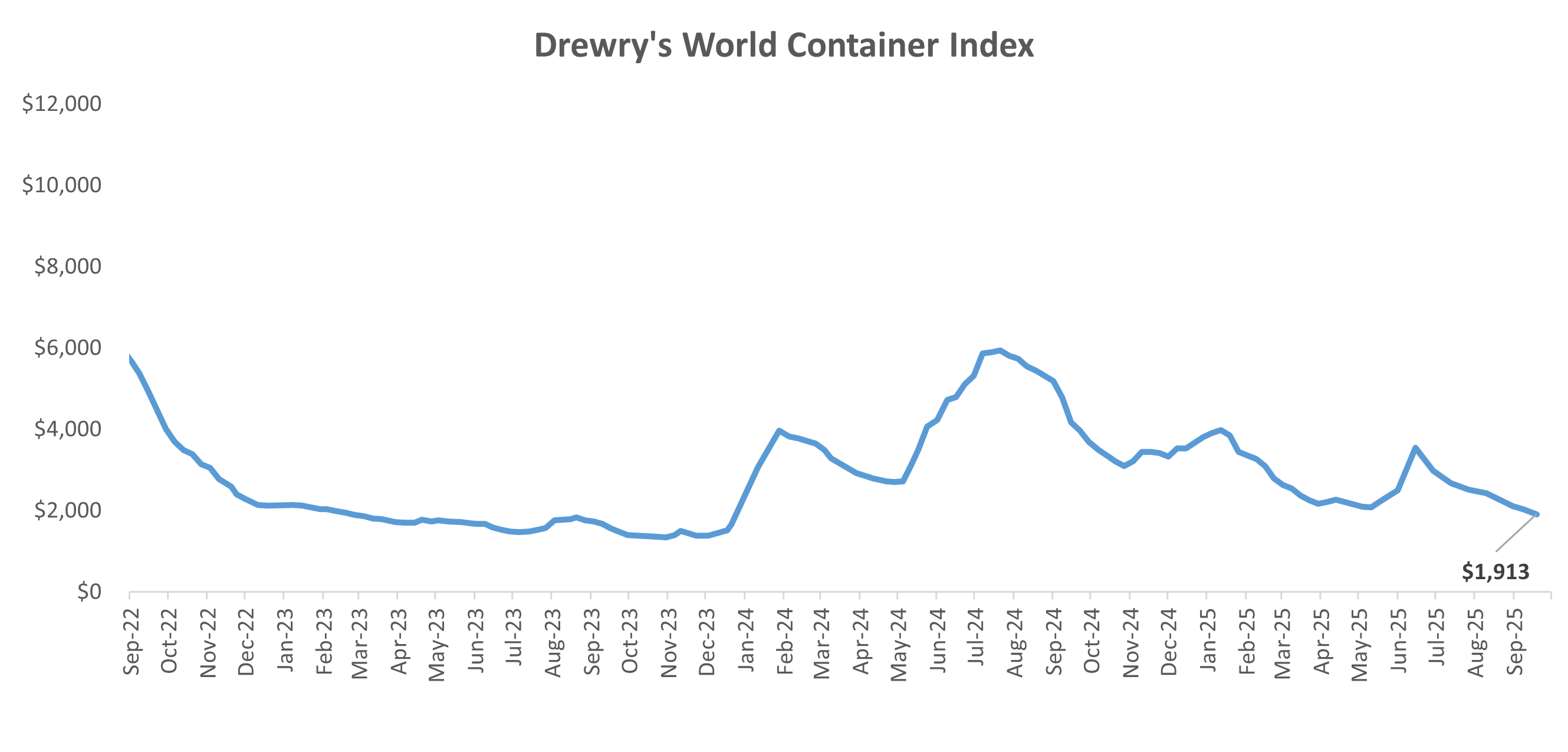

The Drewry World Container Index (WCI) breached the psychological mark of USD 2,000 on the downside, ending the week lower by 6% with one more week to go prior to the Chinese Golden week, underlined by the 11% decline in Asia-Europe headhaul rates which breached the USD 2,000 mark too and ending around the same mark as the composite index at USD 1,910.

The other headhaul trades from Asia to the Mediterranean, US West Coast and US East Coast added further momentum to the downside, losing anywhere from 4-9%.

The Drewry’s current quote at USD 1,913 still stands at a 15% premium over its last quote of 2023, following which a spurt was witnessed with the Red Sea situation. With the seasonal slack period following the Golden Week, the weak demand scenario could further play into extending the price momentum on the downside for Ocean Rates, which will also possibly extend into a mini-domino effect with Breakbulk and other sectors of freight following the container rates.

