The Marine Bunker Exchange (MABUX) report has indicated that the global bunker market has shown an upward trend in 2021.

After a sharp drop to lows in April 2020, which was mainly triggered by the Covid-19 pandemic and a subsequent collapse in economic activity around the world, the global bunker indices have shown a moderate uptrend that continues nowadays as well since May 2020, according to a MABUX.

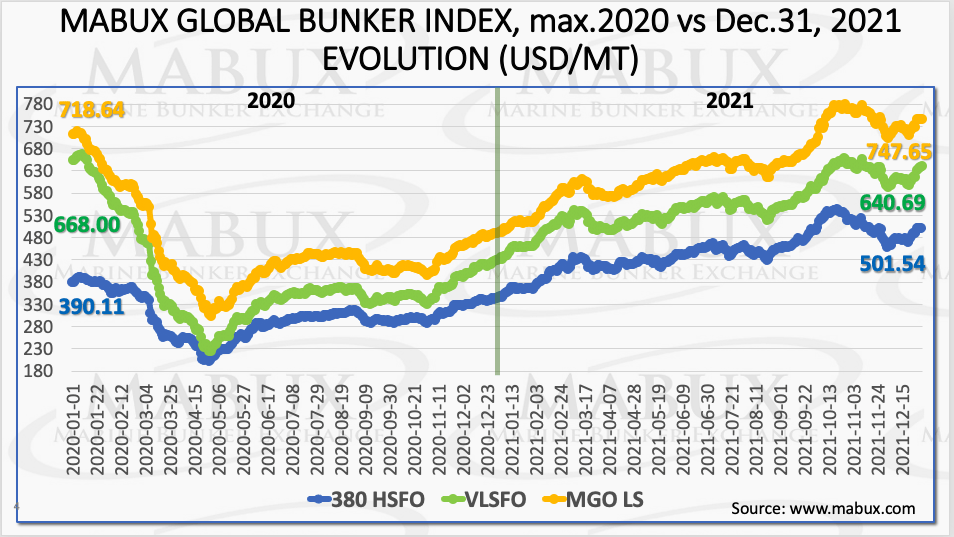

As of 31 December 2021, the Global HSFO 380 Index has already exceeded the maximums of 2020 by 29%, at US$390.11/MT on 7 January 2020, and the Global MGO LS Index, by 4%, with a maximum of 2020 at US$718.64/MT, on 6 January 2020, thereby regaining completely the losses of 2020.

The only fuel grade Global Index, which has not yet exceeded the 2020 highs, is VLSFO recording a minus of 4% versus the 2020 high of US$668/MT, registered on 9 January 2020. However, according to MABUX estimations, it will also turn into a plus in January-February 2022.

