previous week, while the average price for MGO LS in Rotterdam for the same period surged by US$29.83/MT, and the average price difference between bunker LNG and MGO LS in Rotterdam fell by US$41.32 to US$386.43.

The average weekly Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – remained virtually unchanged and stayed at US$93.25.

At the same time, the average value of SS Spread in Rotterdam again jumped over the US$100 mark, to US$106.50. On the contrary, in Singapore, the average SS Spread fell to US$93.

“The situation with SS Spread does not yet give any grounds to expect this index will stay firmly above US$100 point, which somewhat reduces the attractiveness of scrubbers,” commented MABUX.

Furthermore, the correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs over the past week showed that 380 HSFO fuel grade returned into the overcharge segment in three out of four selected ports: in Singapore, the overpricing averaged plus US$25, in Fujairah – plus US$22, in Houston – plus US$10. The only port with undercharged 380 HSFO fuel is Rotterdam – minus US$3 versus zero during the previous week.

Furthermore, VLSFO fuel was also overvalued in three of the four ports, according to the MABUX MBP / DBP Index, with the exception of Rotterdam where it was undervalued by US$3.

Particularly, the average overpricing ratio in other ports was: in Houston – plus US$9, in Singapore – plus US$7, in Fujairah – plus US$4. The most significant change of the MABUX MBP / DBP Index is recorded in Fujairah with plus US$33.

As for MGO LS, on week 34 the MABUX MBP/DBP Index registered an undercharge of this fuel grade at all selected ports ranging from minus US$23 in Houston to minus US$24 in Rotterdam, minus US$33 in Singapore and minus US$10 in Fujairah. There is also a sharp decline of MGO LS underestimation margin registered in Fujairah by US$41.

In general, there has not yet been registered any single trend in the MABUX MBP / DBP Index for the main bunker fuel grades, according to the report.