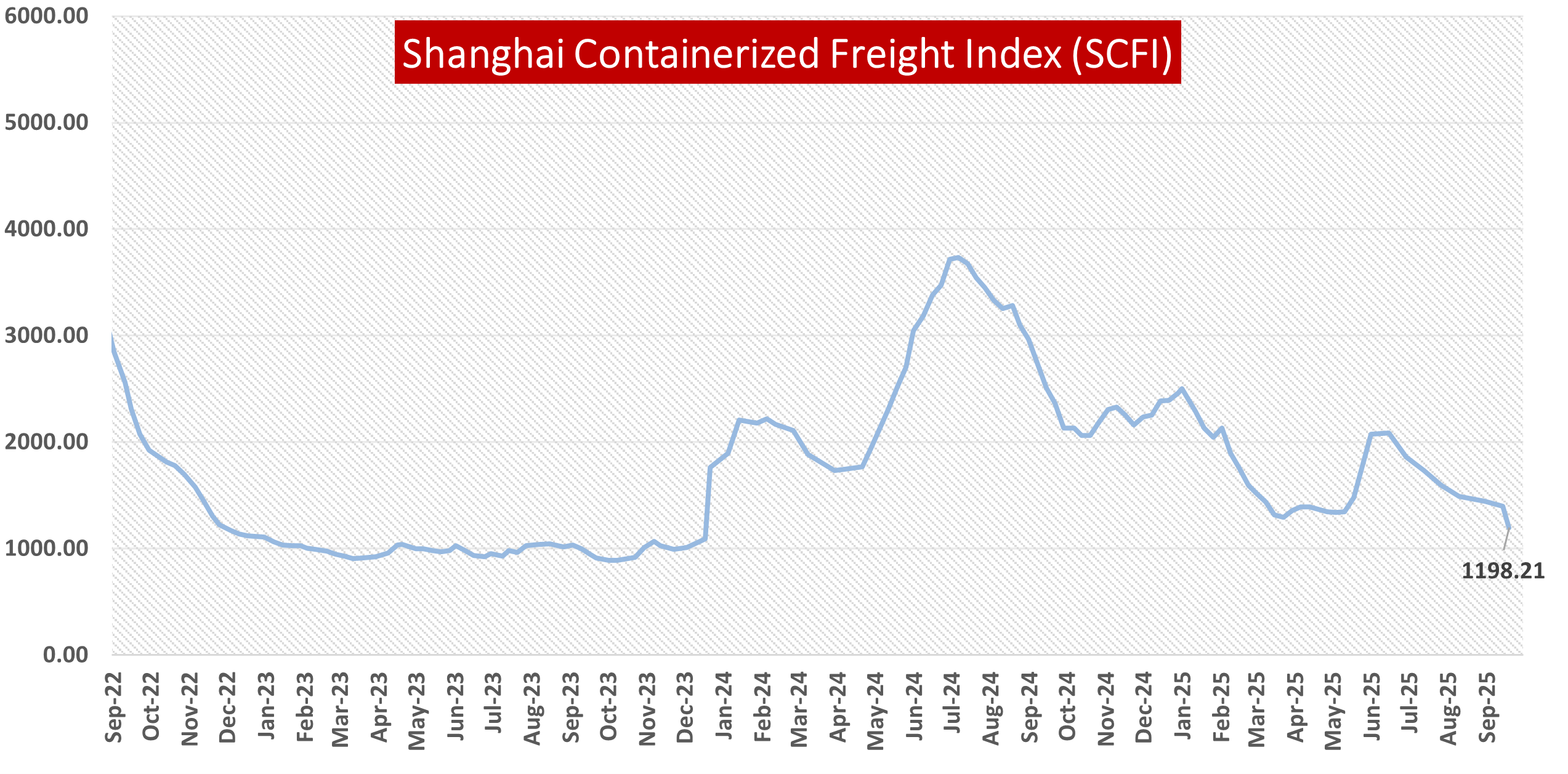

The accelerated dip is further pronounced as the Shanghai Containerized Freight Index (SCFI), as on the 19th of September 2025 logged one of its largest weekly percentage dips- over 14.3% and about 200 points led primarily by the sharp drop in the Asia- North America Rates. On the SCFI, the rates to US from China fell over 20% on both the West and East Coast- headhaul trades.

It must be noted that the SCFI provides an even more recent version of capturing the market mood, which would take about 1-2 weeks to be reflected on some of the other price indices, indicating that there is a fair bit of downside left until the Golden week numbers too.

While tariff situations and rate card scenarios are being reassessed by the US, there are no headwinds seen for a positive demand. While Shippers do have an advantage on the pricing front, the situation would only increase blank sailings to certain ports of call, which can affect their operational turnaround times.

The Drewry commentary does echo the market sentiment in view of the rates declining further, even as the vigil continues on tariff impositions and geopolitical situations, which can dictate the extent of the dip.

The drop in prices hasn’t abated the newbuilding activity as yet, with over 10-10.4 Million TEUs worth of fleet in the pipeline for deliveries until 2030, with about 70% of them being delivered until 2028, as the World Bank pegs for a maximum average growth rate of 6% for container shipping into the medium term, as there continues to be renewed focus on smarter, cleaner ships.

This article was written by Gautham Krishnan