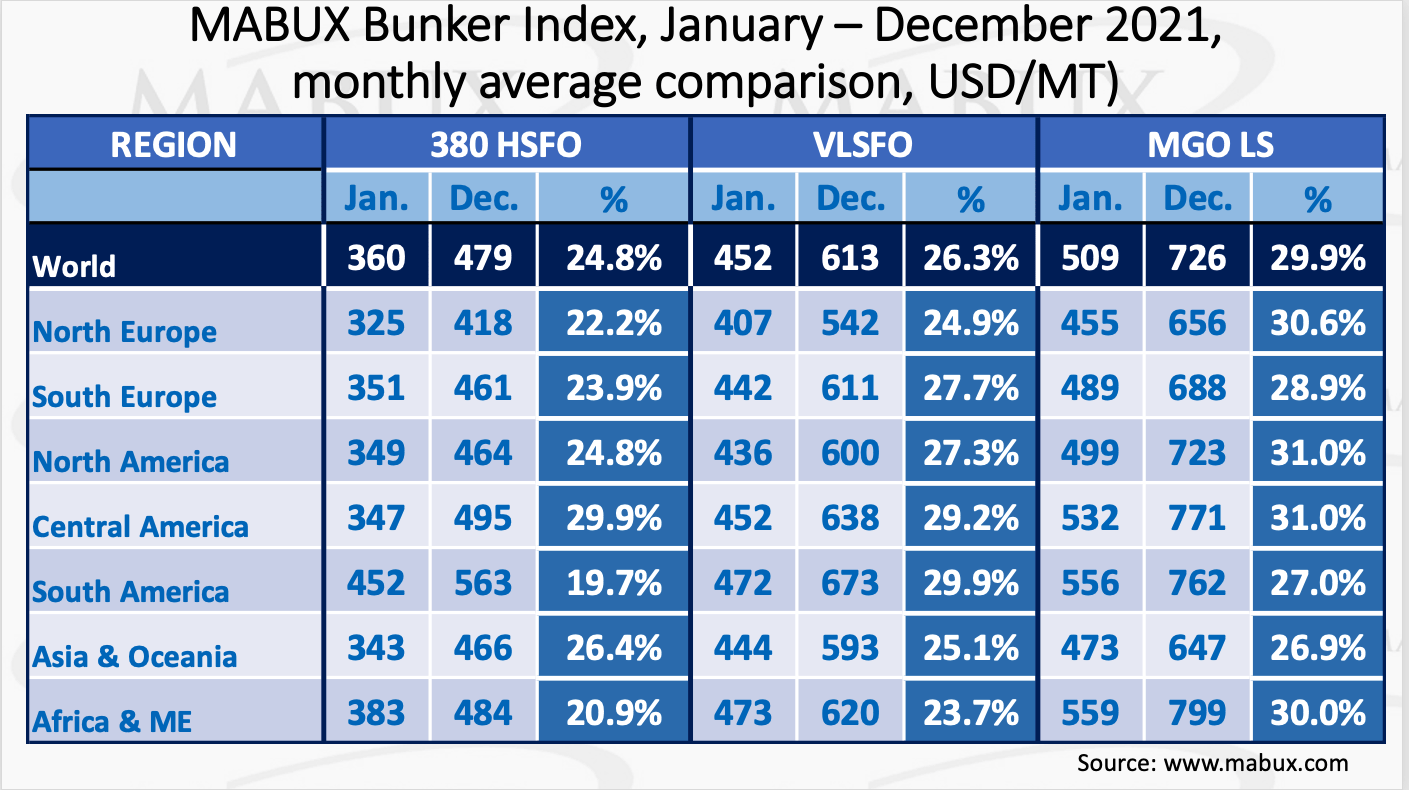

In 2021, 380 HSFO global bunker prices, based on monthly averages, increased by 24.8%, VLSFO by 26.3% and MGO LS by 29.9%, according to MABUX data.

At the same time, the highest growth rate for 380 HSFO was registered in Central America with an increase of 29.9%, for VLSFO – in South America with 29.9%, for MGO LS – in North and Central America with a growth of 31%.

Regarding the growth rates of bunker fuel prices in Northern Europe were broadly in line with the world average: 22.2%, 24.9% and 30.6% for 380 HSFO, VLSFO and MGO LS, respectively.

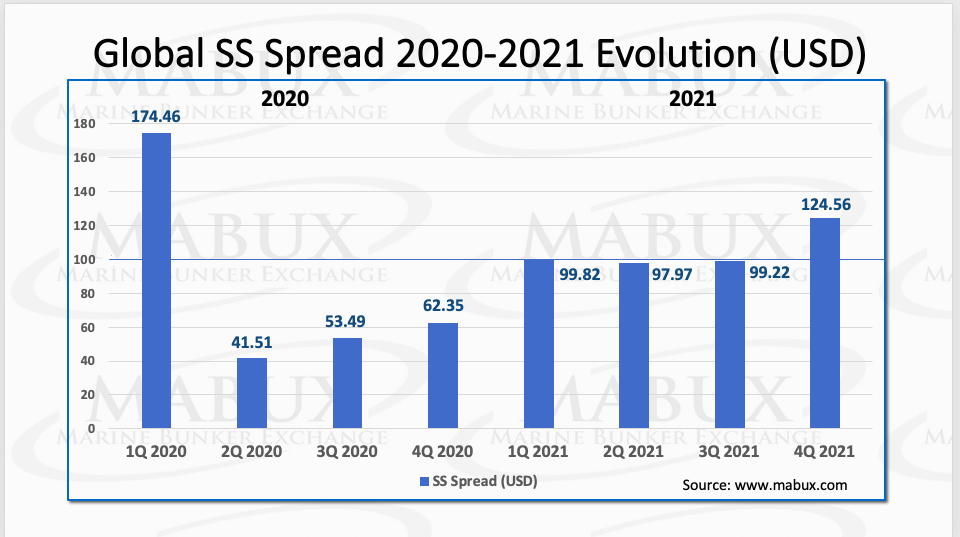

The Global Scrubber Spread (SS) quarterly averages, the difference in price between 380 HSFO and VLSFO, initially faced a sharp decline from the first quarter highs from US$174.46 to US$41.51 in the second quarter of 2020, followed by a gradual recovery thereafter.

