With the Biden Administration now stepping in to tackle the port congestion crisis at Long Beach and Los Angeles, China-US West Coast transit data and insights provided by digital freight forwarding company Shifl underscore how bad the situation has become, and how much work it will take to get cargo moving on time again.

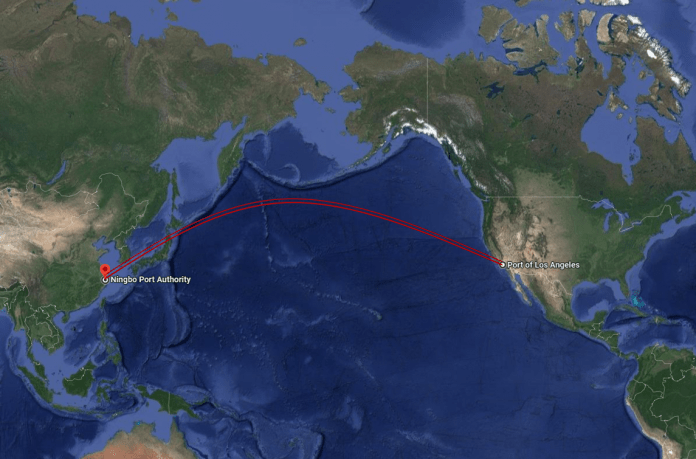

During the period 15 May – 15 October, the average transit time from Chinese base ports to the US West Coast ports of Los Angeles and Long Beach increased from 19 to 36 days, according to Shifl’s data.

“With 40% of US inbound containers moving through Los Angeles and Long Beach ports, efforts by the administration are rightfully focused on a critical node of the global supply chain. The fact that the President of the world’s largest economy is getting involved in addressing this problem is already a huge relief for importers who have been struggling so much,” commented Shabsie Levy, Founder and CEO of Shifl, but pointed out that this is “just the tip of the iceberg”.

There is a lot more that will need to be done to get the shipping industry under control towards a sustainable future, according to Levy.

Cargo owners are currently forced to wait an additional 20 odd days for their products to reach them, which is only part of the equation, said Shifl’s report.

“Usually, a ship from Chinese base ports like Shanghai, Ningbo will take between 16-18 days to arrive and discharge cargo at US West Coast ports,” said Levy, commenting on the findings of the data analysis. “The increase in transit to 36 days, makes it extremely painful for businesses dependent on supply chains,” he highlighted.

Shifl’s data report also showed that with the ports facing delays due to lack of adequate landside infrastructure, containers are sometimes forced to be stuck in closed areas within the port delaying inland transit even further leading to potential business-crippling conditions.

“While we are in constant communication with our customers about the location, release, and delivery times of their shipments, when a ship spends 2-3 weeks waiting to unload, that’s a nerve-wracking situation for the customer” noted Levy.