In 2021, the Global Scrubber Spread remained close to the psychological mark of US$100 most of the time, stably exceeding it, reaching US$124.56 only in the fourth quarter of 2021.

Meanwhile, by the end of December 2021, Global SS Spread came close to the US$140 mark, but it is still significantly lower than the absolute maximum of US$270, registered on 9 January of 2020.

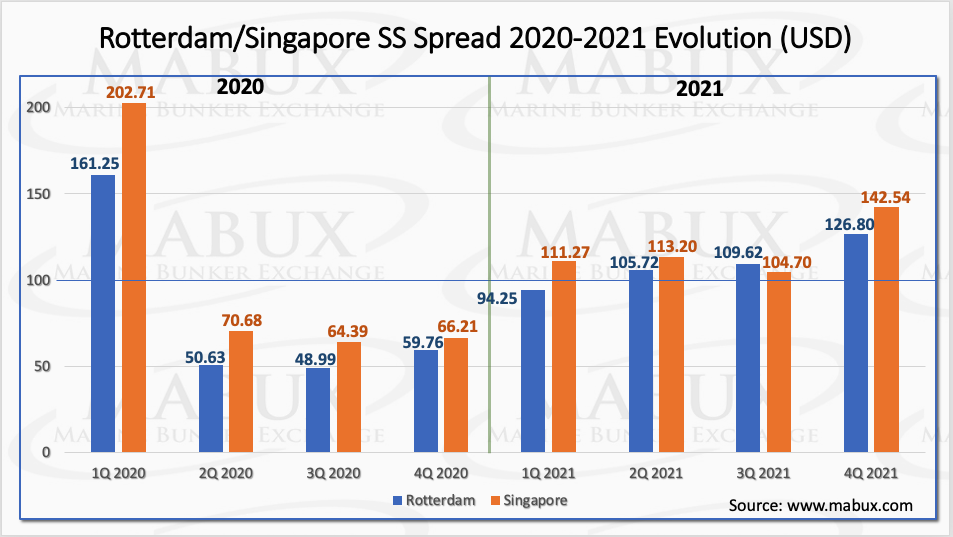

As for SS Spread in Rotterdam and Singapore, the Index growth rate in these ports in 2021 was higher than the world average. As a result, SS Spread in Singapore has been consistently above the US$100 mark since the first quarter of 2021, and in Rotterdam since the second quarter of the year.

On the contrary, the absolute maximum for Rotterdam which was reported on 1 January 2020, is US$290. For Singapore, the highest mark which was registered on 9 January 2020, reached US$347.

The gradual growth of SS Spread globally has improved the benefits of scrubber retrofits. The total number of vessels with scrubbers, both in operation and on order in 2021, reached 4,580, compared to 4,364 in 2020, and 3,163 in 2019, according to DNV GL.

“The hopes that LNG as a marine fuel would significantly increase its share in the global bunker market did not materialise so far,” commented a MABUX representatives in a statement.

The sharp rise in prices for natural gas, provoked by weather factors, unprecedented high demand in Asia versus shortage of energy resources in Europe, made this type of fuel temporarily uncompetitive compared to traditional types of bunker fuel.

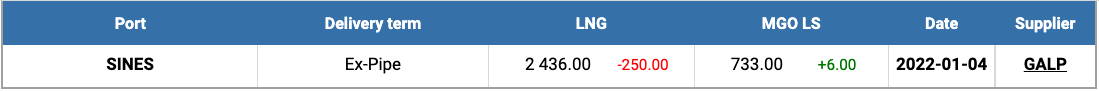

As a result, at the end of 2021, LNG bunkering was practically stopped, and the price of LNG, in particular, in the Portuguese port of Sines as of 4 January 2022, exceeded the price of MGO LS by more than three times, reaching US$2,436/MT.